- United States

- /

- Diversified Financial

- /

- NasdaqGS:FISV

Fiserv (NYSE:FI) Partners With Early Warning For Enhanced Digital Wallet Solution

Reviewed by Simply Wall St

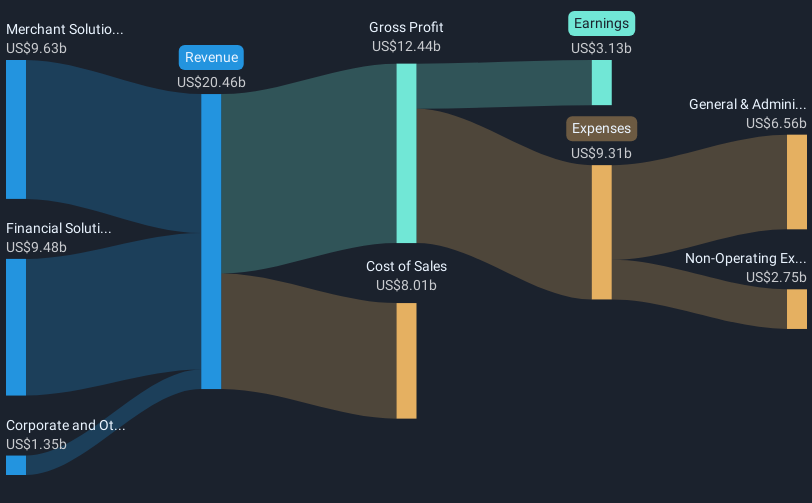

Fiserv (NYSE:FI) recently announced a collaboration with Early Warning Services to introduce the PazeSM digital wallet, aimed at enhancing security and convenience for financial institutions. Over the past month, shares of Fiserv declined by 2%. This movement contrasts with the broader market, which remained flat amid geopolitical tensions in the Middle East and uncertainty surrounding the Federal Reserve’s interest rate decision. While Fiserv's innovation could bolster its competitive edge, these external market conditions likely provided counterweight to the company's strategic developments, affecting its stock performance during the observed period.

We've identified 1 warning sign for Fiserv that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent introduction of the PazeSM digital wallet by Fiserv, in collaboration with Early Warning Services, could significantly bolster its technological offerings, potentially enhancing customer security and convenience. This development might contribute positively to Fiserv's revenue and earnings forecasts, as it aligns with the company’s strategy of integrating advanced solutions to optimize systems and enhance operational efficiency. However, the short-term share price drop of 2% reflects market skepticism, influenced by broader geopolitical tensions and economic uncertainties, rather than the potential benefits of this collaboration.

Over the past three years, Fiserv achieved a total return, including share price and dividends, of 83.11%, demonstrating significant long-term performance. Compared to the previous year, where the company matched the US market's return of 9.8%, this longer-term result shows robust resilience and growth.

Despite its recent performance, Fiserv's current share price of US$184.95 is approximately 18.7% below the analyst consensus price target of US$227.42. This discount suggests room for appreciation if Fiserv can effectively execute its growth initiatives and achieve the expected revenue and earnings targets. The upcoming international expansions, partnerships, and product launches are expected to support merchant solutions growth, positioning Fiserv to potentially meet or exceed these forecasts despite prevailing challenges.

Unlock comprehensive insights into our analysis of Fiserv stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FISV

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)