- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Undiscovered Gems in the United States for December 2024

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a significant 25% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, identifying stocks that offer strong growth potential and are currently underappreciated can provide unique opportunities for investors seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Health In Tech (NasdaqCM:HIT)

Simply Wall St Value Rating: ★★★★★★

Overview: Health In Tech, Inc. operates as an insurance technology platform company with a market cap of $297.38 million.

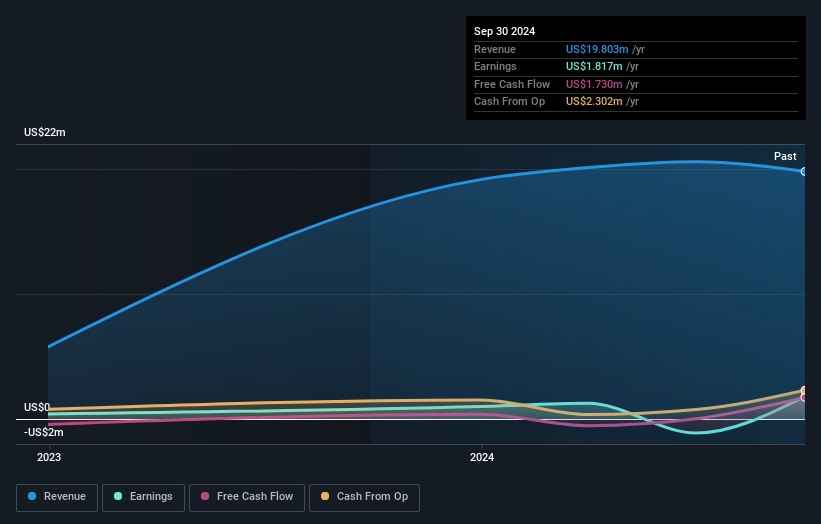

Operations: Health In Tech generates revenue primarily from its insurance brokers segment, amounting to $19.80 million.

Health In Tech, a nimble player in the insurance sector, has seen its earnings soar by 114.8% over the past year, outpacing the industry average of 36.4%. The company remains debt-free and boasts high-quality earnings, underscoring its financial robustness. Despite being highly illiquid with less than three years of financial data available, Health In Tech's recent IPO raised US$9.2 million at $4 per share, marking a significant milestone as it joined the NASDAQ Composite Index. This development suggests potential for increased visibility and investor interest in this emerging entity.

- Delve into the full analysis health report here for a deeper understanding of Health In Tech.

Gain insights into Health In Tech's historical performance by reviewing our past performance report.

Donegal Group (NasdaqGS:DGIC.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Donegal Group Inc., with a market cap of $525.34 million, operates as an insurance holding company offering property and casualty insurance to both businesses and individuals.

Operations: The company generates revenue primarily from its Personal Lines and Commercial Lines insurance segments, with $389.62 million and $536.58 million, respectively. Additionally, it earns $43.58 million from net investment income and experiences investment gains of $6.97 million.

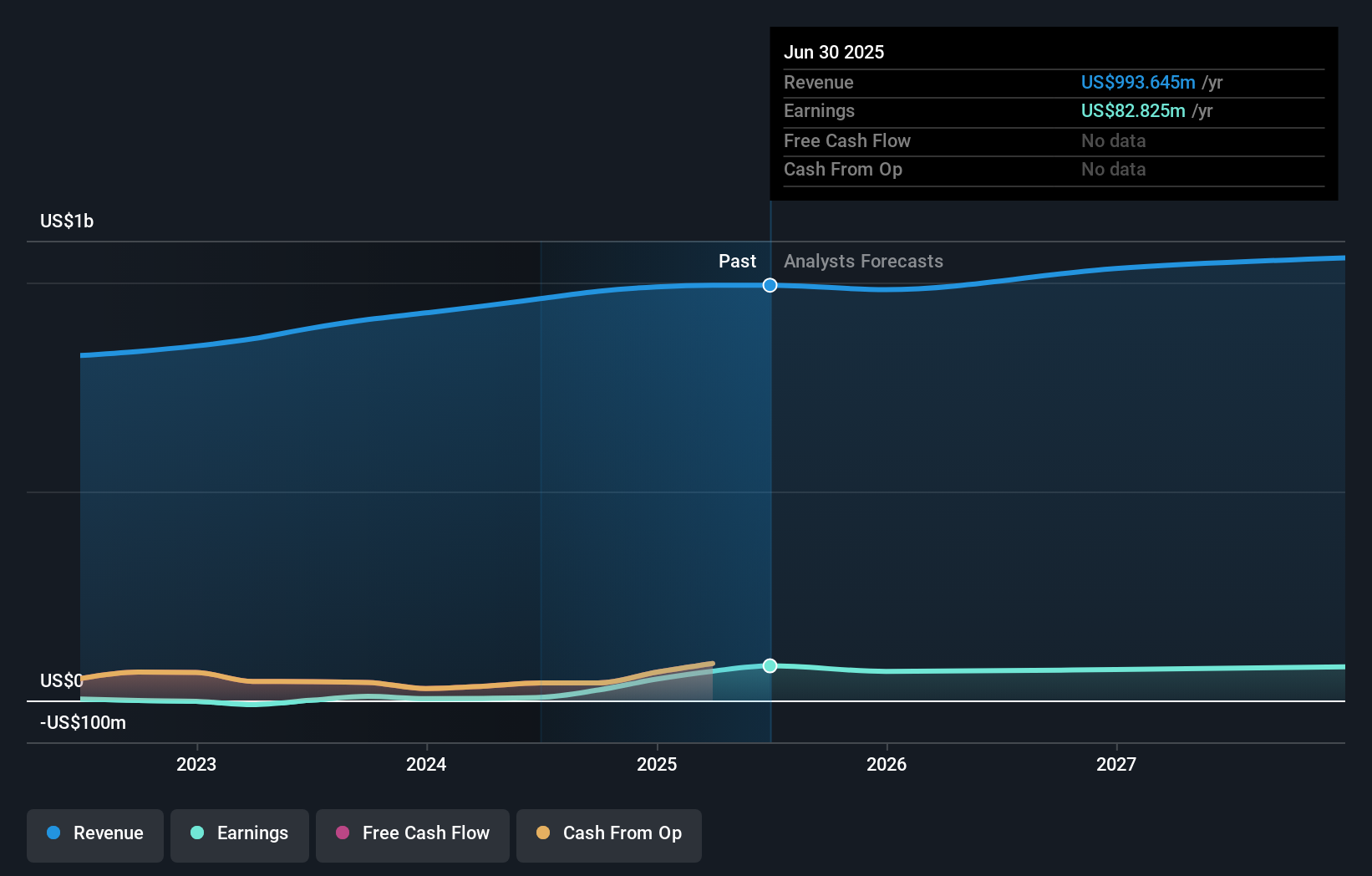

Donegal Group, a niche player in the insurance sector, has been making strides with its strategic focus on small business underwriting and technology upgrades. The company's earnings surged 152% over the past year, outpacing the industry growth of 36%, while maintaining a healthy debt-to-equity ratio that decreased from 9% to 6.8% over five years. With cash exceeding total debt and interest payments covered by EBIT at 37 times, Donegal's financial health seems robust. Recent dividends reflect confidence in future prospects despite potential challenges like weather-related losses and competitive market pressures.

Donnelley Financial Solutions (NYSE:DFIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Donnelley Financial Solutions, Inc. offers innovative software and technology-enabled financial regulatory and compliance solutions across the United States, Asia, Europe, Canada, and internationally with a market cap of approximately $1.78 billion.

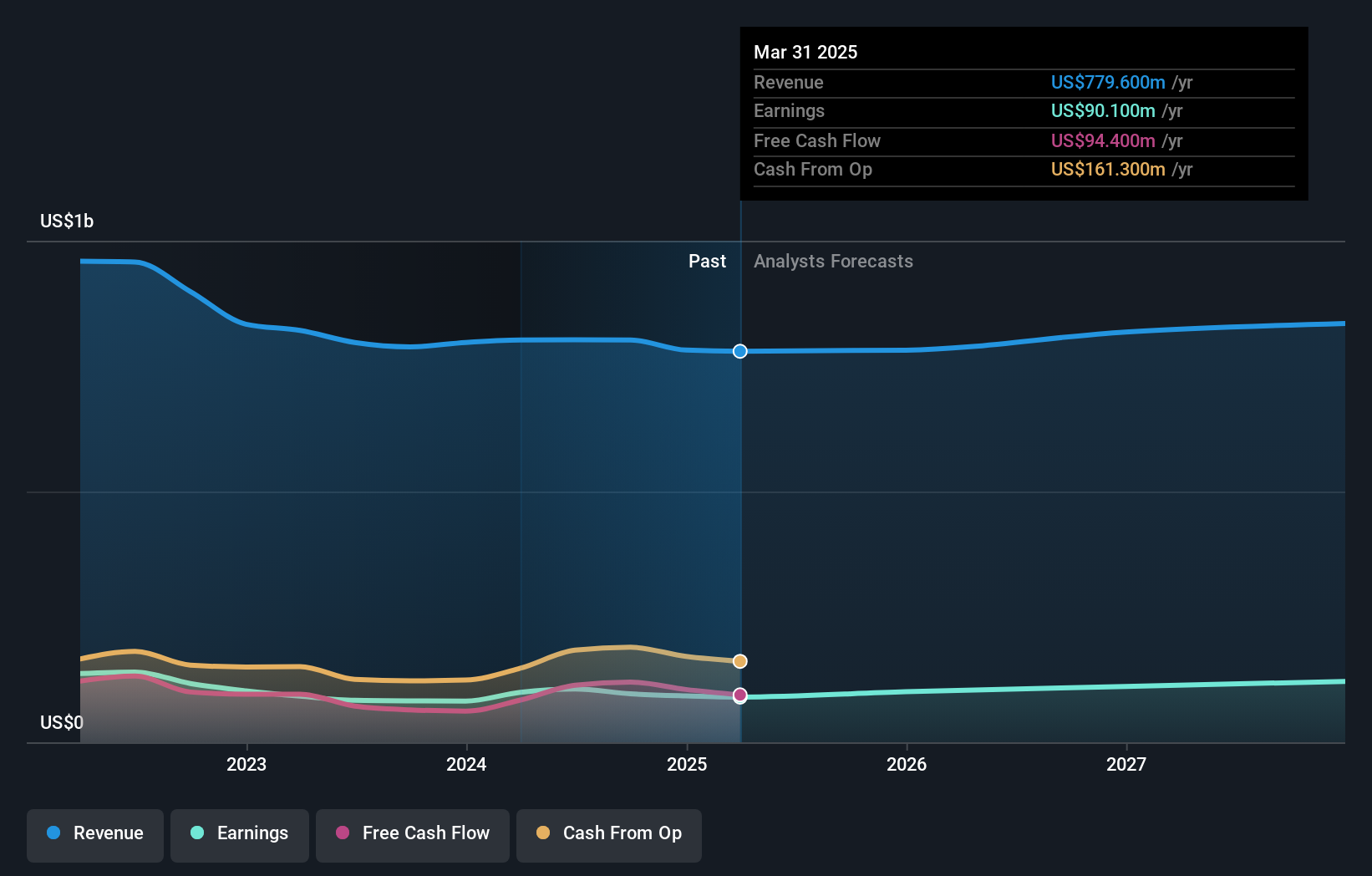

Operations: Donnelley Financial Solutions generates revenue primarily from Capital Markets and Investment Companies through Software Solutions and Compliance and Communications Management, with the largest segment being Capital Markets - Compliance and Communications Management at $336.70 million. The company has a market cap of approximately $1.78 billion.

Donnelley Financial Solutions, a nimble player in the financial services sector, is making waves with its strategic pivot towards software solutions. The company is capitalizing on high-quality earnings and robust free cash flow, evidenced by a net debt to equity ratio of 20.5% and interest coverage of 20.9x EBIT. Recent buybacks saw $13.32 million spent on repurchasing shares, highlighting confidence in its valuation at 2.2% below fair value estimates. While facing challenges from declining print demand and rising costs, the shift to SaaS promises enhanced revenue stability and growth prospects through increased recurring revenue streams from offerings like Venue and Arc Suite.

Summing It All Up

- Click here to access our complete index of 243 US Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with solid track record.