- United States

- /

- Diversified Financial

- /

- NYSE:NATL

NCR Atleos (NATL): Assessing Valuation After Expanding Allpoint Deposit Access Across Tennessee and Nationwide

Reviewed by Simply Wall St

NCR Atleos (NATL) is in focus after expanding its Allpoint Network, enabling Knoxville TVA Employees Credit Union members to make cash deposits at 3,500 branded ATMs nationwide, including new deposit locations across Tennessee.

See our latest analysis for NCR Atleos.

NCR Atleos shares now trade at $38.71, and that Knoxville TVA deal helps explain why the year to date share price return of 13.62 percent and 1 year total shareholder return of 16.46 percent point to gradually improving momentum rather than a euphoric rerating.

If you like the network scale angle of NCR Atleos but want to see what else is gaining traction, it is worth exploring fast growing stocks with high insider ownership.

With revenue and earnings both climbing, yet the shares still trading at a mid teens discount to analyst targets, the real question is whether NCR Atleos remains undervalued or if the market is already pricing in its growth.

Most Popular Narrative: 13.3% Undervalued

With the most followed narrative putting fair value above the recent $38.71 close, the spotlight shifts to whether NCR Atleos can deliver on its growth runway.

High recurring revenue mix (over 70% in Q2), significant productivity gains through AI-driven service optimization, and a rapidly scaling backlog are driving strong margin expansion and robust free cash flow, underpinning announced share buybacks and sustained EPS growth, suggesting current valuation does not reflect enhanced long-term earnings power.

Want to see why steady revenue, rising margins and surging earnings still add up to a discount story, not a premium one? The most influential narrative quietly bakes in ambitious cash flow upgrades and a future earnings multiple that is more conservative than many of today’s market favorites. Curious which specific growth and profitability levers drive that gap between price and fair value, and how long it could last? Dive into the full narrative to unpack the numbers behind this valuation call.

Result: Fair Value of $44.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a faster shift to fully digital banking or aggressive fintech competition eroding ATM margins could quickly challenge the current undervaluation thesis.

Find out about the key risks to this NCR Atleos narrative.

Another Angle on Valuation

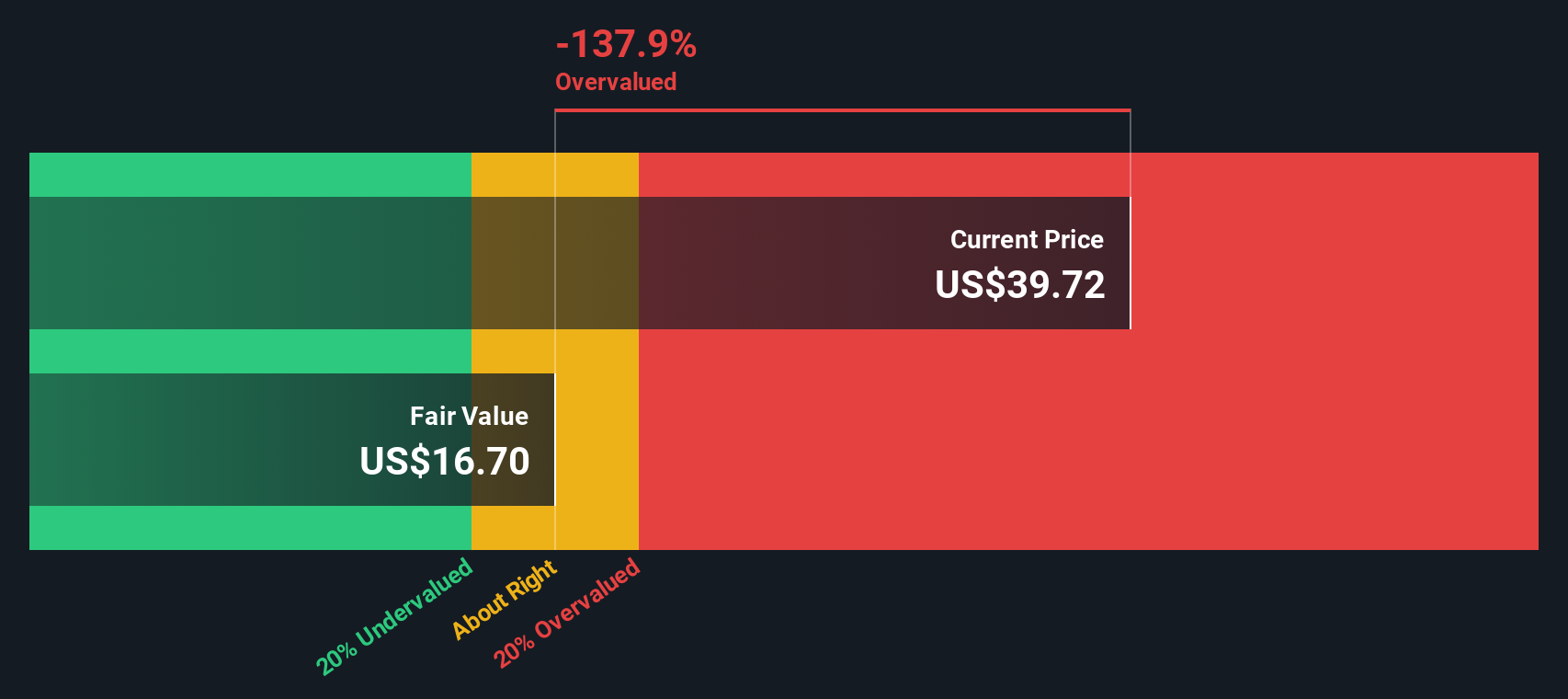

Analysts see NCR Atleos as 13.3 percent undervalued, but our DCF model paints a sharper contrast. It puts fair value closer to $18.01, which implies the shares are trading well above intrinsic value. Is the market right to pay up for the growth story, or is optimism running ahead of cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NCR Atleos Narrative

If this view does not quite fit your own, or you prefer digging into the numbers yourself, you can build a full narrative in under three minutes, Do it your way.

A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to help identify focused, data driven opportunities tailored to your strategy.

- Seek early stage momentum by scanning these 3608 penny stocks with strong financials that already show financial strength, rather than waiting for broader market attention.

- Explore opportunities related to the AI theme by screening these 26 AI penny stocks that combine technological innovation with established business fundamentals.

- Identify value focused candidates by targeting these 903 undervalued stocks based on cash flows, where cash flows may indicate potential upside before sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NCR Atleos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NATL

NCR Atleos

A financial technology company, provides self-directed banking solutions to financial institutions, merchants, manufacturers, retailers, and consumers in the United States, rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)