- United States

- /

- Diversified Financial

- /

- NYSE:FI

Fiserv (NYSE:FI) Appoints New CEO Michael P. Lyons

Reviewed by Simply Wall St

Fiserv (NYSE:FI) recently experienced a significant executive shake-up with the appointment of Michael P. Lyons as CEO following Frank J. Bisignano's resignation. This leadership transition might have contributed to Fiserv's 12% price decline over the past week, a stark contrast to the broader market gains, where major indices, such as the S&P 500, climbed 4%. This decline coincided with substantial developments, including the expansion of Fiserv's partnership with Paysafe, aiming to enhance services for small businesses. Such events seemed to counter the overall positive market sentiment, adding weight to Fiserv's negative price movement.

You should learn about the 2 possible red flags we've spotted with Fiserv.

Find companies with promising cash flow potential yet trading below their fair value.

The recent leadership change at Fiserv and expanded partnership with Paysafe could impact its growth trajectory despite the recent share price decline. Over the past three years, Fiserv's total shareholder return, including share price and dividends, was 68.59%, highlighting strong long-term performance. However, its one-year return underperformed the US Diversified Financial industry, which experienced a 20.4% increase, indicating challenges in maintaining momentum amidst broader market growth.

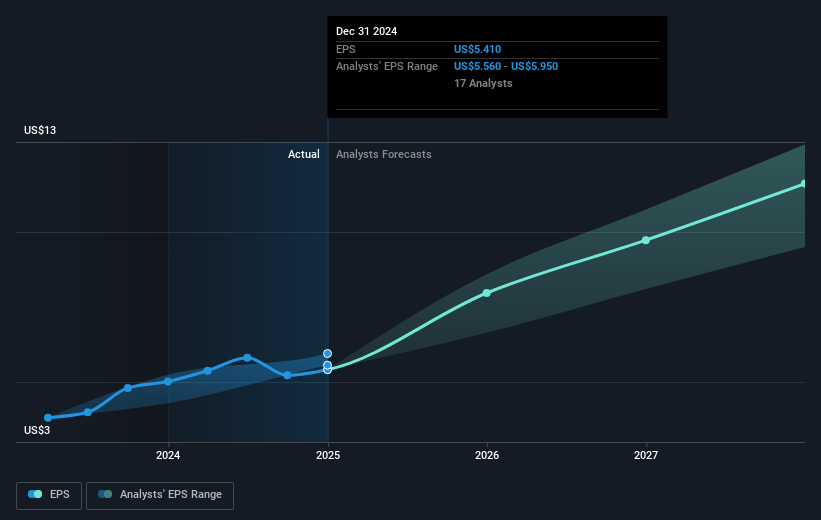

Fiserv's forward-looking narrative, focused on revenue and earnings growth through acquisitions and AI integration, may see mixed outcomes due to the CEO transition. The revenue plunged to US$20.70 billion, while earnings stood at US$3.25 billion. Analysts forecast a revenue growth of 6.4% per year and earnings increase to US$6.1 billion by 2028, assuming effective execution of strategies. However, this depends heavily on seamless integration of Fiserv's acquisitions and partnerships, and any missteps could impede progress.

The current share price of US$184.95 remains below the consensus price target of US$227.42, suggesting potential upside if growth expectations are met. While future earnings growth estimates imply a price-to-earnings ratio of 21.9x by 2028, this exceeds the current industry average, presenting valuation challenges for investors. This scenario underscores the importance of monitoring Fiserv's execution and market conditions in the coming years.

Explore Fiserv's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fiserv, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives