- United States

- /

- Diversified Financial

- /

- NYSE:FI

Fiserv (NYSE:FI) Secures First Community Credit Union With DNA Core Processing Platform

Reviewed by Simply Wall St

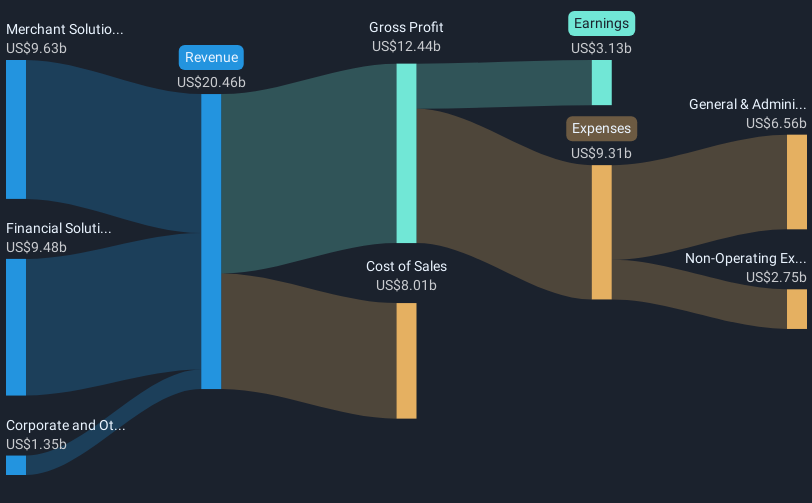

Fiserv (NYSE:FI) saw its share price increase 9% over the last month, buoyed by its recent partnership with First Community Credit Union and several other strategic client announcements. The adoption of the DNA core processing platform highlights the company's cutting-edge approach, enhancing its reputation in the financial services sector. The company's strong financial performance, as reflected in its recent earnings announcement with a notable rise in revenue and net income, also likely contributed to the price rise. Furthermore, Fiserv's share repurchase program, involving the repurchase of significant share quantities, underscores confidence in its market value. Notwithstanding market volatility, as reported on broader indices like the NASDAQ and S&P 500, Fiserv's client expansion and repurchase initiatives suggest positive investor sentiment, setting it apart in a month marked by mixed market performance.

Dig deeper into the specifics of Fiserv here with our thorough analysis report.

Over the past three years, Fiserv's total shareholder return reached 134.80%. Key developments have played a significant role in this impressive performance. In 2024, the company exceeded expectations by raising its organic revenue growth guidance to 16% to 17%, reflecting robust business momentum. Similarly, substantial share repurchase activities, including the recent authorization to repurchase up to 60 million shares, highlight ongoing efforts to enhance shareholder value.

Noteworthy partnerships further strengthened the company's market position, such as collaborating with VikingCloud to provide cybersecurity solutions. Moreover, the strategic partnership with StoneX Group's Payments Division underscores Fiserv's commitment to advancing financial services. Executive changes, like the appointment of Michael P. Lyons as CEO-elect starting January 27, 2025, signal a leadership focus on continued growth. Despite its high Price-To-Earnings ratio of 41.5x, Fiserv outperformed the US Market and the diversified financial industry in the past year, bolstering investor confidence.

- Understand the fair market value of Fiserv with insights from our valuation analysis—click here to learn more.

- Explore the potential challenges for Fiserv in our thorough risk analysis report.

- Got skin in the game with Fiserv? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives