- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (NYSE:GS) Appoints New CFO For Asset Division Managing US$3 Trillion

Reviewed by Simply Wall St

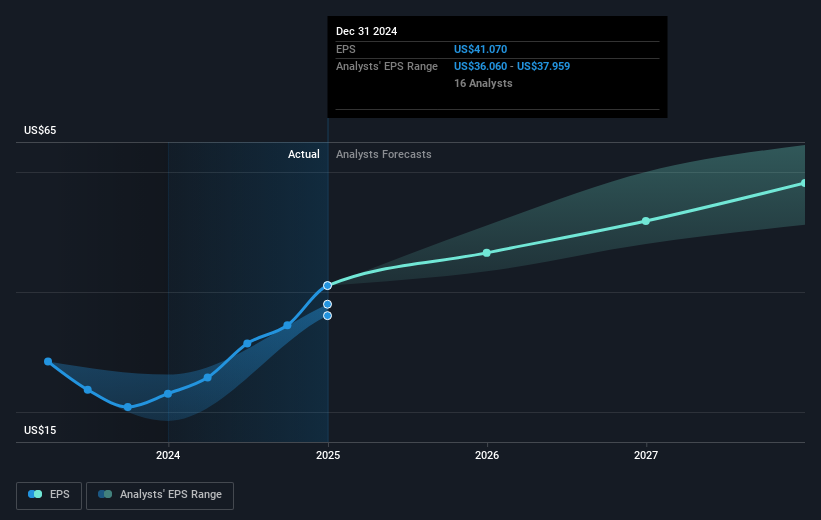

Goldman Sachs Group (NYSE:GS) experienced a 2.25% price increase over the last quarter, corresponding with significant organizational changes and strategic shifts. Key events include the appointment of Elizabeth Overbay as CFO of its asset and wealth management division, signaling the firm's commitment to expanding beyond traditional banking operations. These changes coincided with a volatile market, where major indexes recorded losses, yet markets showed resilience by climbing following inflation data indicating price pressures may be easing. Additionally, the company announced strong Q4 earnings with a net income of $4.1 billion and completed a significant share buyback program, further firming its market position. Although the broad market faced headwinds from economic and geopolitical factors, such as proposed tariffs, Goldman Sachs' focus on asset diversification and financial stability likely played a role in its stock's performance relative to the overall financial sector, which saw a considerable 55% earnings growth during the latest earnings season.

Take a closer look at Goldman Sachs Group's potential here.

Over the last five years, Goldman Sachs Group has achieved a total shareholder return of 264.27%. This impressive performance is a testament to its effective strategic initiatives and operational successes. Key factors include the company initiating a share repurchase program up to US$30 billion in February 2023, significantly boosting shareholder value. Goldman Sachs also reported a substantial profit increase for the year ending in 2024, with net income rising to US$14.28 billion, illustrating robust business growth. The firm’s earnings grew by over 70% in the past year, surpassing the industry average, contributing to its stock appreciation.

Additionally, the company's strategic shift towards asset management and fintech ventures has played a pivotal role in its growth. The recent completion of a substantial share buyback, involving over 31 million shares for US$12.78 billion, alongside consistent dividend declarations, further underlines its commitment to returning capital to shareholders, reinforcing the impressive total returns over this period.

- See whether Goldman Sachs Group's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Goldman Sachs Group's growth trajectory—explore our risk evaluation report.

- Have a stake in Goldman Sachs Group? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives