- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Is FIS’s Shift to Cloud-Native SaaS and AI with Amount Acquisition Redefining Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In September 2025, Fidelity National Information Services announced it had reengineered its Private Capital Suite into a cloud-native SaaS platform and completed the acquisition of Amount, a digital banking origination and decisioning provider with advanced AI capabilities.

- These developments mark a significant step in FIS's digital transformation, aiming to automate private capital processes, expand digital account-opening tools, and enhance support for multijurisdictional compliance in the evolving financial services landscape.

- Let's consider how FIS's renewed focus on advanced cloud-native and AI solutions could influence its long-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fidelity National Information Services Investment Narrative Recap

To own shares in Fidelity National Information Services (FIS), investors generally need to have confidence that the company can successfully defend and grow its core banking and fintech business amid rising digital competition and industry change. The recent cloud-native SaaS Private Capital Suite launch and the acquisition of Amount expand FIS's technology stack, but their immediate impact on offsetting execution risks around acquiring and integrating new businesses, as well as maintaining margins in the face of fintech disruptors, is not yet material.

The acquisition of Amount stands out as particularly relevant, as it addresses one of the most important catalysts for FIS, the rising demand for AI-enabled, digital-first banking solutions that can be scaled across traditional and emerging platforms. By embedding advanced AI origination and onboarding capabilities, FIS has the potential to unlock higher-value, recurring digital revenue streams and deepen relationships with both bank and non-bank clients, tying directly to core growth objectives outlined by analysts.

However, it's crucial to note that, unlike technological innovation, persistent integration and operational execution risks remain...

Read the full narrative on Fidelity National Information Services (it's free!)

Fidelity National Information Services is projected to reach $11.7 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes a 4.3% annual revenue growth rate and a substantial earnings increase of $2.24 billion from current earnings of $158.0 million.

Uncover how Fidelity National Information Services' forecasts yield a $85.61 fair value, a 29% upside to its current price.

Exploring Other Perspectives

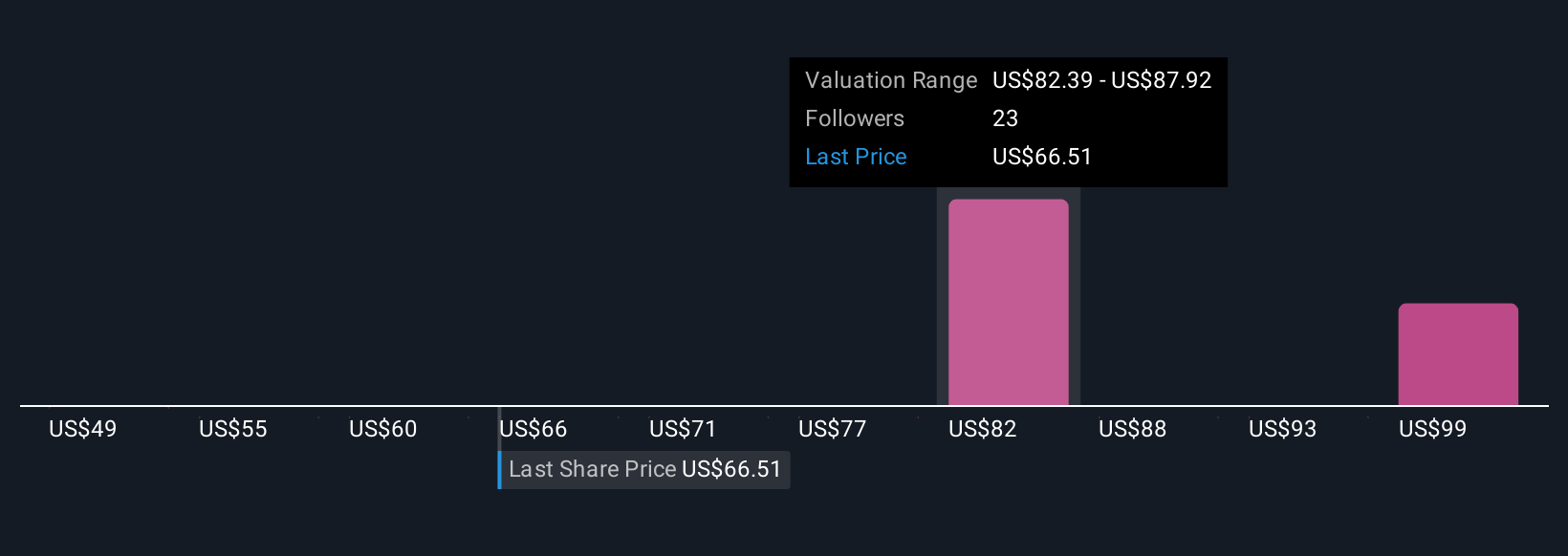

Simply Wall St Community members offered three fair value estimates for FIS, ranging from US$49.20 to US$105.48 per share. While opinions diverge, many watch for whether FIS’s ramp-up of cloud and AI-powered platforms is enough to defend market share as fintech competitors accelerate.

Explore 3 other fair value estimates on Fidelity National Information Services - why the stock might be worth as much as 59% more than the current price!

Build Your Own Fidelity National Information Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Fidelity National Information Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Information Services' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion