- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (NYSE:ICE) Sees 5% Rise Last Quarter Amid Strong Earnings Performance

Reviewed by Simply Wall St

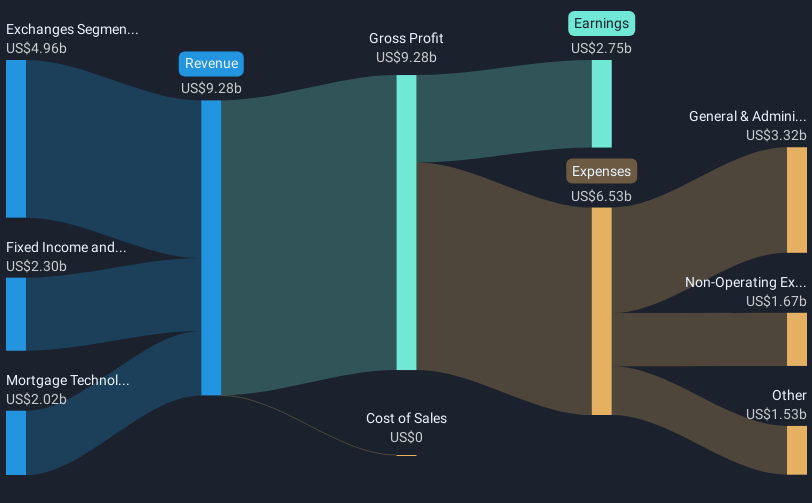

Intercontinental Exchange (NYSE:ICE) recently entered into a partnership with Circle Internet Group to explore using Circle's stablecoin and tokenized money market offerings, potentially enhancing its financial services. The company also announced amendments to its bylaws for regulatory compliance. Despite a challenging market environment, where major indices like the S&P 500 plunged 6% during the tariff turmoil and marked their steepest losses since the pandemic, ICE's stock saw a 4.6% price increase last quarter. This notable resilience can be attributed to strategic initiatives, such as the substantial dividend increase and strong earnings performance, which likely supported investor confidence.

Be aware that Intercontinental Exchange is showing 2 risks in our investment analysis.

Over the last five years, Intercontinental Exchange (ICE) achieved a total shareholder return of 91.36%, reflecting both share price appreciation and dividends. This performance highlights ICE’s ability to capitalize on growth opportunities amidst evolving markets. ICE's integration of Black Knight broadened its reach in mortgage technology, suggesting enhanced revenue potential.

Furthermore, ICE reported an increase in revenue and net income in 2024, underscoring its robust financial standing. Partnerships with companies like Circle Internet Group and Reddit expanded ICE's product offerings, aiming to capture emerging market demands. These developments, combined with strategic focus on areas such as energy trading and climate risk data, have propelled ICE's comparative performance beyond the US Capital Markets industry, which reported an 11.7% return over the past year, significantly above the 3.3% US market return.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives