- United States

- /

- Capital Markets

- /

- NYSE:MSCI

MSCI (MSCI) Valuation Check as New Digital Asset Index Rules Draw Investor Attention

Reviewed by Simply Wall St

MSCI (MSCI) is back in the spotlight as it weighs stricter rules for digital assets in its indexes, including the potential exclusion of companies whose balance sheets rely heavily on cryptocurrencies and digital asset treasuries.

See our latest analysis for MSCI.

Those tougher digital asset rules land at an interesting time for the stock. A recent 7 day share price return of 3.09 percent has helped to steady what has otherwise been a weak year to date share price return of negative 7.3 percent. Longer term total shareholder returns over three and five years still show solid compounding gains that suggest momentum has cooled rather than disappeared.

If you are weighing MSCI's role in portfolios, it can also be useful to see what else investors are using for diversification, including fast growing stocks with high insider ownership.

With revenue and profit still growing briskly and the share price lagging its historical returns, the debate now turns to valuation: is MSCI quietly cheapening up, or has the market already priced in its next leg of growth?

Most Popular Narrative: 15.8% Undervalued

With MSCI last closing at $553.51 against a narrative fair value of $657.56, the current setup frames a premium quality name at a discounted narrative price.

The company is capitalizing on the growing institutionalization of wealth management and increasing demand for advanced portfolio construction, direct indexing, and analytics tools, evidenced by record wins in wealth management; this is likely to result in a greater share of recurring, high-margin subscription revenue and long-term margin expansion.

Curious how steady mid single digit growth assumptions, richer margins and a still elevated earnings multiple can all coexist in one model? The full narrative reveals the math behind that confidence.

Result: Fair Value of $657.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer sustainability demand and ongoing fee compression in passive products could both challenge MSCI's growth assumptions and pressure its premium valuation over time.

Find out about the key risks to this MSCI narrative.

Another Lens on Valuation

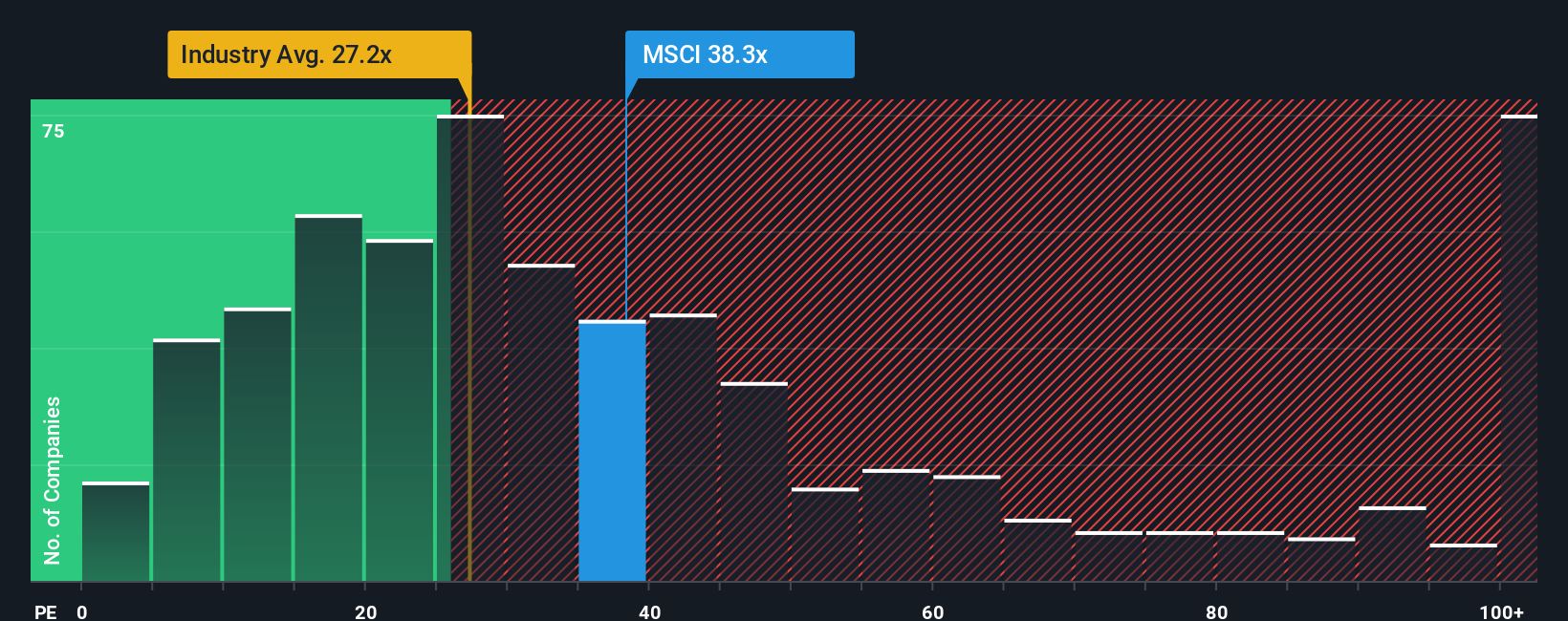

While the narrative view points to MSCI being 15.8 percent undervalued, our earnings based lens sends a different signal. At about 34 times earnings versus an industry 25.2 times, a peer 33.3 times, and a 16.6 times fair ratio, the stock screens as expensive. Is this quality premium secure or stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at MSCI when the market is full of opportunities. Use the Simply Wall Street Screener to uncover ideas others are still overlooking.

- Explore potential multibagger opportunities early by targeting these 3612 penny stocks with strong financials that already show robust balance sheets and real, growing businesses behind the tiny share prices.

- Position your portfolio for the next wave of innovation by zeroing in on these 26 AI penny stocks that are involved in automation, data intelligence, and new software platforms.

- Seek stronger income potential by focusing on these 13 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout ratios and dependable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)