- United States

- /

- Medical Equipment

- /

- NasdaqGM:IRMD

3 US Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 1.7% over the last week and climbing 12% in the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, identifying undiscovered stocks with strong potential can provide unique opportunities for investors looking to capitalize on emerging growth stories.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

IRADIMED (IRMD)

Simply Wall St Value Rating: ★★★★★★

Overview: IRADIMED CORPORATION develops, manufactures, markets, and distributes MRI-compatible medical devices and related accessories, disposables, and services in the United States and internationally with a market cap of $769.01 million.

Operations: The company generates revenue primarily from its patient monitoring equipment segment, which contributed $75.15 million. It has a market cap of $769.01 million.

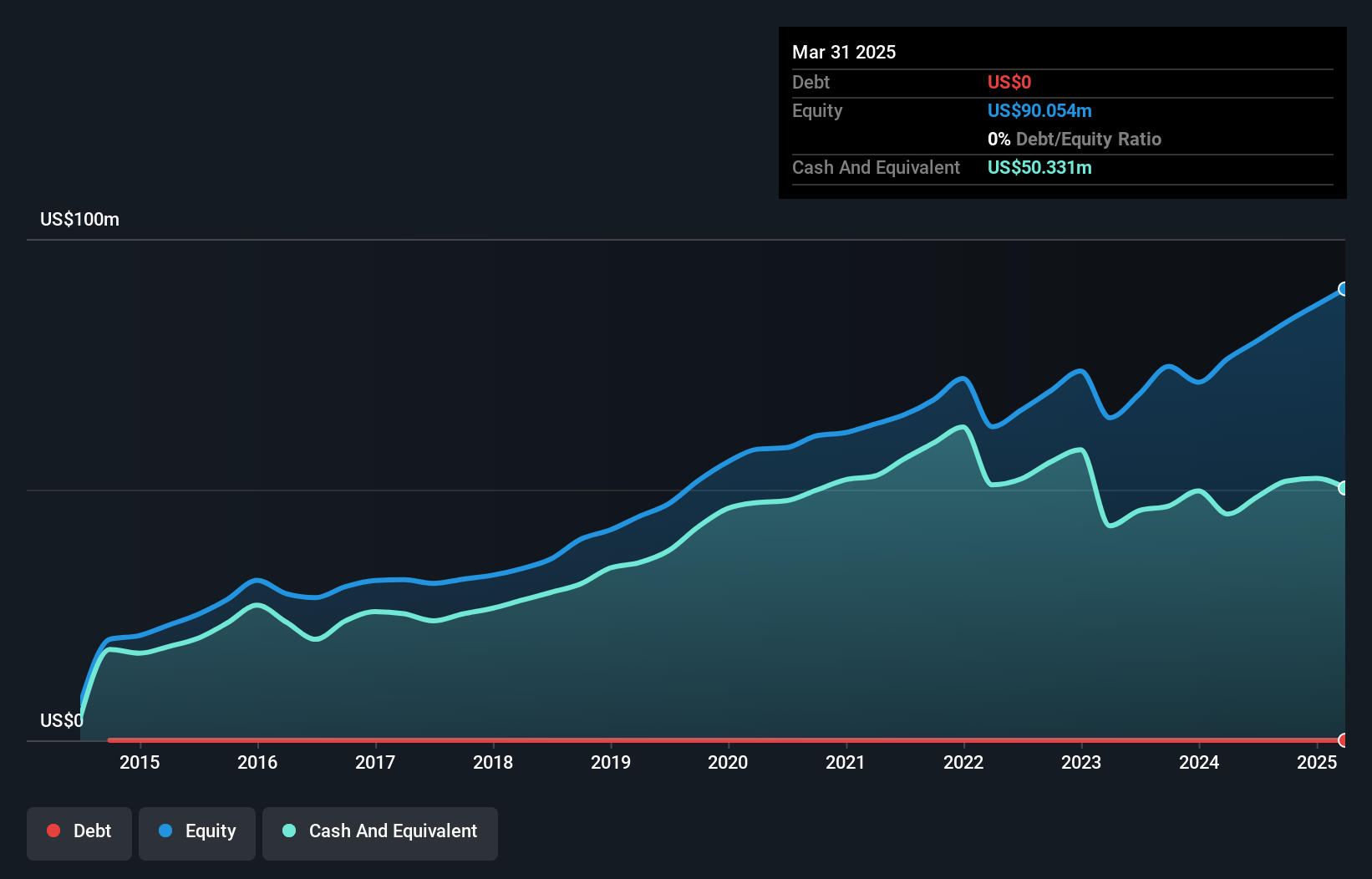

IRADIMED, a nimble player in the medical equipment sector, is making waves with its innovative MRidium® 3870 IV Infusion Pump. The company is debt-free and boasts high-quality earnings, with a notable annual growth rate of 30.8% over the past five years. Trading at 32.6% below fair value estimates, IRADIMED's recent FDA clearance for its new pump underscores its leadership in MRI-compatible devices. With revenue forecasted to grow by 12.8% annually over the next three years, IRADIMED's focus on expanding domestic sales could offset potential challenges from international markets and capital expenditures impacting cash flow and margins.

Great Southern Bancorp (GSBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Great Southern Bancorp, Inc. is a bank holding company for Great Southern Bank, offering various financial services across the United States with a market capitalization of $667.89 million.

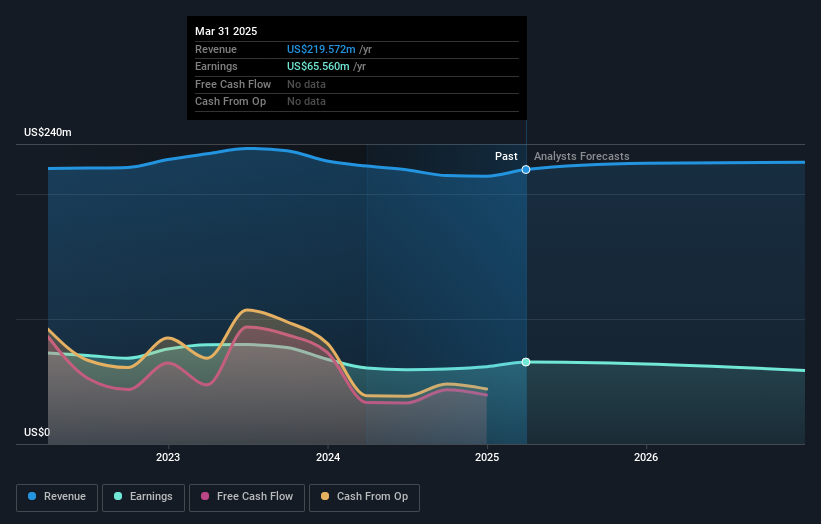

Operations: GSBC generates revenue primarily through its banking operations, amounting to $219.57 million. The company's net profit margin is a key financial indicator for assessing profitability.

With total assets of US$6 billion and equity standing at US$613.3 million, Great Southern Bancorp is a financial entity with a strong footing. Its deposits total US$4.8 billion, closely matched by loans of US$4.7 billion, supported by a net interest margin of 3.4%. The company showcases prudent risk management with customer deposits comprising 88% of its liabilities and an allowance for bad loans at 1858%, well above the industry standard. Additionally, it has repurchased over 730,000 shares for nearly US$38 million this year alone, reflecting confidence in its valuation despite trading below fair value estimates by around 57%.

Donnelley Financial Solutions (DFIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Donnelley Financial Solutions, Inc. offers innovative software and technology-enabled financial regulatory and compliance solutions across the United States, Asia, Europe, Canada, and internationally with a market capitalization of approximately $1.69 billion.

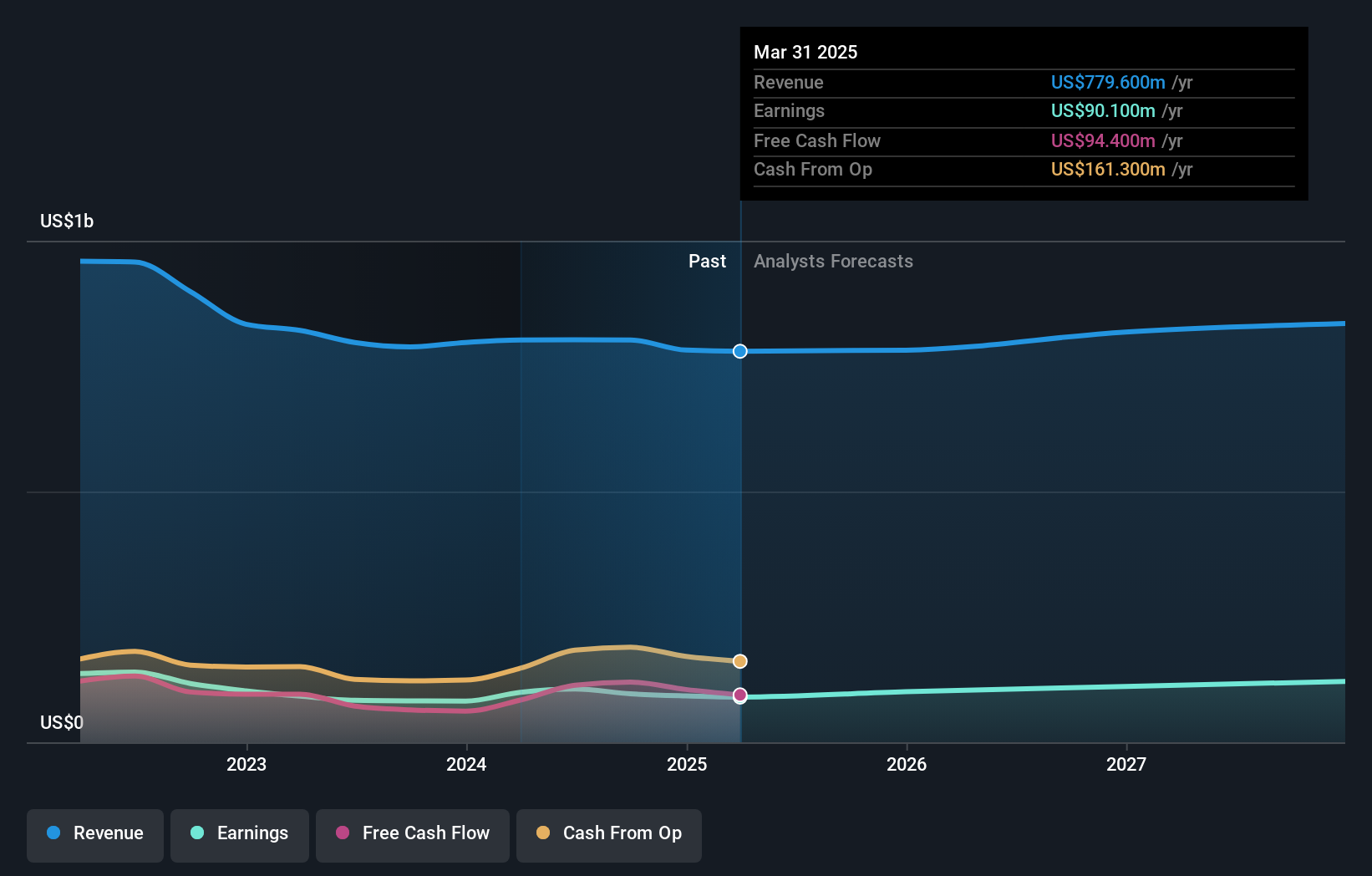

Operations: DFIN generates revenue through four key segments: Capital Markets - Software Solutions ($212.50 million), Investment Companies - Software Solutions ($121.50 million), Capital Markets - Compliance and Communications Management ($314.50 million), and Investment Companies - Compliance and Communications Management ($131.10 million).

Donnelley Financial Solutions, with a focus on software and compliance products, is making strides in the capital markets sector. The company has reduced its debt to equity ratio from 126% to 45.1% over five years, though it remains high at 41.3%. Despite facing negative earnings growth of -9.6%, DFIN's EBIT covers interest payments well (11.7x). Recent share repurchases amounted to $101 million for 6.25% of shares, signaling confidence in its future prospects. With revenue projected to grow by 2.7% annually and margins expected to rise from 11.6% to 14.9%, DFIN seems poised for steady progress amidst market challenges.

Seize The Opportunity

- Embark on your investment journey to our 284 US Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRMD

IRADIMED

Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives