- United States

- /

- Diversified Financial

- /

- NYSE:CRBG

Corebridge Financial (CRBG): Evaluating Whether Recent Price Swings Signal an Undervalued Opportunity

Reviewed by Simply Wall St

Curious about whether Corebridge Financial (CRBG) deserves a spot on your radar? The company’s latest moves have not set off alarms or drawn bright headlines, but the steady attention from investors suggests there could be more beneath the surface. This might leave you wondering if the recent dip in its share price is just noise or an early sign of something bigger to come.

Over the past year, Corebridge Financial’s stock has gained nearly 24%, despite losing a bit of steam this month and drifting sideways in recent weeks. A bounce of 7% in the past three months indicates some renewed interest, but the broader picture is still one of measured moves. Outside of these price swings, Corebridge has reported solid 9% revenue growth, though net income remains in the red. These are factors to consider when weighing the company’s value.

After this period of growth and recalibration, is Corebridge Financial trading at a bargain relative to its future potential, or is the current price already factoring in whatever comes next?

Most Popular Narrative: 17.1% Undervalued

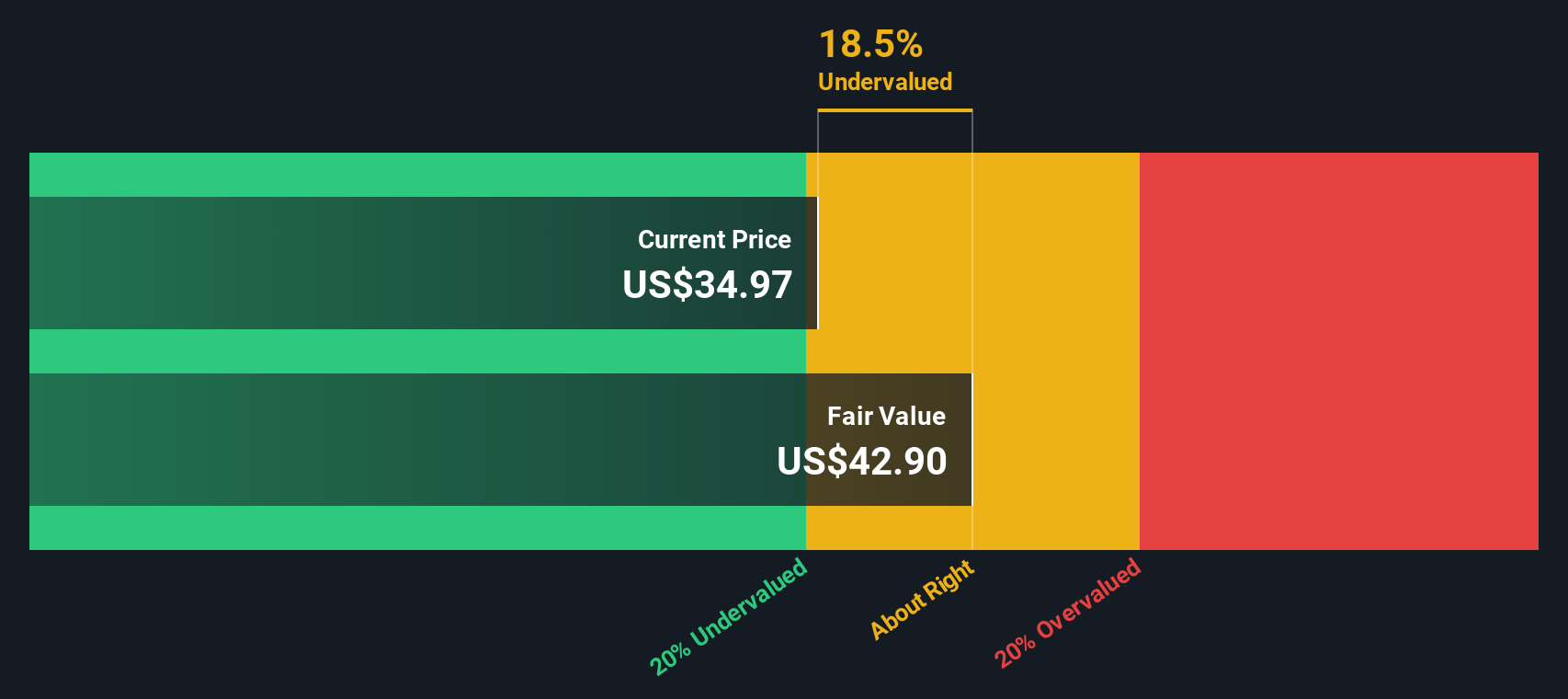

According to community narrative, Corebridge Financial is currently viewed as undervalued, with analysts projecting a fair value that sits notably above the latest share price. Their optimism stems from a mix of demographic trends, technology improvements, and capital management transformations.

“Corebridge is set to benefit from robust growth in individual retirement and annuities sales as the aging U.S. population turns 65 in record numbers. This is fueling increased demand for guaranteed income products, supporting long-term revenue and AUM expansion. Ongoing shifts from defined benefit pensions to IRAs and 401(k)s are creating sustained secular tailwinds for lifetime income and insurance solutions. This positions Corebridge's broad, innovative annuity and retirement product suite for above-market sales growth and improved future earnings.”

Is Corebridge Financial’s valuation really built on unstoppable trends? Dive deeper to discover just how bold the analyst forecasts are beneath the surface. The narrative hints at impressive future earnings, ambitious profit margins, and a game-changing transformation strategy. However, the details may surprise even seasoned investors. The real numbers driving this bullish price target could challenge your assumptions.

Result: Fair Value of $41.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential headwinds such as prolonged low interest rates or the loss of key distribution partners could put Corebridge’s growth trajectory and bullish forecast at risk.

Find out about the key risks to this Corebridge Financial narrative.Another View: What Does Our DCF Model Say?

Looking at our DCF model provides another angle on Corebridge Financial’s value. This approach also suggests that the stock may be trading below its fair value. This adds another layer to the story. But does the SWS DCF model capture the full picture, or is there more to consider?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Corebridge Financial Narrative

If this analysis doesn’t quite fit your own perspective or you prefer to draw your own conclusions, you’re free to shape the story yourself in just a few minutes. do it your way.

A great starting point for your Corebridge Financial research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one promising idea. There are exciting investment angles waiting for you to take action. Use the Simply Wall Street Screener to broaden your horizon, spot strong trends, and position your portfolio to benefit from tomorrow’s opportunities.

- Spot high-yield potential by searching for dividend stocks with yields > 3% that could boost your income even as markets change.

- Capitalize on new tech frontiers by researching AI penny stocks that are transforming industries with innovative artificial intelligence solutions.

- Explore rapid-growth possibilities in the digital realm by evaluating cryptocurrency and blockchain stocks as they lead in the adoption of blockchain across the investing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRBG

Corebridge Financial

Provides retirement solutions and insurance products in the United States.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives