- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (NYSE:GS) Shares Dip 6% As Apple Card Partnership Sale Explored

Reviewed by Simply Wall St

Goldman Sachs Group (NYSE:GS) recently appointed Elizabeth Overbay as CFO in its asset and wealth management division, signifying its focus on diversification. This follows board appointments of KC McClure and John Waldron, emphasizing governance and operational strengthening. Despite these appointments, the company's share price dipped 5.8% last quarter. Factors include the company's exploration of selling its Apple card partnership and a class-action settlement approval, possibly influencing investor sentiment. The market as a whole experienced a turbulent week, with major indices like the S&P 500 and Nasdaq witnessing declines of 3.1% and 3.5% respectively, due to economic policy uncertainties and slowing growth concerns. Though the Fed indicated a stable economic outlook, investor caution affected broader market sentiment, potentially reflecting on Goldman Sachs' performance. The combination of internal changes amidst a volatile market atmosphere might explain the price movement for Goldman Sachs.

Unlock comprehensive insights into our analysis of Goldman Sachs Group stock here.

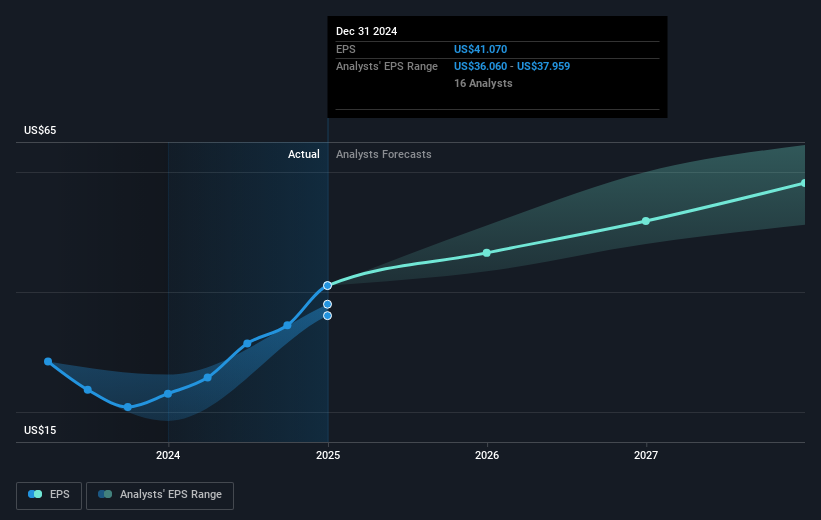

Over the past five years, Goldman Sachs' total shareholder return, including share price appreciation and dividends, reached 256.61%. This impressive growth period featured several key developments. Notably, Goldman Sachs enhanced its executive team in early 2025, aiming to strengthen its asset management capabilities. The company's substantial earnings increase in 2024, with net income rising significantly, showcased its operational resilience in a challenging landscape. Additionally, Goldman Sachs' buyback program added value for shareholders by repurchasing a total of 31.3 million shares, totaling US$12.8 billion in the last quarter of 2024.

This strategic shift away from consumer banking, reflecting a focus once more on investment banking and trading, followed losses exceeding US$3 billion in consumer operations. The company also secured final court approval for a US$20 million class action settlement in January 2025, managing its legal liabilities. Additionally, its recent cash dividend increase and active role in underwritings highlight efforts to enhance shareholder value amidst ongoing market changes.

- See whether Goldman Sachs Group's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Goldman Sachs Group's growth trajectory—explore our risk evaluation report.

- Invested in Goldman Sachs Group? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Goldman Sachs Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives