- United States

- /

- Capital Markets

- /

- NYSE:MC

Moelis (MC) Is Up 6.7% After Winning Netflix–Warner Bros. Mandate Amid Brighter M&A Outlook

Reviewed by Sasha Jovanovic

- In recent days, Morgan Stanley highlighted Moelis & Company in a positive sector outlook, suggesting advisory firms could benefit from an earlier-than-expected rebound in sponsor-led transactions and related capital markets activity.

- This supportive industry view arrives soon after Moelis was appointed financial advisor to Netflix on its US$82.70 billion bid for Warner Bros., a high-profile mandate that underscores the firm’s standing in large-scale M&A advisory.

- With this backdrop, we’ll examine how the anticipated rebound in sponsor deal activity may reshape Moelis’ investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Moelis Investment Narrative Recap

To own Moelis, you need to believe in its ability to convert deal-flow cycles into sustainable earnings, despite a transaction-heavy and often volatile advisory model. The recent Morgan Stanley sector call and the Netflix/Warner Bros. assignment support the near term catalyst of a sponsor and large-cap M&A recovery, but they do little to resolve the key risk of higher costs from Moelis’ expansion into new advisory verticals if revenues soften again.

The Netflix advisory mandate is the clearest link to this story, reinforcing Moelis’ relevance on marquee transactions at the same time analysts flag a potential upturn in sponsor-led deal activity. While this single win will not define long term performance, it does highlight how landing large, fee rich mandates can help offset the margin pressure that comes with aggressive hiring and expansion when deal volumes are uneven.

But against this improving deal backdrop, investors still need to watch how Moelis manages rising compensation and expansion costs if...

Read the full narrative on Moelis (it's free!)

Moelis' narrative projects $2.1 billion revenue and $381.7 million earnings by 2028. This requires 15.3% yearly revenue growth and a $183.6 million earnings increase from $198.1 million.

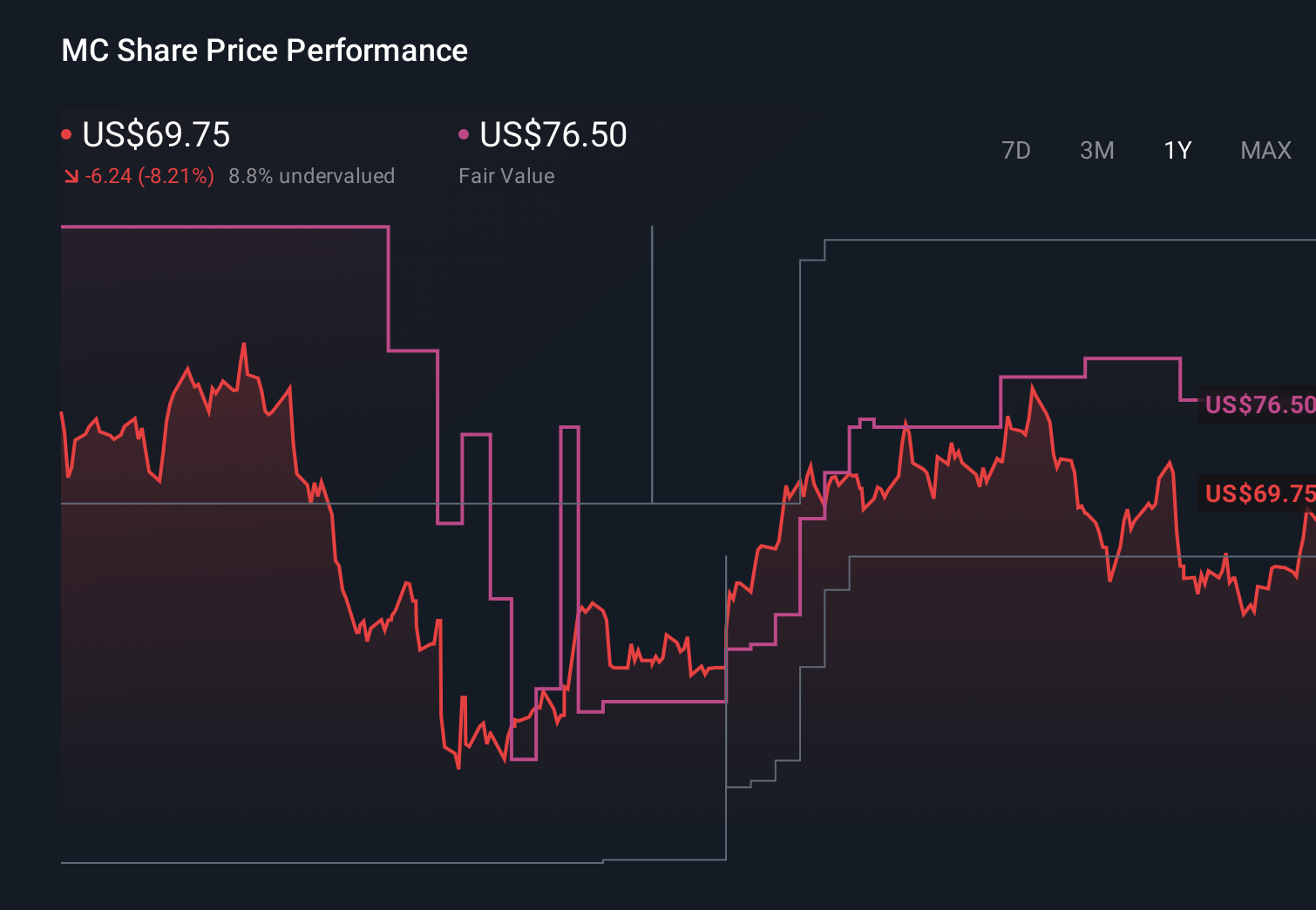

Uncover how Moelis' forecasts yield a $76.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$21 to US$77 per share, showing how differently people can view Moelis’ prospects. Against that wide range, the reliance on cyclical, event driven revenues becomes a central question for anyone thinking about the firm’s longer term performance, so it is worth exploring several alternative viewpoints before forming a view.

Explore 2 other fair value estimates on Moelis - why the stock might be worth less than half the current price!

Build Your Own Moelis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moelis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moelis' overall financial health at a glance.

No Opportunity In Moelis?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MC

Moelis

Operates as an investment banking advisory company in North and South America, Europe, the Middle East, Asia, and Australia.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026