- United States

- /

- Diversified Financial

- /

- NYSE:FIS

A Fresh Look at Fidelity National Information Services (FIS) Valuation After Bold Digital Banking Moves and SaaS Expansion

Reviewed by Kshitija Bhandaru

Fidelity National Information Services (FIS) has grabbed attention by acquiring Amount, a cloud-native digital banking platform, and reimagining its Private Capital Suite as a cloud-based SaaS solution. These moves highlight FIS’s push for innovation-driven growth in modern finance.

See our latest analysis for Fidelity National Information Services.

Despite FIS’s strategic strides in digital banking and private capital, the share price hasn’t regained its earlier highs, reflecting an ongoing recalibration of market confidence. After a volatile year marked by analyst upgrades and important acquisitions, the 1-year total shareholder return stands at -19.5%, signaling that momentum has yet to turn decisively positive for long-term investors.

If these moves spark your interest in what’s next for financial innovators, you may want to broaden your investing horizons and discover fast growing stocks with high insider ownership

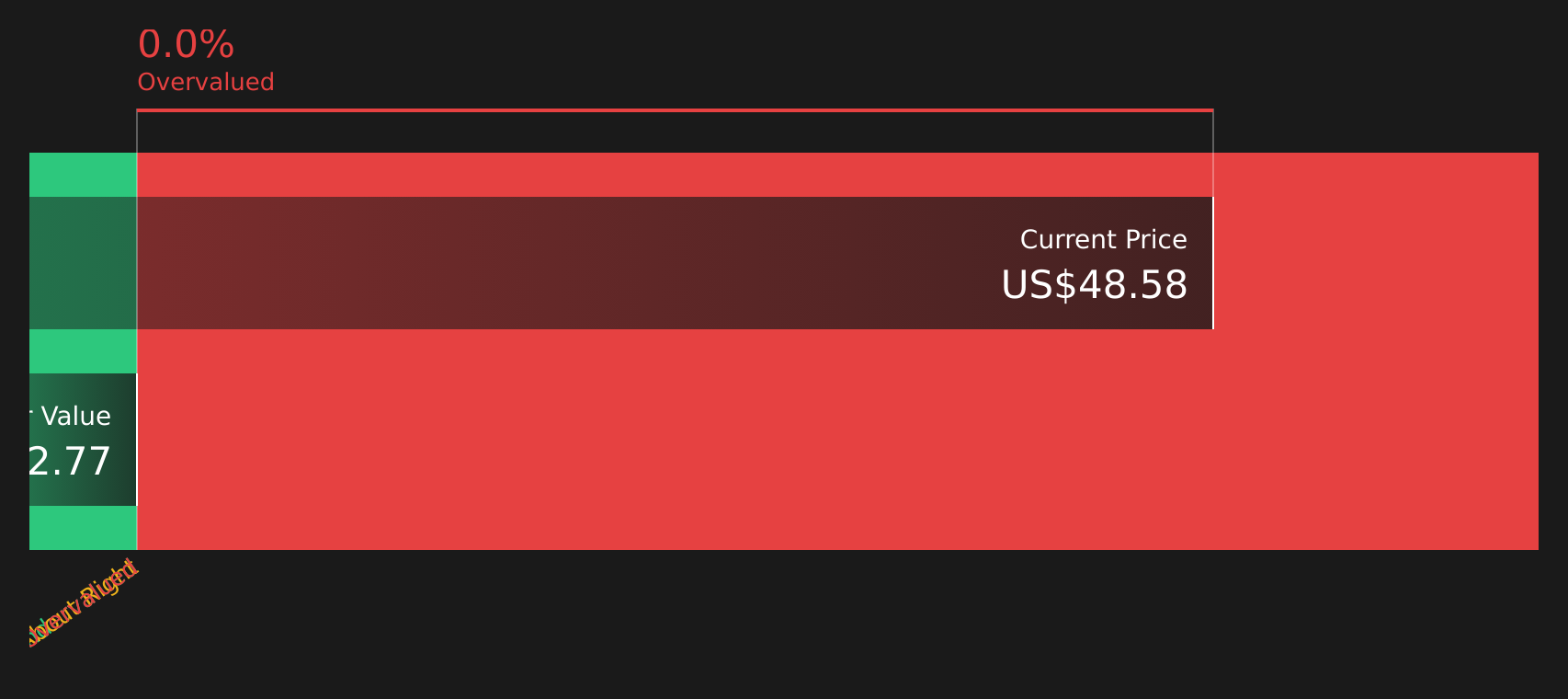

With shares still trading well below their price targets and analysts split on the pace of recovery, investors are left to wonder whether FIS is genuinely undervalued or if the market has already accounted for its future growth prospects.

Most Popular Narrative: 22.1% Undervalued

With Fidelity National Information Services’ fair value estimated at $85.61, which is well above the recent close, narrative watchers are paying attention to what’s driving this optimism.

Expansion of bank M&A and consolidation activity continues to play to FIS's strengths as a scaled, deeply integrated technology partner. This is leading to new core banking platform wins and cross-selling opportunities with larger, combined clients, providing additional tailwinds to both revenue growth and client retention rates.

Want to know which figures justify this bullish stance? The narrative’s future profit margins and valuation multiples are anything but typical for established financial firms. Dive in to see how these bold projections could reshape expectations for FIS’s growth story.

Result: Fair Value of $85.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rise of agile fintech rivals and challenges integrating recent acquisitions could disrupt FIS’s trajectory and potentially put long-term growth and margins at risk.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Looking Beyond Analyst Targets

While analyst price targets suggest FIS is undervalued, a look at our DCF model presents an even more optimistic scenario. According to the SWS DCF model, FIS shares are still trading well below fair value, which implies significant upside if the cash flow assumptions hold true. Could these divergent valuations present an overlooked opportunity, or are they a sign of deeper market skepticism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fidelity National Information Services Narrative

If you have your own take on FIS’s prospects or prefer to dig into the fundamentals yourself, you can craft and share your perspective in just a few minutes. Do it your way

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop with just one opportunity. Expand your search for companies positioned for growth, stability, or powerful trends with these handpicked screeners from Simply Wall Street.

- Tap into the next wave of healthcare innovation by checking out these 32 healthcare AI stocks as it makes breakthroughs in patient care and medical technology.

- Boost your income potential and financial confidence by adding these 19 dividend stocks with yields > 3% that deliver robust yields above 3% right to your portfolio.

- Capture exciting gains at the frontier of science by exploring these 26 quantum computing stocks at the forefront of quantum computing advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives