- United States

- /

- Capital Markets

- /

- NYSE:HTGC

Hercules Capital (HTGC) One-Off $71M Loss Challenges Margin Recovery Narratives

Reviewed by Simply Wall St

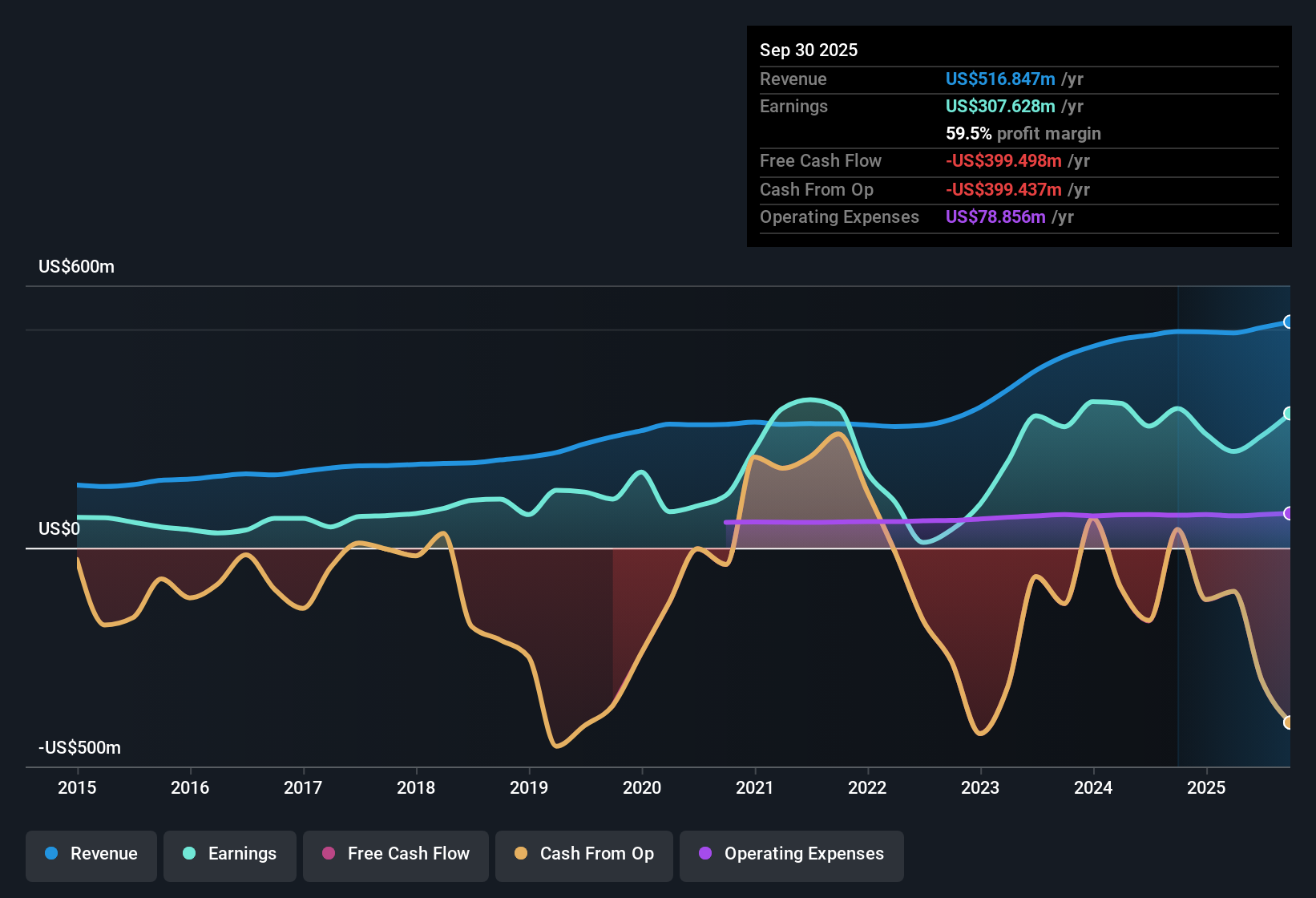

Hercules Capital (HTGC) reported net profit margins of 50.9% for the twelve months to September 30, 2025, slipping from 57.2% a year earlier. Current results were shaped by a sizable one-time loss of $71.1 million, pulling down earnings headlines despite the company’s strong track record of 8.2% annual earnings growth over the last five years. With forecasts pointing to earnings and revenue growth of 9.5% and 7.8% per year respectively, both coming in below broader US market trends, investors are now weighing the company’s attractive 12.5x P/E valuation and discount to fair value against continuing pressure on margins and earnings quality.

See our full analysis for Hercules Capital.Let’s see how these headline numbers stack up when put alongside the dominant Hercules Capital narratives. Some expectations will get confirmed, while others may be in for a surprise.

See what the community is saying about Hercules Capital

Analyst Profit Margin Goal: 67.2% in Three Years

- Analysts project Hercules Capital’s profit margins could climb from the current 50.9% to 67.2% by 2028, marking a substantial improvement if achieved.

- According to the analysts' consensus view, a catalyst for this expansion is the company's push into tech and life sciences, fueling ongoing portfolio growth and driving higher net investment income.

- Consensus narrative emphasizes that scale and recent platform improvements should increase operating leverage, which could support this margin expansion.

- However, rising expenses tied to rapid portfolio growth are at risk of partially offsetting margin gains, making efficient cost control critical.

- With analyst forecasts riding on ambitious margin targets, the latest results set a high bar. See if the consensus thesis really fits Hercules' fundamentals. 📊 Read the full Hercules Capital Consensus Narrative.

Peer and Industry Discount Widens to 20% to 50%

- Hercules Capital trades at a 12.5x P/E, meaning its valuation sits 20% below the peer group average (14.9x) and 50% beneath the broader US Capital Markets industry average (25.6x).

- Analysts' consensus view sees this valuation gap as a potential opportunity, given forecasts for ongoing revenue and margin expansion.

- Consensus narrative points to the company's ample liquidity and strong sponsor relationships, suggesting fundamentals may support a rerating toward peer levels.

- It also highlights that risks such as sector concentration and compressed net interest margins could prevent Hercules from fully closing the gap.

One-Off $71 Million Loss Clouds Dividend Sustainability

- The one-time $71.1 million loss booked by Hercules Capital this year is not just a headline number. It directly impacts profit stability and may challenge the ongoing sustainability of its dividend.

- Analysts' consensus narrative flags this exceptional charge as a key risk to watch, as recent earnings quality has been affected and any future non-recurring losses could further stress dividend coverage.

- Critics also note that growing SG&A and interest expenses, if not managed, could crimp distributable earnings and potentially put downward pressure on shareholder payouts.

- Investors should watch for any signs in future reports that the company is bringing nonrecurring items under control to shore up its payout.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hercules Capital on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these numbers? It only takes a few minutes to turn fresh perspectives into your own narrative and shape the conversation. Do it your way

A great starting point for your Hercules Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Hercules Capital’s falling profit margins, rising costs, and recent one-off loss raise concerns about the consistency and sustainability of its dividend payments.

If dependable dividends are your priority, compare your options with these 2008 dividend stocks with yields > 3% to spot companies offering higher yields with stable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hercules Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTGC

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)