- United States

- /

- Capital Markets

- /

- NYSE:LAZ

Does Lazard’s Recent 13% Drop Signal a Long-Term Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you are debating whether now is the time to jump into Lazard stock, you are definitely not alone. The past year has been a wild ride, with the share price rebounding 3.3%. This is not spectacular, but certainly not stagnant either. Those who've held on for longer have enjoyed truly impressive returns, with the stock up over 80% in the last three years and more than 70% over the last five. At the same time, recent weeks have looked choppy, with Lazard pulling back about 4.7% over the last seven days and dropping almost 13% in the past month. Most of this movement can be traced back to shifting perceptions about global investment demand and changing risks in the financial sector, not just for Lazard but for peer firms as well.

But here is where things get compelling. By traditional measures of value, Lazard is showing signs of being a hidden gem. In fact, the company scores a perfect 6 out of 6 on major undervaluation checks, making it one of the strongest value opportunities in its space right now. In the next section, we will break down the individual valuation strategies analysts use to assess a stock like Lazard. Before we are done, you will see there may be an even smarter way to think about value for the long-term investor.

Why Lazard is lagging behind its peers

Approach 1: Lazard Excess Returns Analysis

The Excess Returns Model helps investors evaluate a stock by measuring the extra profit a company can generate from its own invested capital, over and above the normal required rate of return. This approach shows how skillfully and efficiently a management team is allocating shareholder money. It focuses on long-term value creation rather than short-term gains.

For Lazard, the book value currently stands at $7.86 per share. Its stable earnings per share (EPS), based on the median return on equity from the past five years, are $4.77 per share. The company’s cost of equity, or the expected return required by shareholders, is $1.20 per share. This means Lazard generates an excess return of $3.58 per share, showcasing its ability to deliver well above its capital costs. The average return on equity for Lazard is 38.22%, indicating that it is using its resources very effectively. Looking ahead, analysts calculate a stable book value of $12.48 per share using future weighted estimates from two analysts.

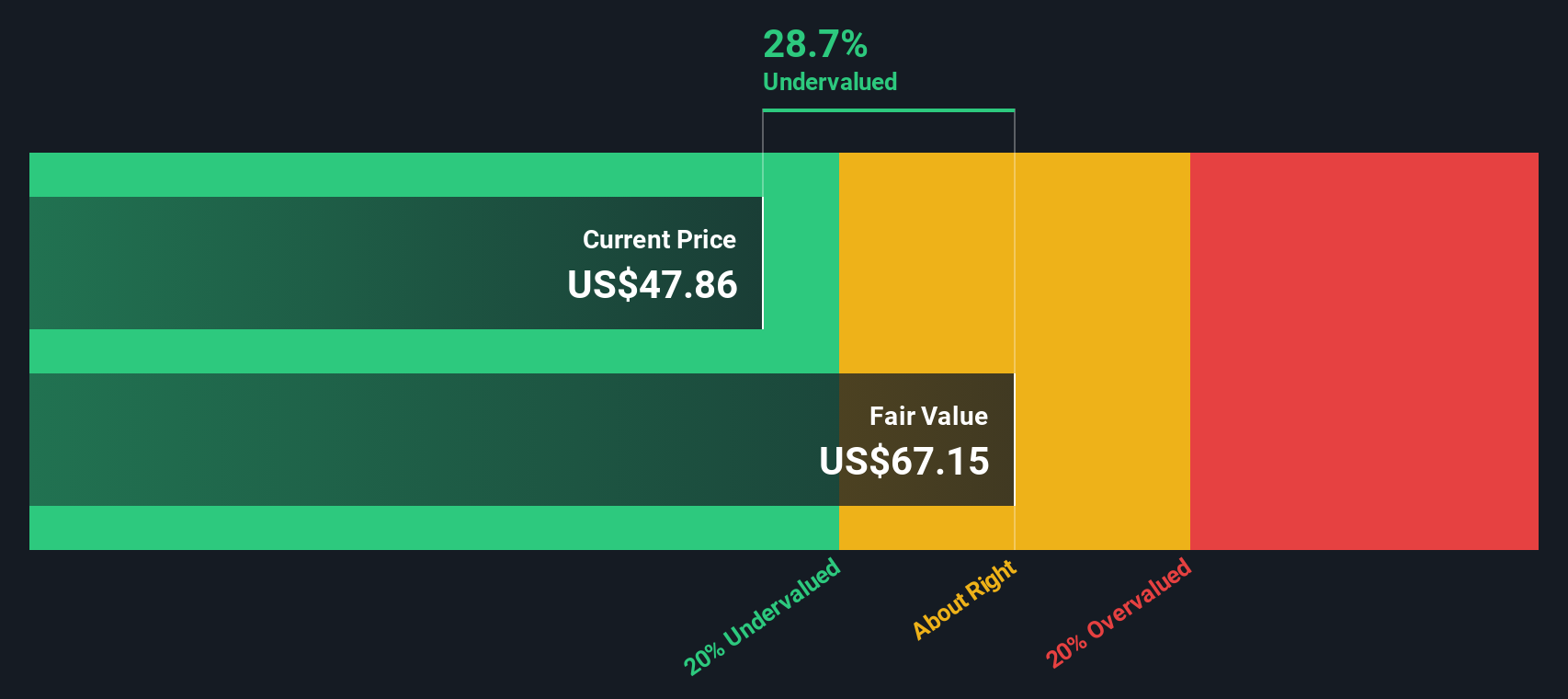

Based on these calculations, the Excess Returns Model estimates an intrinsic value for Lazard stock of $67.46 per share. With the current share price reflecting a 27.2% discount, the model suggests that Lazard is significantly undervalued by the market.

Result: UNDERVALUED

Our Excess Returns analysis suggests Lazard is undervalued by 27.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lazard Price vs Earnings

For profitable companies like Lazard, the price-to-earnings (PE) ratio is a widely used method to gauge valuation. This metric tells investors how much they are paying for each dollar of earnings, making it a direct link between a company’s profitability and its share price. Generally, higher growth expectations and lower risks drive PE ratios higher, while slower growth or higher risks result in lower "normal" PE multiples.

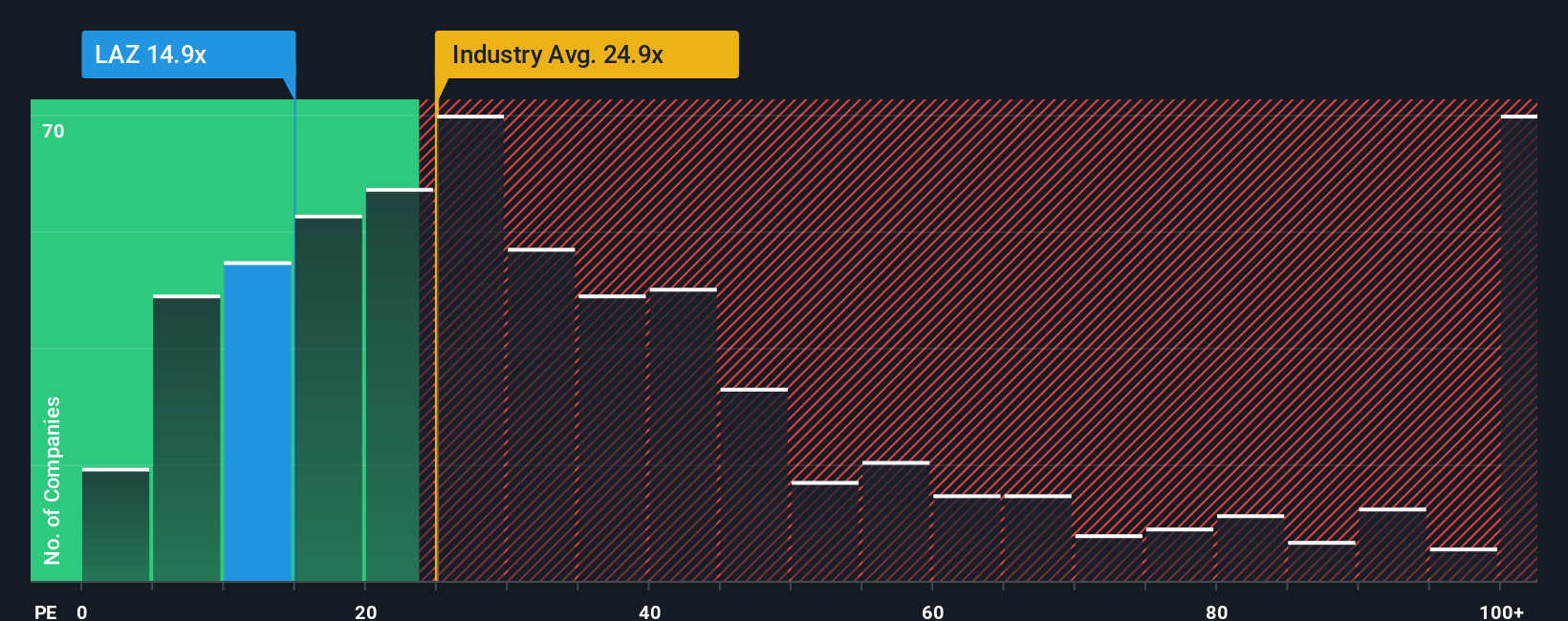

Lazard’s current PE ratio sits at 15.3x, notably lower than both the industry average of 25.5x and the peer group average of 22.4x. This indicates that the stock is being priced more conservatively than many of its Capital Markets sector counterparts. However, simple comparisons to these averages can miss important nuances in a company’s outlook and fundamentals.

This is where Simply Wall St’s Fair Ratio comes in. Unlike standard industry and peer benchmarks, the Fair Ratio (calculated here as 20.2x) accounts for Lazard’s unique combination of earnings growth potential, profit margins, market cap, and risk profile. This makes it a more tailored and accurate reference point for judging value. When comparing Lazard’s current PE of 15.3x to the Fair Ratio of 20.2x, it suggests the stock is attractively undervalued on an earnings basis and may offer value-oriented investors a compelling entry point.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lazard Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple story or viewpoint investors bring to a company, combining beliefs about what will drive its future, such as expected revenue, earnings growth, and margins, as well as what the company's fair value should be.

Narratives bridge the gap between a company’s business story and its actual financial forecasts, allowing you to connect what you believe about Lazard’s strategic moves or expansion plans directly to numbers like future profits and estimated share price. With these tools, millions of investors on Simply Wall St’s platform, especially via the Community page, can quickly create or follow Narratives for stocks they care about, including Lazard.

Using Narratives makes it much easier to decide when to buy or sell, since each Narrative shows a Fair Value based on your (or others') scenario, compared directly to Lazard’s live share price. Plus, Narratives update dynamically as news breaks or earnings roll in, so your viewpoint is always relevant.

For example, some investors think Lazard's global expansion will unlock huge future profits, supporting a price target as high as $65; others worry about cost pressures and forecast a target as low as $52. This demonstrates how Narratives empower every investor to apply their own judgment with clarity and confidence.

Do you think there's more to the story for Lazard? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAZ

Lazard

Operates as a financial advisory and asset management firm in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives