- United States

- /

- Consumer Finance

- /

- NYSE:ML

MoneyLion Inc.'s (NYSE:ML) Shares Climb 50% But Its Business Is Yet to Catch Up

MoneyLion Inc. (NYSE:ML) shares have continued their recent momentum with a 50% gain in the last month alone. The last month tops off a massive increase of 228% in the last year.

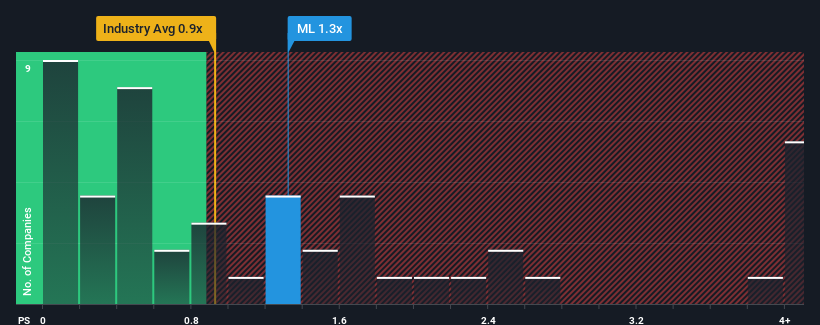

Even after such a large jump in price, you could still be forgiven for feeling indifferent about MoneyLion's P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Finance industry in the United States is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for MoneyLion

How Has MoneyLion Performed Recently?

MoneyLion certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MoneyLion.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like MoneyLion's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the three analysts following the company. With the industry predicted to deliver 34% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that MoneyLion is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does MoneyLion's P/S Mean For Investors?

Its shares have lifted substantially and now MoneyLion's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that MoneyLion's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 3 warning signs for MoneyLion that we have uncovered.

If these risks are making you reconsider your opinion on MoneyLion, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade MoneyLion, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ML

MoneyLion

A financial technology company, provides personalized products and financial content for consumers in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives