- United States

- /

- Mortgage REITs

- /

- NYSE:ORC

Orchid Island Capital (ORC): Assessing Valuation Following Dividend Declaration, Book Value Update, and Dilution Risk

Reviewed by Kshitija Bhandaru

Orchid Island Capital (ORC) attracted attention after the company announced its October 2025 monthly cash dividend of $0.12 per share. The announcement also included fresh updates on book value, quarterly net income, and share count.

See our latest analysis for Orchid Island Capital.

Momentum around Orchid Island Capital has ebbed and flowed. While its 1-year total shareholder return stands at a healthy 9.7%, the year-to-date share price return remains negative. Recent dividend news and updates on book value have sparked renewed attention, but broader performance still reflects a cautious outlook after a few volatile quarters.

If the mix of income and risk in Orchid Island Capital has you thinking broader, this could be the perfect time to discover fast growing stocks with high insider ownership

With a newly declared dividend, improved book value, and robust quarterly income, is Orchid Island Capital flying under the radar as an undervalued pick? Or are markets already pricing in all future growth prospects?

Most Popular Narrative: 9.3% Undervalued

With a last close price of $7.26 and a consensus fair value set at $8.00, the current narrative signals promise if a few key forecasts play out. The valuation hinges on massive income expansion and factors that could unlock significant upside in book value and returns.

"The confluence of historically wide mortgage spreads over swaps (circa 200 bps on production coupons) and low market volatility presents a rare opportunity for Orchid Island Capital to acquire high-carry, attractively priced assets and hedge effectively, positioning the company for margin expansion and sustained earnings growth as spreads eventually normalize."

Curious what projections drive such a bullish outlook? The narrative suggests an aggressive profit explosion and earnings mega-shift, yet the exact growth assumptions behind these bold numbers might surprise you. Find out how a few strategic bets could tilt the entire valuation.

Result: Fair Value of $8.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent higher interest rates or continued equity dilution could quickly undermine the bullish thesis and limit the upside potential for Orchid Island Capital.

Find out about the key risks to this Orchid Island Capital narrative.

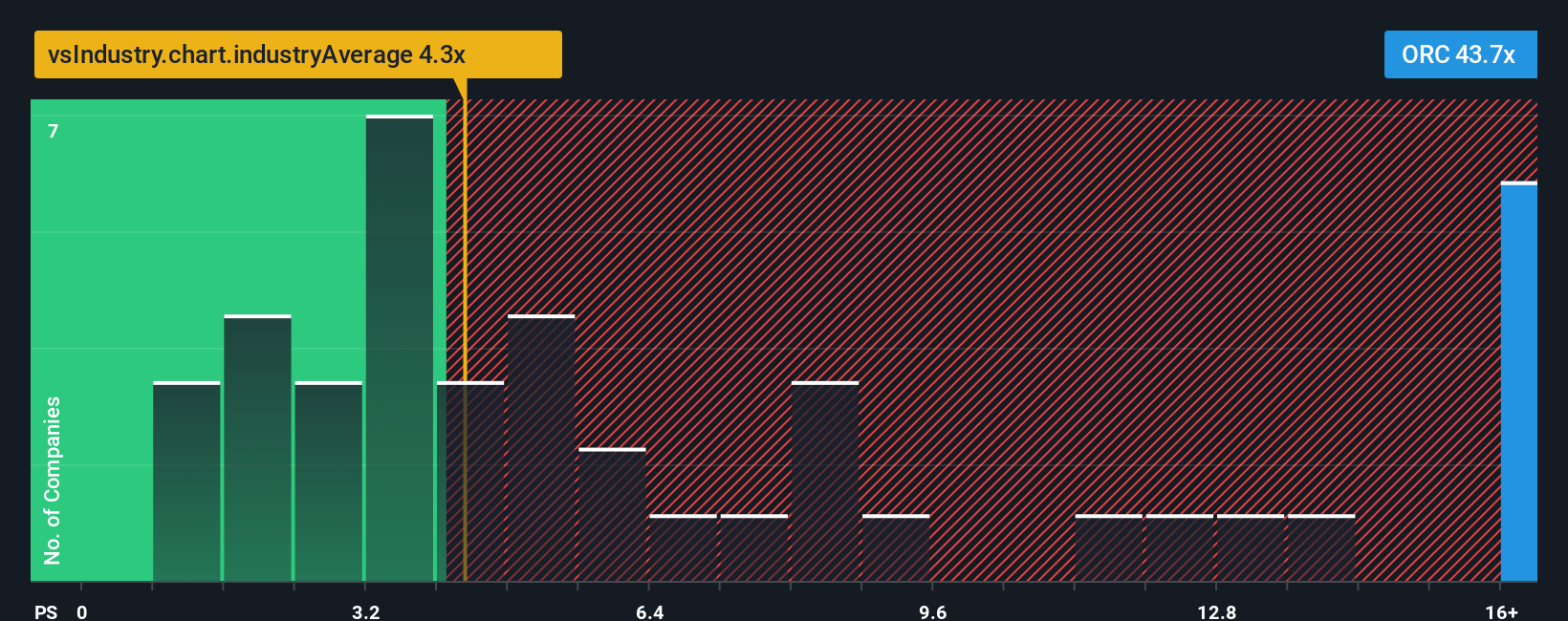

Another View: High Multiple Brings Caution

Looking at Orchid Island Capital through a different lens, its price-to-sales ratio stands at a lofty 43.7x, much higher than the US Mortgage REITs industry average of 4.3x and the peer average of 4.9x. The fair ratio based on market regression is 7x, so today's pricing appears stretched. That means investors face higher valuation risk, as the market could move toward that lower ratio over time. Does this premium price reflect hidden strengths, or could it signal a need for caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orchid Island Capital Narrative

If you see things differently, or want a hands-on approach, dive into the data and construct your own take on Orchid Island Capital in just minutes. Do it your way

A great starting point for your Orchid Island Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Smart investors never stand still. Give yourself an edge by using the Simply Wall Street Screener to spot emerging trends and untapped opportunities before the crowds catch on.

- Tap into surging artificial intelligence breakthroughs by checking out these 24 AI penny stocks poised for rapid transformation in the tech sector.

- Unlock undervalued potential with these 870 undervalued stocks based on cash flows, where robust fundamentals meet promising forward-looking cash flows and long-term upside.

- Boost your passive income goals by seeing which companies offer strong yields and reliability with these 18 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORC

Orchid Island Capital

A specialty finance company, invests in residential mortgage-backed securities (RMBS) in the United States.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives