- United States

- /

- Mortgage REITs

- /

- NYSE:LADR

Can Ladder Capital's (LADR) Stagnant Revenue Trends Reshape Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- In recent days, analysts highlighted concerns about Ladder Capital's flat revenue trends, limited projected net interest income growth, and stable tangible book value per share. This raises questions about the company’s ability to enhance shareholder value and sustain future growth despite a challenging operating environment.

- Given these issues, we'll examine how muted growth expectations and operational challenges may affect Ladder Capital's longer-term investment narrative.

- We'll explore how stagnant revenue and income projections might alter the company's risk and growth outlook within the broader real estate investment trust sector.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ladder Capital Investment Narrative Recap

To own Ladder Capital shares, an investor needs to believe in the company’s ability to navigate muted growth while maintaining a stable dividend, despite soft revenue and income forecasts. The recent analyst concerns about flat revenues and book value are unlikely to fundamentally alter the near-term focus on consistent dividends, but they do reinforce the largest current risk: pressure on loan growth and margins in a tough lending market.

The latest dividend announcement, holding steady at US$0.23 per share for Q3 2025, remains the most relevant news in this context. This steady payout may appeal to income-focused shareholders, yet it also highlights questions about longer-term sustainability if earnings and revenue growth remain muted as projected.

By contrast, investors should be aware that ongoing constraints in commercial mortgage origination may continue to limit Ladder's revenue and net margin expansion, especially if...

Read the full narrative on Ladder Capital (it's free!)

Ladder Capital's narrative projects $340.9 million revenue and $113.5 million earnings by 2028. This requires 11.8% yearly revenue growth and a $25.1 million earnings increase from $88.4 million.

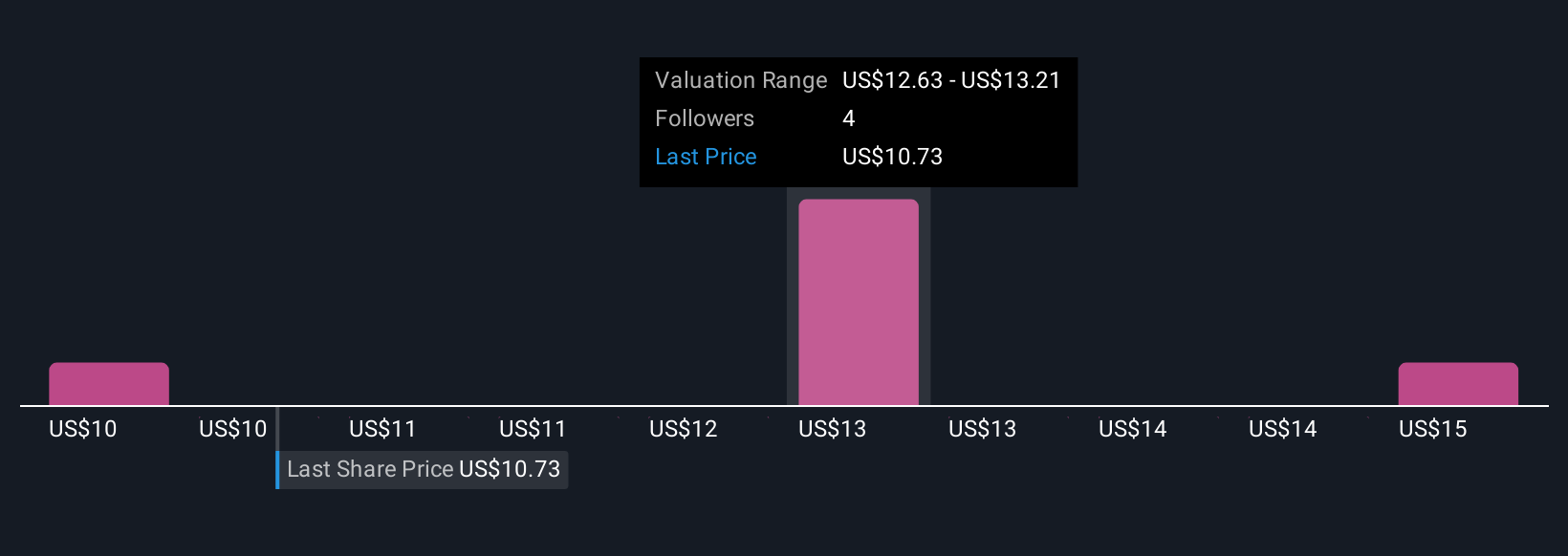

Uncover how Ladder Capital's forecasts yield a $12.83 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Ladder Capital's fair value between US$9.77 and US$15.53 per share. With revenue growth remaining subdued and risks of constrained loan origination, consider how underlying fundamentals may shape returns and review several viewpoints before making decisions.

Explore 3 other fair value estimates on Ladder Capital - why the stock might be worth as much as 44% more than the current price!

Build Your Own Ladder Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ladder Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ladder Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ladder Capital's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LADR

Ladder Capital

Operates as an internally-managed real estate investment trust in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives