- United States

- /

- Capital Markets

- /

- NYSE:IVZ

A Fresh Look at Invesco (IVZ) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Invesco.

Invesco’s solid 1-year total shareholder return of 36% and a share price that has climbed over 36% in the past 90 days point to building momentum, likely reflecting renewed optimism around the company’s growth prospects and perceived resilience despite a dip in annual revenue.

If you’re interested in finding more standouts with upward momentum, now is an excellent moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With momentum clearly building, the real question for investors now is whether Invesco is still trading at an attractive value or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: 1.8% Undervalued

With Invesco’s latest fair value estimate at $24.04, just above the last close of $23.60, the narrative highlights a close contest between recent gains and further upside potential. This is based on future growth expectations and profitability assumptions.

The company's aggressive expansion in private markets and alternative asset offerings, including strategic partnerships (for example, with Barings and MassMutual) and increased distribution through wealth management channels, aligns with the growing demand for alternatives and could drive higher-fee revenue streams and improved earnings resilience.

Which key financial forecasts lock in this valuation? The narrative is betting on a dramatic shift in profitability, strategic partnerships, and a potential transformation of Invesco’s earnings profile. Get the inside view on the critical drivers below the surface.

Result: Fair Value of $24.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure from lower-fee passive products and heightened competition in ETFs could limit Invesco’s earnings growth and challenge this optimistic outlook.

Find out about the key risks to this Invesco narrative.

Another View: Market Multiples Tell a Different Story

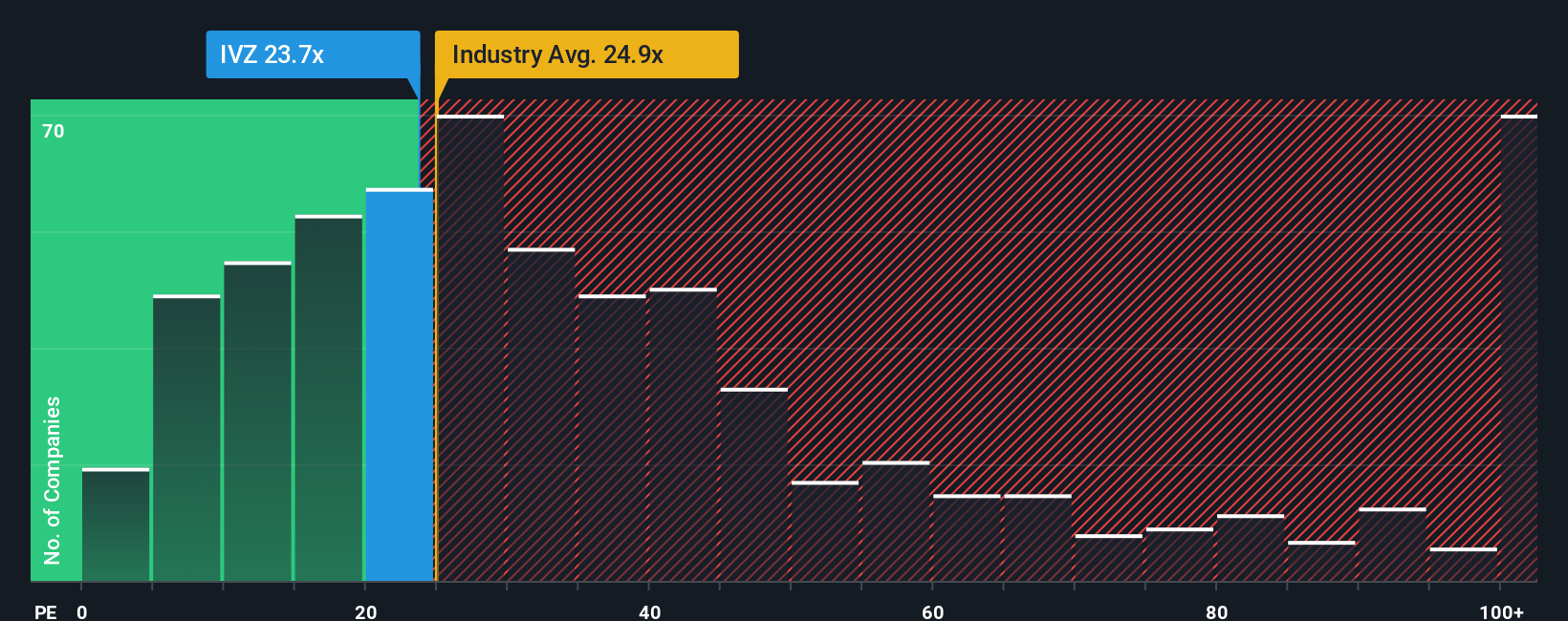

Looking at Invesco’s price-to-earnings ratio of 24.9x, it appears more expensive than its peer average of 22.7x and well above the “fair ratio” of 18.2x that the market might one day revert to. This could hint at less upside than the optimistic narrative suggests. Is this a sign of risk, or simply a market growing comfortable with higher expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Invesco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Invesco Narrative

If you want to dig deeper or see things from a different perspective, you can easily build your own narrative in just a few minutes. So why not Do it your way

A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors seize every opportunity. Use the power of Simply Wall Street's screeners to get ahead, tap into trends, and strengthen your portfolio with top picks others might miss.

- Uncover stocks with strong cash flow potential and take the lead by checking out these 874 undervalued stocks based on cash flows before the rest of the market catches on.

- Boost your passive income strategy by spotting reliable payout opportunities through these 18 dividend stocks with yields > 3% to keep your wealth growing, even when the market shifts.

- Ride the wave of emerging technologies by tapping into these 26 quantum computing stocks. Here, innovation meets real investment potential for forward-thinking portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives