- United States

- /

- Consumer Finance

- /

- NYSE:LU

How Investors May Respond To Lufax (LU) Renewing 2026 Ping An Agreements And Seeking Shareholder Input

Reviewed by Sasha Jovanovic

- Lufax Holding has renewed several core 2026 agreements, including its Account Management Framework Agreement and Financial Services Framework Agreement with Ping An Consumer Finance, and it has called an Extraordinary General Meeting for December 29, 2025, to seek shareholder input on these arrangements.

- By locking in these operational frameworks and formally engaging shareholders, the company is underscoring how central these partnerships are to its business model and future direction.

- We’ll now examine how securing the 2026 Financial Services Framework Agreement with Ping An Consumer Finance shapes Lufax Holding’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Lufax Holding's Investment Narrative?

To own Lufax Holding, you need to believe the business can turn currently loss-making CN¥32,766.56 thousand revenue into sustainable profitability while operating under tight regulatory scrutiny and with a relatively new management team. The renewed 2026 Account Management and Financial Services Framework Agreements with Ping An Consumer Finance help shore up a key operational pillar, which, in my view, slightly strengthens the short term catalyst around business continuity and funding access rather than fundamentally changing the story. The Extraordinary General Meeting adds a governance and execution watchpoint: it may give clearer visibility into how closely Ping An ties into Lufax’s long term model, but it also reminds you how dependent the company is on that relationship. Against weak multi year returns and unprofitable operations, that dependency is a central risk.

However, that Ping An reliance introduces a specific concentration risk investors should understand in detail. Our expertly prepared valuation report on Lufax Holding implies its share price may be lower than expected.Exploring Other Perspectives

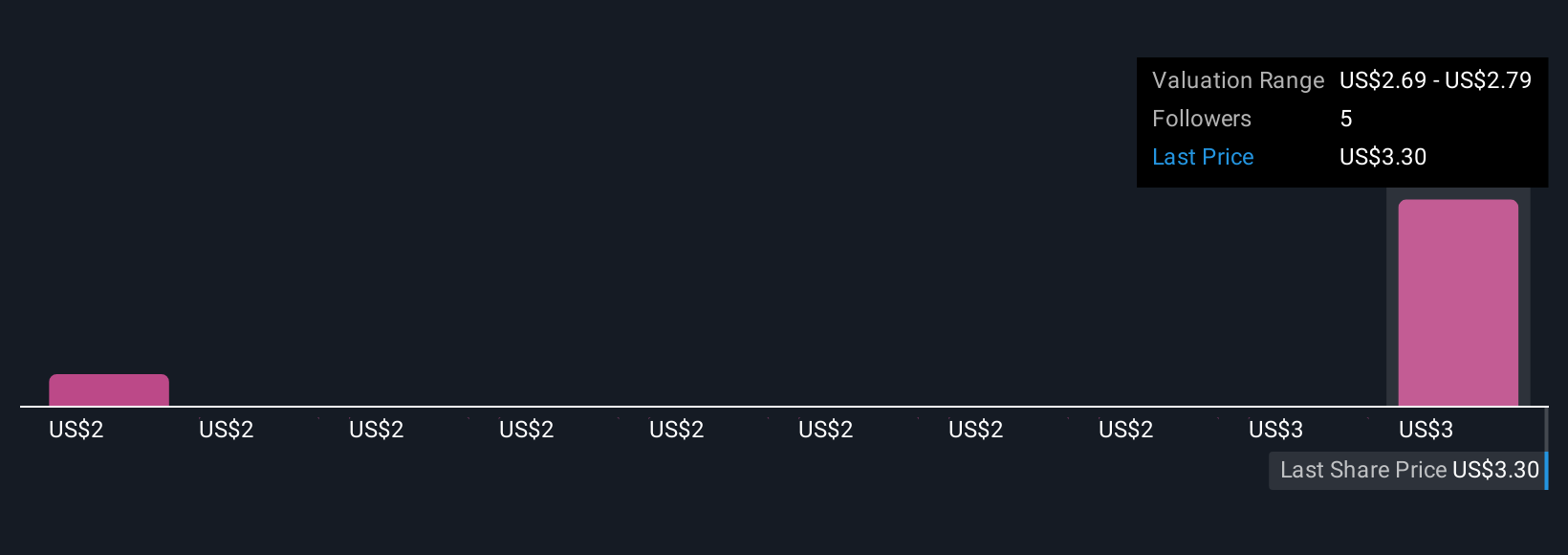

Two Simply Wall St Community fair value estimates span about US$1.81 to US$2.79 per share, underlining how far opinions can diverge. Set that against Lufax’s fresh Ping An framework renewals and auditor change, and you can see why many readers may want to weigh several views before deciding how much execution and governance risk they are comfortable with.

Explore 2 other fair value estimates on Lufax Holding - why the stock might be worth as much as 7% more than the current price!

Build Your Own Lufax Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lufax Holding research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Lufax Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lufax Holding's overall financial health at a glance.

No Opportunity In Lufax Holding?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LU

Lufax Holding

Operates as a financial service empowering institution for small and micro businesses in China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026