Stock Analysis

- United States

- /

- Banks

- /

- NYSE:SMBK

Unveiling 3 US Growth Companies With High Insider Ownership And Up To 15% Revenue Growth

Reviewed by Simply Wall St

Amid a backdrop of significant volatility in major U.S. indexes, with technology stocks facing steep declines, investors may find solace in growth companies that boast high insider ownership and solid revenue growth. Such companies can offer a sense of stability and confidence, as high insider ownership often aligns management’s interests with those of shareholders, particularly appealing during uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.5% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Duolingo (NasdaqGS:DUOL) | 15% | 47.9% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Underneath we present a selection of stocks filtered out by our screen.

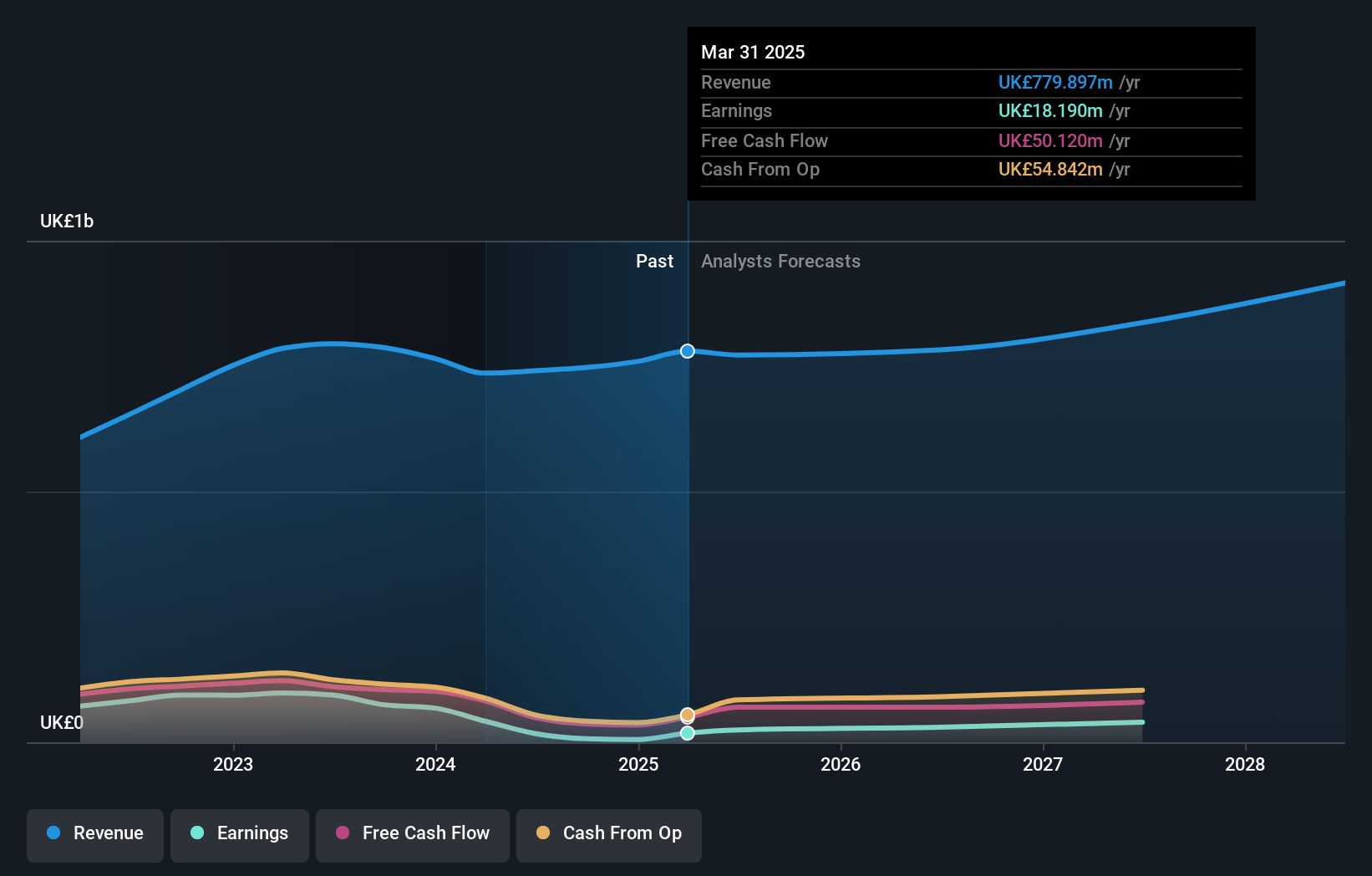

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endava plc is a provider of technology services focusing on sectors such as consumer products, healthcare, mobility, and retail across North America, Europe, the UK, and internationally, with a market capitalization of approximately $1.82 billion.

Operations: Endava's revenue from computer services amounts to £736.13 million.

Insider Ownership: 23%

Revenue Growth Forecast: 11.8% p.a.

Endava, a growth company with substantial insider ownership, is navigating a complex period. While its revenue growth at 11.8% per year is robust, surpassing the US market average of 8.6%, its profit margins have declined from 12.5% to 5.7%. Despite recent setbacks including a net loss in Q3 and lowered revenue expectations for FY2024, Endava's earnings are projected to grow significantly at 35.9% annually. The company trades at 37.2% below estimated fair value, highlighting potential undervaluation amidst challenges.

- Navigate through the intricacies of Endava with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Endava shares in the market.

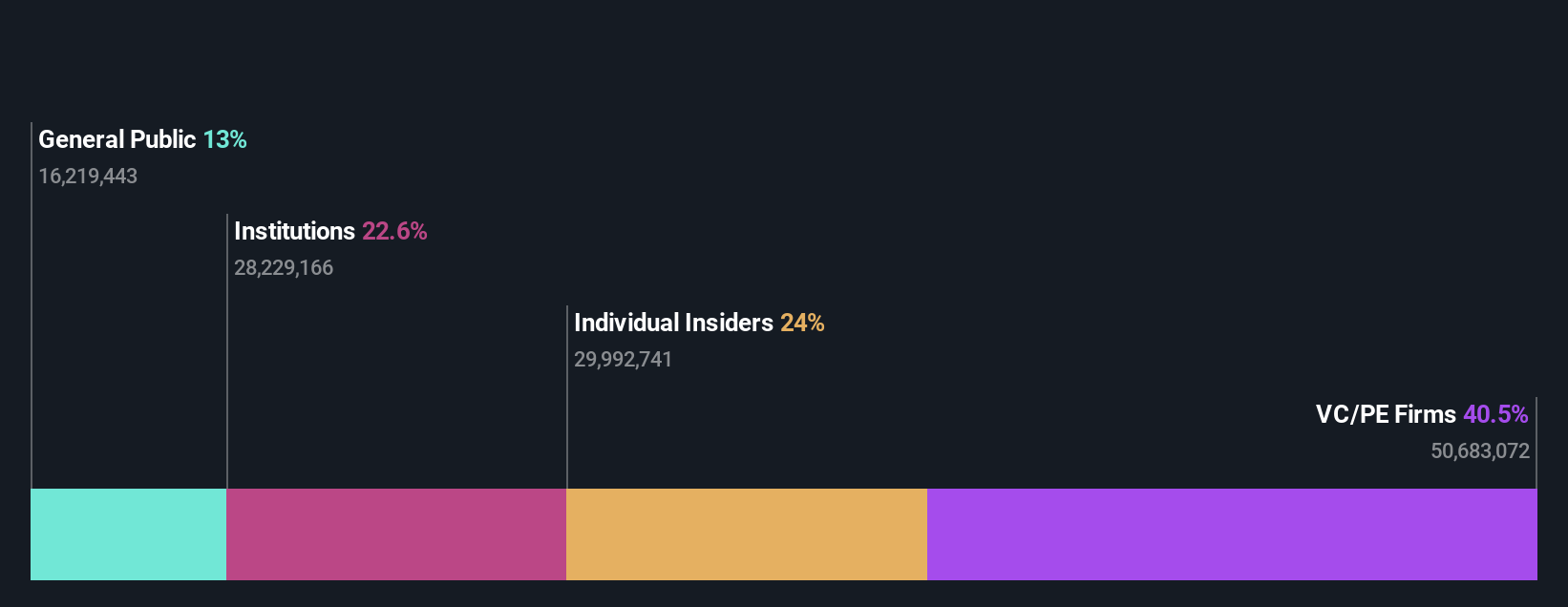

Paymentus Holdings (NYSE:PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. operates globally, offering cloud-based bill payment technologies and solutions, with a market capitalization of approximately $2.52 billion.

Operations: The company generates revenue primarily through services to financial companies, totaling $651.04 million.

Insider Ownership: 17.6%

Revenue Growth Forecast: 15.9% p.a.

Paymentus Holdings, a growth-oriented company with significant insider ownership, has demonstrated robust financial performance and promising growth prospects. Recently reporting a substantial year-over-year increase in Q1 sales to US$184.88 million and net income to US$7.23 million, the company also provided an optimistic revenue forecast ranging from US$737 million to US$755 million for the full year. Despite limited recent insider transactions, Paymentus's earnings are expected to grow by 21.6% annually over the next three years, outpacing the broader U.S. market projection of 14.8%.

- Click to explore a detailed breakdown of our findings in Paymentus Holdings' earnings growth report.

- Our expertly prepared valuation report Paymentus Holdings implies its share price may be too high.

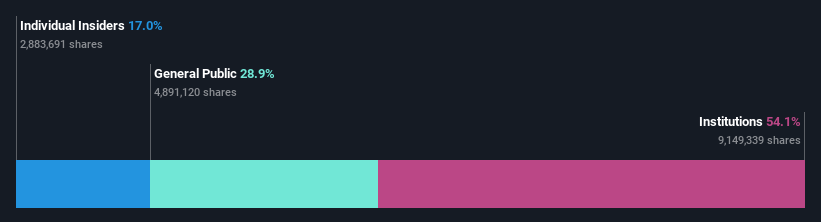

SmartFinancial (NYSE:SMBK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartFinancial, Inc., operating as the bank holding company for SmartBank, offers a range of financial services in Tennessee, Alabama, and Florida with a market capitalization of approximately $458.35 million.

Operations: The company generates revenue through financial services provided in Tennessee, Alabama, and Florida.

Insider Ownership: 16.9%

Revenue Growth Forecast: 13.4% p.a.

SmartFinancial, a company with substantial insider ownership, recently reported a slight decline in quarterly and half-year earnings compared to the previous year. Despite this, the firm has been active in shareholder returns, completing significant share buybacks totaling US$8.45 million and maintaining consistent dividend payments. While insider transactions have been minimal recently, SmartFinancial is trading below its estimated fair value and forecasts suggest robust annual earnings growth of 24.3%, outpacing broader market expectations.

- Dive into the specifics of SmartFinancial here with our thorough growth forecast report.

- According our valuation report, there's an indication that SmartFinancial's share price might be on the expensive side.

Summing It All Up

- Embark on your investment journey to our 186 Fast Growing US Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether SmartFinancial is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMBK

SmartFinancial

Operates as the bank holding company for SmartBank that provides various financial services to individuals and corporate customers in Tennessee, Alabama, and Florida.

Flawless balance sheet with reasonable growth potential.