- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (NYSE:GS) Appoints Raghav Maliah As New Investment Banking Chairman

Reviewed by Simply Wall St

Raghav Maliah's appointment as Chairman of Investment Banking marks a significant leadership change at Goldman Sachs Group (NYSE:GS) aimed at strengthening their presence in the Asia Pacific region. Over the last quarter, the company's stock price registered a 25% rise, which occurs against a backdrop of market trends showing the S&P 500 and Nasdaq Composite reaching record levels. While the ongoing share repurchase program and quarterly dividends likely added weight to the positive price movement, the context of broader market strength should not be neglected when considering the factors behind this significant price increase.

We've spotted 2 possible red flags for Goldman Sachs Group you should be aware of.

Raghav Maliah's appointment as Chairman of Investment Banking at Goldman Sachs Group (NYSE:GS) may enhance the firm's focus on the Asia Pacific region, potentially affecting longer-term revenue through expanded market opportunities. Over five years, the shares registered a very large total return of 299.53%, underscoring a substantial appreciation when factoring in dividends. In the past year, GS's one-year return outpaced both the US market's 13.9% return and the US Capital Markets industry's 34.2% return, highlighting its strengths despite economic volatility.

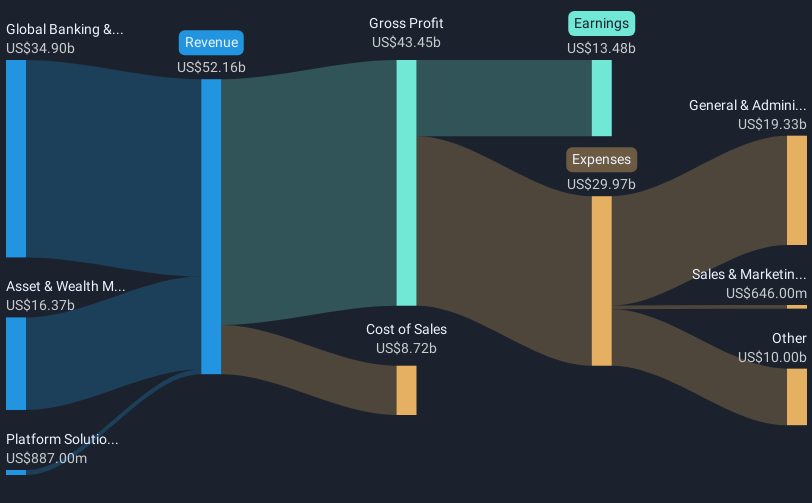

The news of leadership changes coincides with ongoing developments such as AI integration and efficiency-focused investments, which investors might see as fundamental underpinnings for revenue and earnings upticks. Current forecasts suggest earnings may grow to US$16.2 billion by 2028 from US$14.13 billion today, reflective of these catalysts. Nonetheless, broader economic risks could temper these gains. The stock's 25% rise aligns with positive market sentiment, yet the current share price of US$549.36 represents a 6.2% discount to the consensus price target of US$585.58, implying potential headroom for future stock appreciation if forecasts are met.

Assess Goldman Sachs Group's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives