- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital (OWL): Assessing Valuation After Recent 13% Share Price Slide

Reviewed by Kshitija Bhandaru

Blue Owl Capital (OWL) has been drawing investor attention lately with its recent performance. Over the past month, shares have slipped roughly 13%, adding to a broader decline seen this year. This movement has many considering what is driving sentiment for the stock now.

See our latest analysis for Blue Owl Capital.

Blue Owl Capital’s momentum has been cooling, with the recent 13% share price slide adding to a longer-term drift in performance. Over the past year, investors have seen a 17% decline in total shareholder return, even as the company continues to grow its revenues and net income. This is a sign that the market is reassessing either future growth potential or perceived risks. In short, the stock’s recent moves reflect fading momentum after periods of optimism.

If you’re curious to see what else is happening beyond the financial sector, this could be an ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares down this year despite strong revenue and net income growth, is Blue Owl Capital now trading at a discount that undervalues its future prospects, or is the market fully pricing in what comes next?

Most Popular Narrative: 32.9% Undervalued

Blue Owl Capital's narrative-based fair value estimate sits at $23.92, much higher than its last close of $16.05. This indicates a wide gap between outlook and market price.

Significant ongoing growth in permanent capital vehicles, particularly through expansion in private credit, real assets, and evergreen/interval fund strategies, is providing stable and recurring management fee revenue and positioning Blue Owl for higher future earnings and durable margin expansion.

Want to know the math behind that bullish target? The secret sauce: bold revenue forecasts and profit margin expansion underpin the valuation. But what hidden bets have analysts made? Unpack the surprising projections and see what’s driving consensus beyond the headlines!

Result: Fair Value of $23.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major risks remain, including the challenges of integrating new acquisitions and the unpredictability of fundraising during periods of market volatility.

Find out about the key risks to this Blue Owl Capital narrative.

Another View: Are Multiples Pointing to a Different Story?

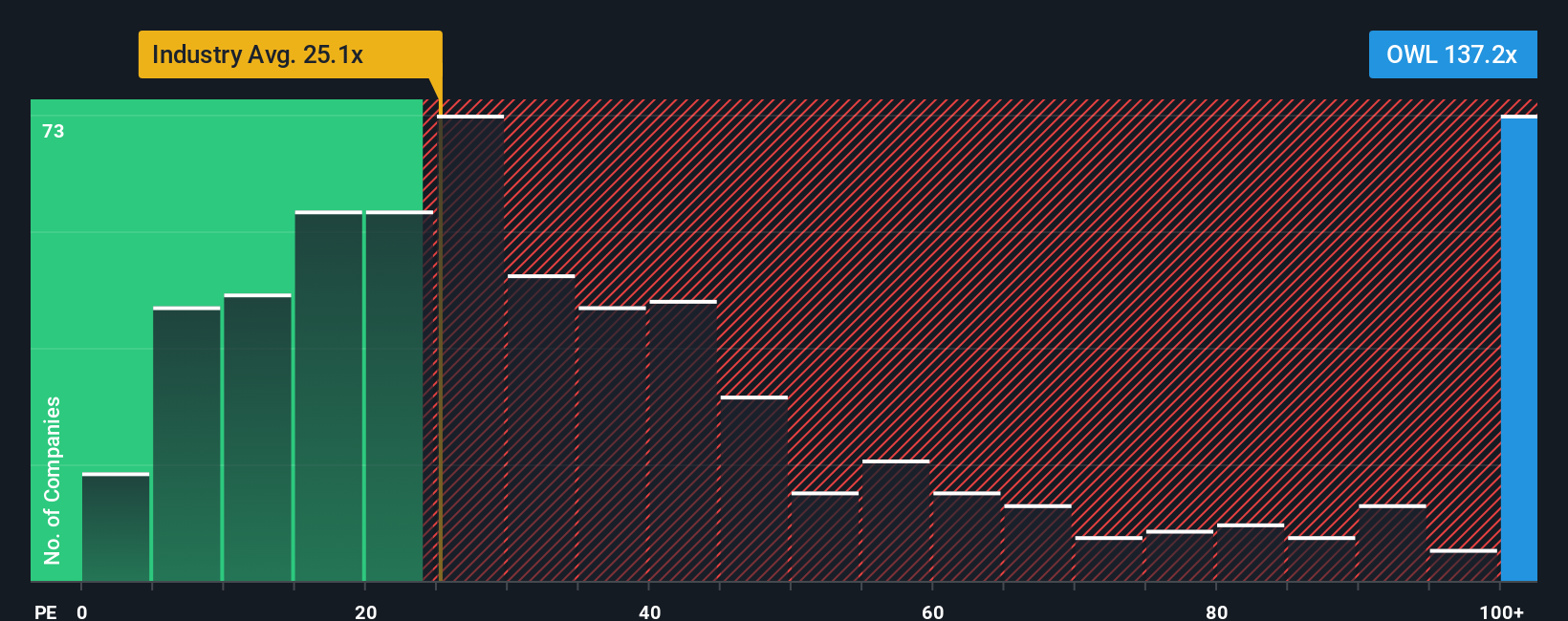

While analyst models value Blue Owl as significantly undervalued, a look at the price-to-earnings ratio tells a more cautious tale. Blue Owl trades at 138.6x earnings, much higher than both its industry peers at 26.3x and its fair ratio of 53x. This sizable gap could signal overvaluation risk, or it could reflect a rapid change in future results. Which view makes more sense for today's market?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blue Owl Capital Narrative

If you see the story differently or want to investigate the numbers for yourself, you can shape your own perspective on Blue Owl Capital in just a few minutes. Do it your way

A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when you can tap into a world of investment themes? Give yourself more options and confidence with these powerful strategies:

- Boost your potential returns by uncovering these 916 undervalued stocks based on cash flows boasting solid fundamentals and attractive price points that the market may be missing.

- Supercharge your income stream by taking the chance to evaluate these 19 dividend stocks with yields > 3% offering robust yields above 3% for long-term stability.

- Ride the future of tech advancements by checking out these 23 AI penny stocks at the forefront of artificial intelligence innovation and real-world impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives