- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Nelnet (NNI): Evaluating Whether a 26% Year-to-Date Rally Still Leaves Valuation Attractive

Reviewed by Simply Wall St

Nelnet (NNI) has quietly rewarded patient investors, with the stock up about 26% year to date and more than doubling over five years, even as annual revenue recently dipped slightly.

See our latest analysis for Nelnet.

With the share price now at $133.18 and a year to date share price return of about 26 percent, momentum still looks constructive, while the five year total shareholder return of roughly 101 percent underlines how well the story has played out over time.

If Nelnet's steady climb has you thinking about where else disciplined capital can compound, this could be a smart moment to explore fast growing stocks with high insider ownership.

Yet with revenue contracting slightly and the share price hovering near analyst targets, investors face a key question: is Nelnet still mispriced relative to its long term prospects, or is the market already baking in future growth?

Price-to-Earnings of 11x: Is it justified?

At roughly $133 per share, Nelnet trades at about 11 times earnings, a level that screens as modest against both the market and its niche.

The price-to-earnings multiple compares what investors pay today for each dollar of current profit. This is a key lens for a diversified financial group with mature, cash-generative segments. For Nelnet, it helps translate volatile earnings swings into a more stable yardstick for how the market values its profit engine.

Despite a sharp rebound in earnings over the last year and net profit margins now above 25 percent, the market is not awarding a premium valuation. This suggests investors are cautious about how sustainable recent profitability will be. At the same time, the multiple still reflects that Nelnet generates high-quality earnings rather than purely cyclical or one-off gains.

Compared with the broader US market, where the average price-to-earnings sits around 18.5 times, Nelnet looks notably cheaper. It is only slightly more expensive than the 10 times average in the US consumer finance industry. That mix of a discount to the market but a small premium to direct industry peers hints that investors see Nelnet as higher quality than a typical lender, but not a high-growth story.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 11x (ABOUT RIGHT)

However, slowing revenue growth, combined with the stock trading near analyst targets, could expose investors if margins compress or regulatory shifts affect key lending activities.

Find out about the key risks to this Nelnet narrative.

Another View: DCF Flags Overvaluation Risk

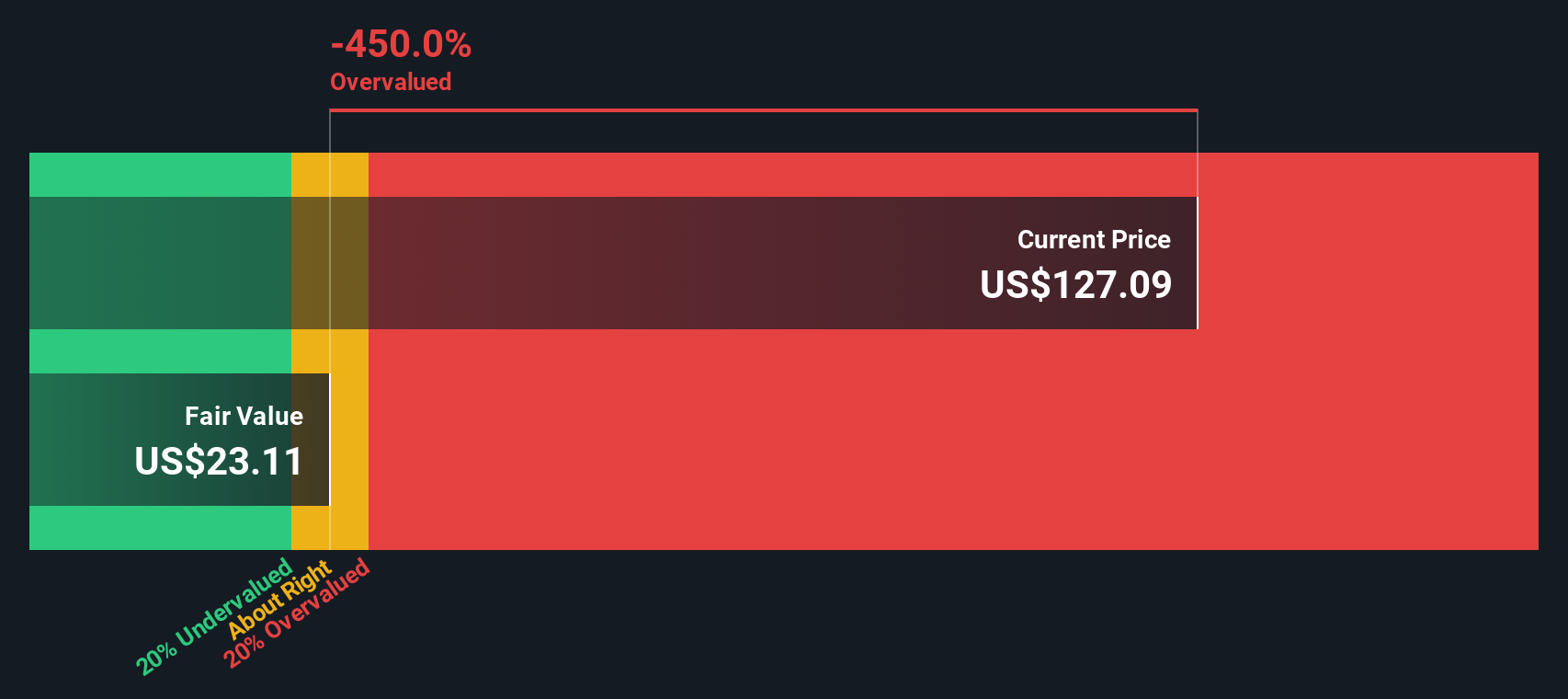

While 11 times earnings looks reasonable, our DCF model paints a very different picture. It puts Nelnet’s fair value near $22.76 per share versus today’s $133.18, implying the stock is trading well above modeled cash flow value. Is the market seeing something the model cannot? Or is optimism running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nelnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nelnet Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your next opportunity by using targeted screeners that surface high conviction ideas most investors will not even notice.

- Capture income potential with consistently strong payouts by targeting these 14 dividend stocks with yields > 3% that can anchor your portfolio in choppy markets.

- Ride structural growth trends in automation and machine learning by focusing on these 25 AI penny stocks positioned to benefit as AI spending accelerates.

- Position yourself ahead of the next digital finance wave by zeroing in on these 81 cryptocurrency and blockchain stocks shaping payments, infrastructure, and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026