- United States

- /

- Capital Markets

- /

- NYSE:MSDL

Morgan Stanley Direct Lending Fund (MSDL) Valuation After $275 Million Senior Note Redemption and Balance Sheet Moves

Reviewed by Simply Wall St

Something is stirring with Morgan Stanley Direct Lending Fund (NYSE:MSDL) after its recent announcement to redeem $275 million in senior notes, including the 7.55% Series A Senior Notes due in 2025. This is not just a routine move; management is clearly looking to optimize the balance sheet in response to the shifting interest rate landscape and fresh second-quarter results. For existing investors and those watching from the sidelines, it is the kind of calculated step that often signals more to come, especially as expectations build for Federal Reserve rate cuts in the coming years.

For context, the past year has brought mixed signals for Morgan Stanley Direct Lending Fund’s share price. Despite the steady financial management efforts and major events like this large debt redemption, the stock is down nearly 2% over the past year, with a steeper dip of 15% year-to-date. Most of the recent momentum has been sideways or slightly negative, reflecting a market that is still working through what this combination of operational decisions and macro changes might mean for the business and its long-term value story.

After this year’s slide and a noteworthy debt move, is Morgan Stanley Direct Lending Fund now trading at a bargain, or is the market simply adjusting to a slower growth outlook?

Price-to-Book Ratio: Is it justified?

Morgan Stanley Direct Lending Fund’s valuation using the price-to-book (P/B) ratio cannot be reliably compared to its peers or the industry, due to insufficient data. This lack of information makes it difficult to determine if the current valuation is justified, undervalued, or overvalued compared to similar companies in the capital markets sector.

The price-to-book ratio assesses a company's market value relative to its book value and is frequently used for financial institutions to gauge whether shares are priced above or below the assets that back them. In this case, investors are left without the usual reference points, which complicates value assessments and makes it harder to determine whether the stock’s recent discount reflects an opportunity or a warning sign.

In the absence of a clear benchmark, the true value of Morgan Stanley Direct Lending Fund remains uncertain for now.

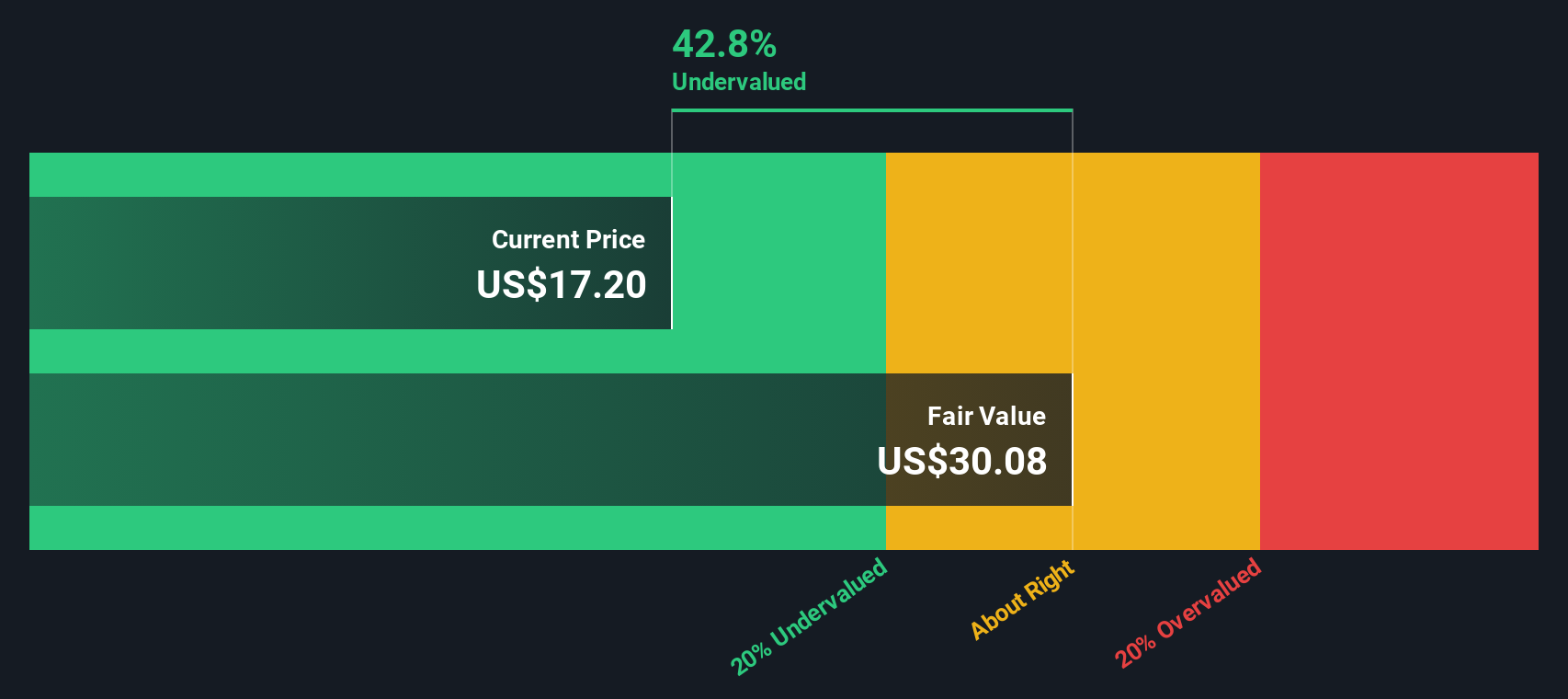

Result: Fair Value of $30.16 (UNDERVALUED)

See our latest analysis for Morgan Stanley Direct Lending Fund.However, persistent share price weakness and a lack of reliable growth or income data could quickly challenge any case for recent undervaluation.

Find out about the key risks to this Morgan Stanley Direct Lending Fund narrative.Another View: Discounted Cash Flow Model

Taking a different angle, our DCF model also points to undervaluation for Morgan Stanley Direct Lending Fund. Unlike ratio-based valuations, this approach relies on future cash flows, which can be tricky to predict. Could this offer a deeper or riskier insight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Morgan Stanley Direct Lending Fund Narrative

If you see things differently or enjoy hands-on analysis, you can draw on the numbers and shape an independent view in just minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Morgan Stanley Direct Lending Fund.

Looking for more investment ideas?

Smart investors look beyond a single opportunity. Make your next savvy move by tapping into unique opportunities that others might overlook with these powerful screening tools:

- Spot up-and-coming companies with strong fundamentals and seize the potential in penny stocks with strong financials before the crowd catches on.

- Boost your returns by targeting companies offering solid income streams through dividend stocks with yields > 3% and secure your financial future with sustainable payouts.

- Stay ahead of the curve in tomorrow's innovation by finding early movers with AI penny stocks, where artificial intelligence is driving growth and new market leaders emerge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSDL

Slightly overvalued unattractive dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)