- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

Enova International, Inc. (NYSE:ENVA) Stock Rockets 26% But Many Are Still Ignoring The Company

Enova International, Inc. (NYSE:ENVA) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

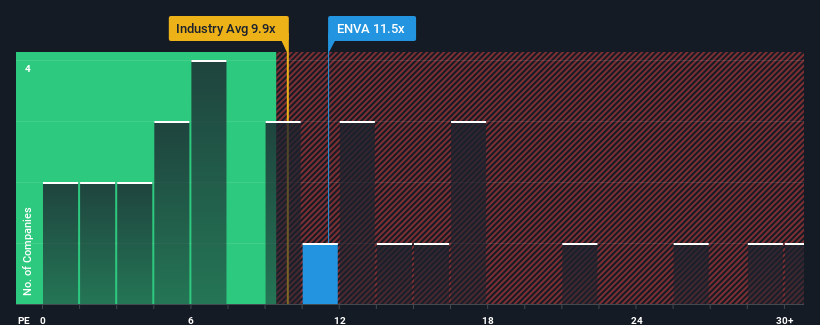

Even after such a large jump in price, Enova International may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.5x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Enova International's and the market's retreating earnings lately. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Enova International

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Enova International's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 52% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we find it odd that Enova International is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Enova International's P/E?

The latest share price surge wasn't enough to lift Enova International's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Enova International currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Enova International you should know about.

Of course, you might also be able to find a better stock than Enova International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives