- United States

- /

- Capital Markets

- /

- NYSE:MS

Does Morgan Stanley’s Strong Rally in 2025 Signal More Growth Ahead?

Reviewed by Bailey Pemberton

Thinking about what to do with Morgan Stanley stock? You are certainly not alone. With the market serving up daily headlines and price moves, it is tempting to wonder whether you are looking at a winner that has room to grow, or a play that has already had its run. Morgan Stanley’s share price recently closed at $158.09, and if you look at the numbers, the story is intriguing. The stock has soared 266.0% over the past five years and posted an impressive 51.3% gain in the past year alone. Even after a minor setback of -1.9% in the last week, the past month delivered a robust 6.8% return. Year-to-date, shareholders are enjoying a 26.7% rise.

These positive moves are not just random. The financial sector has generally been on the upswing, thanks in part to renewed optimism about the economy and ongoing shifts in interest rates. Investors have also begun rewarding large, diversified banks. Morgan Stanley’s steady hand through market changes has added to its appeal. That said, there is always the question of whether the growth is built on solid ground, especially when looking at how Wall Street is currently valuing the business. According to a recent analysis that looks at six key valuation checks, Morgan Stanley is undervalued on three of them, earning it a valuation score of 3 out of 6.

Ready to dive deeper? Let us break down the common valuation approaches to see where Morgan Stanley really stands and consider if there is an even more insightful way to value the company before you make your next move.

Approach 1: Morgan Stanley Excess Returns Analysis

The Excess Returns model measures how much value a company creates by earning returns above its cost of equity. This approach focuses on how well Morgan Stanley turns invested capital into profit over time and whether that performance seems sustainable given its prospects.

For Morgan Stanley, the key inputs are:

- Book Value: $61.59 per share

- Stable Earnings Per Share (EPS): $9.97 per share (Source: Weighted future Return on Equity estimates from 12 analysts.)

- Cost of Equity: $6.47 per share

- Excess Return: $3.50 per share

- Average Return on Equity: 15.13%

- Stable Book Value: $65.93 per share (Source: Weighted future Book Value estimates from 14 analysts.)

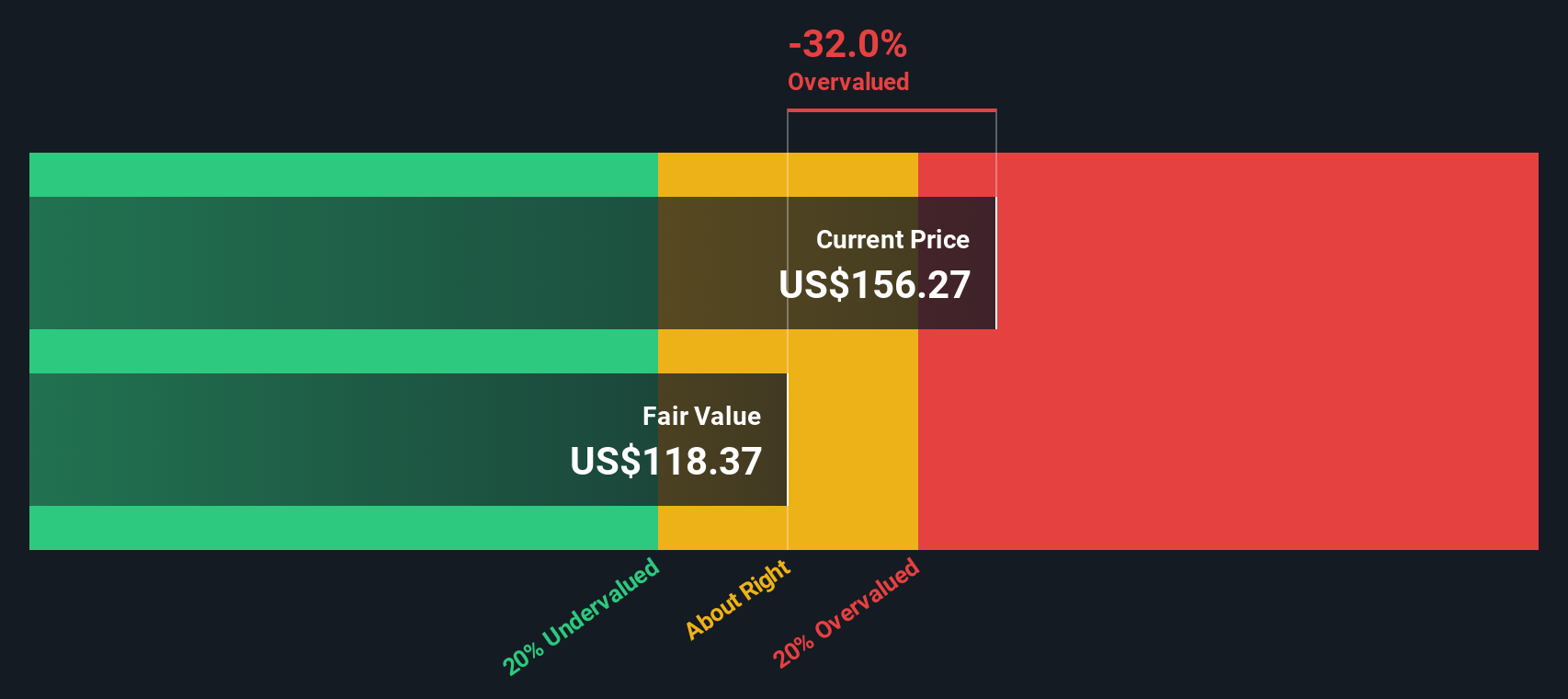

Using these inputs, the model estimates Morgan Stanley's intrinsic value at $117.89 per share. Compared to the current share price of $158.09, this suggests the stock is 34.1% overvalued. The numbers suggest much of the current price may already reflect ambitious growth expectations, with limited upside at these levels.

Result: OVERVALUED

Our Excess Returns analysis suggests Morgan Stanley may be overvalued by 34.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Morgan Stanley Price vs Earnings

The price-to-earnings (PE) ratio is a widely used way to value profitable companies like Morgan Stanley because it directly links a company’s current share price to its bottom-line earnings. Investors often rely on this metric to gauge how expensive or cheap a stock is relative to its profits. A company expected to grow faster or deliver more predictable earnings will generally be awarded a higher PE multiple, while companies facing uncertain prospects or higher risks command a lower one.

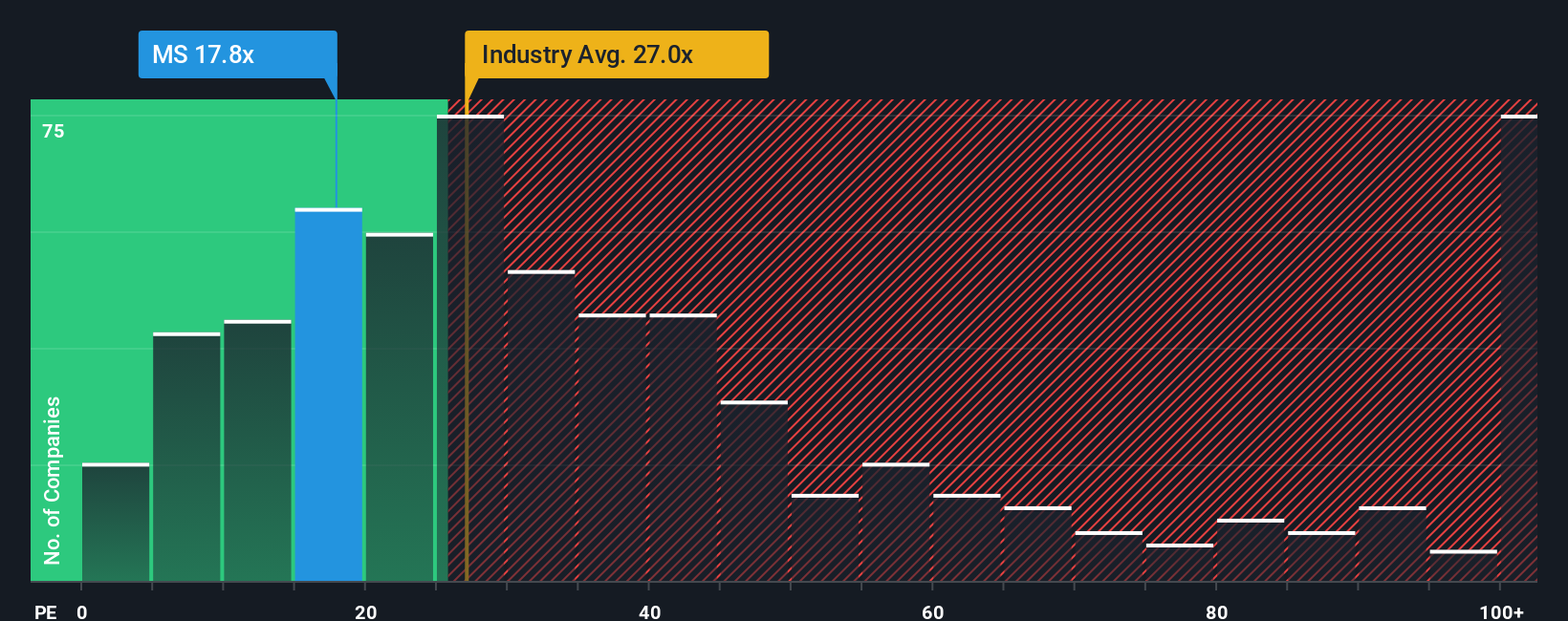

Currently, Morgan Stanley trades at a PE ratio of 17.85x. This is well below the Capital Markets industry average of 26.98x and is also less than the peer group’s average of 37.74x. On the surface, this might suggest the stock is attractively priced compared to its industry and peers. However, context is key, since multiples alone do not account for specific company factors such as growth outlook, profitability, and risk profile.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio is a proprietary metric designed to reflect what a reasonable PE multiple should be for Morgan Stanley, based on factors like earnings growth, historical profitability, industry, size, and risk. By considering this broader set of features, the Fair Ratio is a more tailored benchmark than a simple peer or sector comparison.

For Morgan Stanley, the Fair Ratio is calculated at 20.95x. With the actual PE ratio at 17.85x, the company is trading slightly below its Fair Ratio, suggesting potential for modest upside. Since the difference between the Fair Ratio and actual PE is more than 0.10x, Morgan Stanley shares currently look undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Morgan Stanley Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives. A Narrative is your personal story or viewpoint about a company like Morgan Stanley, backed up by your estimates for its future revenue, earnings, margins, and, ultimately, fair value.

Rather than just looking at historical numbers, Narratives help you connect what you believe is happening in the business with a clear financial forecast and then a fair value. This means your investment decision is based on both the company’s story and the numbers behind it.

Narratives are an easy and accessible tool available right now on Simply Wall St’s Community page, where millions of investors are already sharing their perspectives. With Narratives, you can quickly see if Morgan Stanley’s fair value, based on your or others’ expectations, suggests it is a buy or sell compared to its current price.

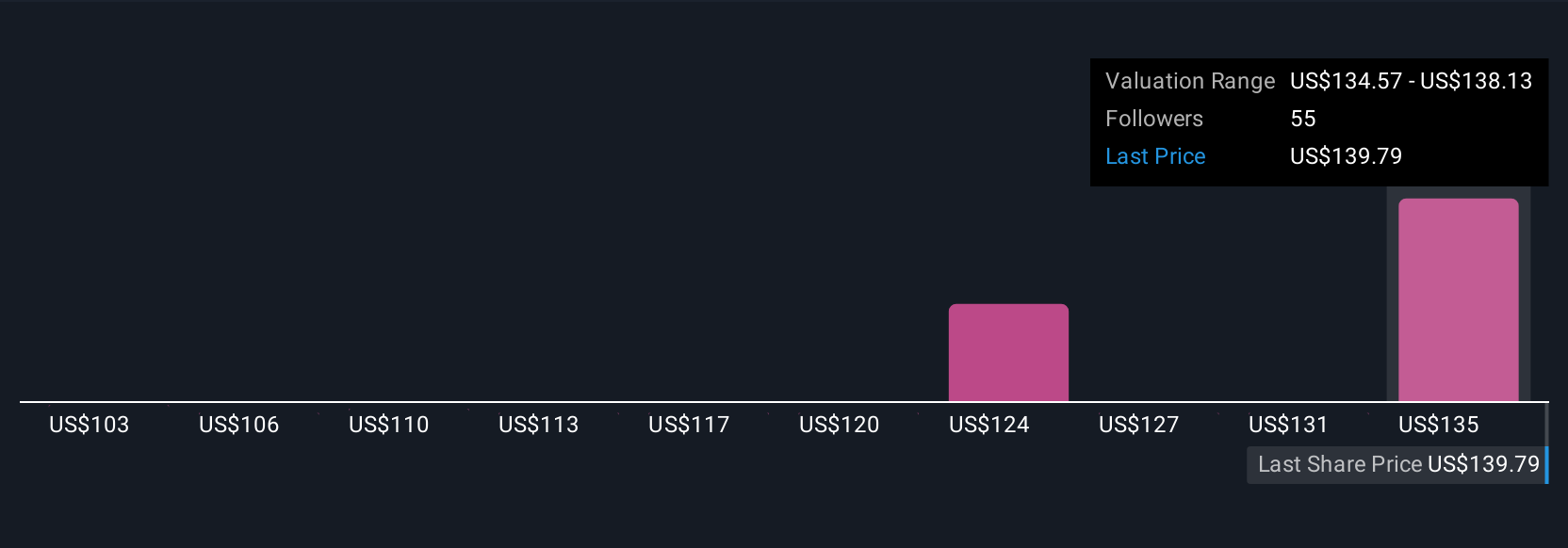

Because Narratives automatically update when new news or earnings arrive, your fair value stays relevant and up to date. For example, among investors, some see upside for Morgan Stanley with a fair value as high as $160.00 per share, while others are more cautious, estimating fair value closer to $122.00, reflecting different outlooks for future growth and risks.

Do you think there's more to the story for Morgan Stanley? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives