- United States

- /

- Consumer Finance

- /

- NYSE:DFS

Revisiting Discover (NYSE:DFS) on Earnings - Why the Stock may be Undervalued

Discover Financial Services (NYSE:DFS) just reported earnings Q1 earnings. The slow decline of the stock may indicate that Investors are more concerned with the future of consumer spending and credit more than the quality of the company, however a 20% increase in the dividend per share and a US$4.2b repurchase program may have bumped investor confidence. In this article, we will review Discover's business, intrinsic valuation and risk factors.

Discover reported a net income of US$1.2b, or US$4.22 diluted EPS - beating the US$3.62 estimates by 16.6%. While management did not provide an outlook in the press release, we can

The key takeaways from our analysis are:

- The company's primary income comes from the interest earned from consumer credit cards.

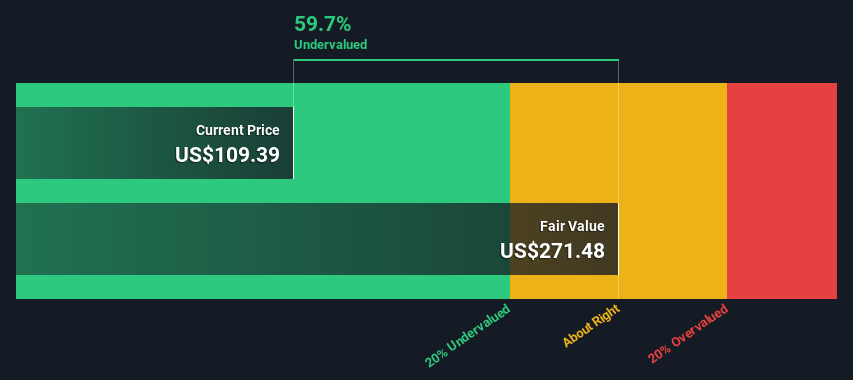

- DFS is 60% undervalued based on our excess returns model, while the price to book ratio may be keeping investors away from the stock.

- The short term expectations are those of weakened financial performance and a possible deterioration of credit services in Q2 - based on rising rates and a lower consumer earnings power.

Remember to put Discover in your watchlist, and get notified of key fundamental changes for the company.

Business Overview

Discover has two main segments, digital banking and payment services.

Digital Banking

The segment consists of credit cards, private student loans, personal loans, home loans and deposit products.

Credit/debit card transactions in the U.S. give Discover a discount and fee revenue from merchants. The company charges merchants fees for processing transactions, but then "splits" those fees and discounts with consumers in exchange for using their card. This takes the form of rewards, cashback, etc.

This model incentivizes consumers to use a credit card instead of cash, and ultimately incur more revolving debt for personal spending, from which Discover charges an interest.

Discover also offers mobile banking solutions, including an online checking account. The checking account seems to be one of the most cost-effective options in the U.S. with no annual fees and limited outbound transfer fees. Investors should note, that this approach seems to be in the interest of consumers, and may contribute to the account growth seen over the past year. Offering a quality banking system to consumers can increase the market share of the company and allow them to offer supplementary services later on, in order to increase profitability.

In Q1 2022 the total loan balance was US$93,5b, and 79% of them were credit card loans.

In 2021, the total interest income was US$10.651b, while credit cards accounted for 81% of that - This practically means that Discover's main source of income is the use of credit cards in consumer spending.

Investors that want to monitor the factors impacting this segment should keep track of consumer savings rates, credit card interest rates in the US, and delinquency rates. For example, the savings rate is back to 6.3% of the disposable income for consumers, which indicates that people have less money to spend in a high inflationary environment - while credit card use may jump as consumers need more financing, the risk associated with leveraging up can also increase as the purchasing and earnings power of consumers declines. Because of this, the next few quarters might not be great for profitability for Discover, but the company may focus on offering the most cost-effective services to consumers and see a growth in market share as people switch from more expensive alternatives.

For investors, this means that they might have to wait some time before they see the new accounts contributing to a higher profit margin.

Payment Solutions

The second segment includes the Discover global payments solutions.

This includes processing via ATMs, point of sale terminals, the Diners Club, and other network businesses. The company points out that some US$125.8b have been spent across their network in Q1 2022, which is utilized by about 270 million global cardholders.

In 2021, this segment made an income of US$789m, which accounts for some 7% of the total income. In 2021, network transactions volume has increased 27% to 189 billion, and -1.6% in 2020. So it is fair to say that this segment is still growing at a decent rate.

We can see that payment processing are secondary to the bottom line in the business, but have an important role in the attractiveness of the full ecosystem of services which Discover offers.

Valuation

Considering that Discover mostly operates as a bank, we can utilize two general approaches that are appropriate. One is to utilize the price to book value of equity, and the other is to do an excess returns valuation model.

Estimating the intrinsic value of the company will help investors better navigate when the next earnings results are released.

Price to Book Ratio

Discover's price to book ratio is 2.5x, which is higher than the industry's 1.2x average price to book value of equity.

While this might make it seem like the company is undervalued compared to peers, we should note that Discover has some high quality income, which should be taken into account when estimating the intrinsic value. The company's return on equity is 40.6%, vs the industry's 20.5% ROE.

Excess Returns Valuation

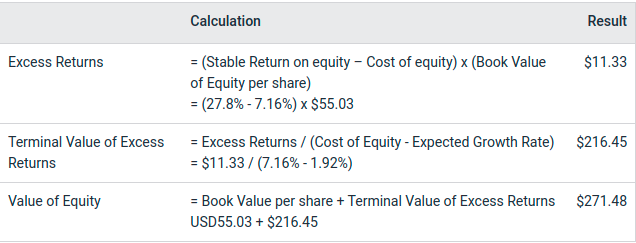

The model relies on how much a company returns on a normalized basis, above the current cost of equity. The calculation below, shows that Discover is making $11.33 in excess returns. We use that in order to come up with a terminal value of the company per share, which we add on top of the $55 book value per share and come up with an intrinsic value of $271.5 per share.

Compared to the current price, it seems that the stock is some 60% undervalued on an intrinsic basis.

Conclusion

Currently, the industry seems to be undergoing a tightening of consumer earnings power, and increased interest rates, which may impact people's credit rating. This can result in a shift in consumer behavior and an increase in credit delinquency rates that can impact the company's operations.

The company seems to be developing some value potential from the inside, and may slowly find ways to derive more from their mobile banking and payment processing services. This may put contrarians in a good position, as the short term future outlook may be negative, while the company overall seems to be undervalued.

Looking ahead, we prepared a list of items that can help you with your Discover analysis:

- A helpful tool for investors before earnings is to revisit analysts' future forecasts, which show that the company is expected to decline its bottom line from 2021 highs. However, our model takes this into account and still shows that the stock may be undervalued.

- Investors should also consider the business model we described above, and ask themselves if they think Discover is a well run and innovative company, as this may help create value over time.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:DFS

Discover Financial Services

Through its subsidiaries, provides digital banking products and services, and payment services in the United States.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives