- United States

- /

- Capital Markets

- /

- NYSE:FDS

Is FactSet's (FDS) Investment-Driven Margin Pressure Signaling a Shift in Its Long-Term Growth Priorities?

Reviewed by Simply Wall St

- FactSet Research Systems recently reported mixed fourth-quarter and full-year results, with revenues exceeding expectations but earnings falling short and fiscal 2026 guidance described as conservative, influenced by ongoing investments and longer sales cycles.

- Analyst sentiment has been affected as interpretations of FactSet’s outlook, combined with margin pressures and evolving technology costs, stirred uncertainty despite ongoing product innovation and expanded client partnerships.

- We’ll now explore how FactSet’s cautious guidance and investment-driven margin trends could reshape its investment narrative for 2025 and beyond.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FactSet Research Systems Investment Narrative Recap

At its core, being a FactSet Research Systems shareholder means investing in the long-term growth of data-driven financial workflow solutions and the company's ability to expand through new partnerships and AI-enhanced products. The recent earnings miss and conservative fiscal 2026 guidance have heightened short-term uncertainty, though these developments do not fundamentally alter the key catalyst of product innovation or override persistent margin risks from higher technology spending.

Among FactSet’s many recent moves, the integration of MarketAxess’ AI-powered CP+ bond pricing into the FactSet platform stands out. This addition highlights FactSet’s intent to deepen its value proposition for institutional clients, a critical effort as product enhancements remain pivotal to supporting client retention and future revenue growth.

In contrast, the margin pressures tied to ongoing investments, something every potential investor should understand in detail...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' outlook anticipates $2.7 billion in revenue and $730.7 million in earnings by 2028. Achieving this calls for a 5.7% annual revenue growth rate and an increase in earnings of $197.8 million from the current $532.9 million level.

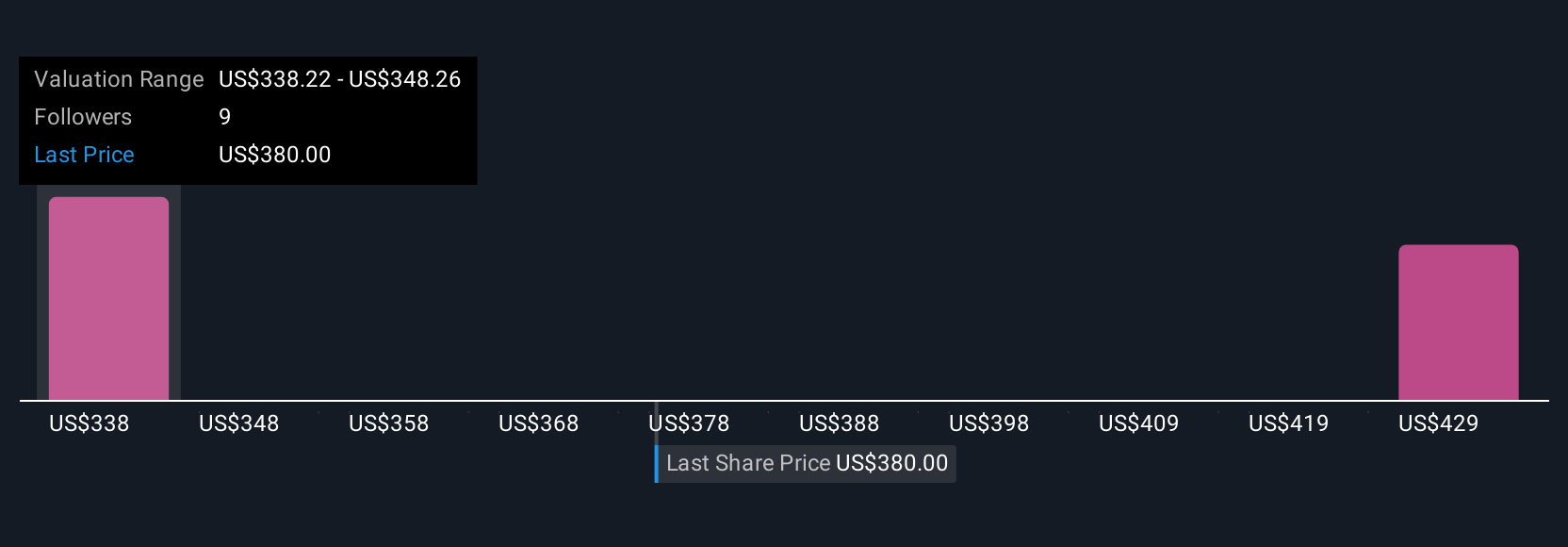

Uncover how FactSet Research Systems' forecasts yield a $346.44 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate FactSet’s fair value to span from US$276.99 to US$346.44 per share. Amidst this spread, keep in mind that ongoing technology investments could weigh on operating margins and influence future results across the sector.

Explore 3 other fair value estimates on FactSet Research Systems - why the stock might be worth just $276.99!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives