- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Corpay (NYSE:CPAY) Becomes Official Foreign Exchange Partner For SK Slavia Praha

Reviewed by Simply Wall St

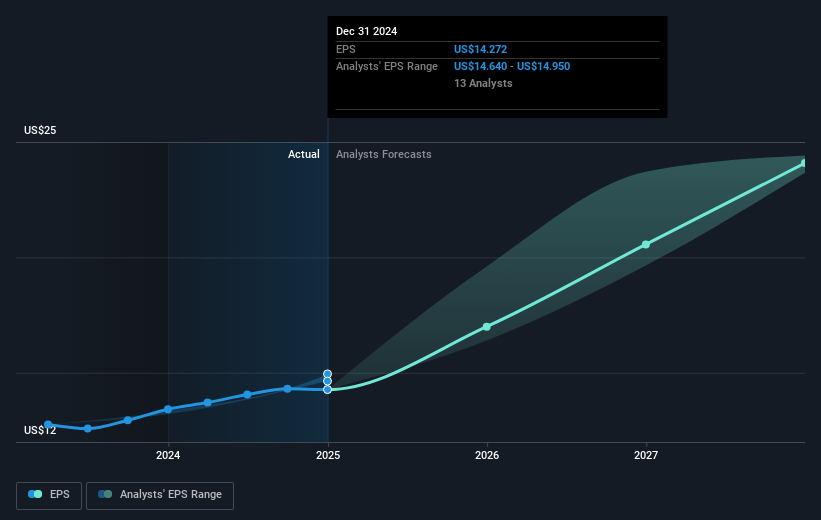

Corpay (NYSE:CPAY), known for enhancing service offerings through critical partnerships such as with SK Slavia Praha and the Federation Internationale de Gymnastique, witnessed a 3% drop in share price over the last quarter. This performance unfolded amid a broader market decline of 1.9%, influenced by fears over tariffs and economic uncertainties. Notably, Corpay's collaborations, strategic earnings guidance updates, and robust share buyback program highlights its continued focus on strengthening financial performance. However, despite ongoing efforts, apprehensions surrounding economic policies and slowing tech sector growth put pressure on the company's share performance. Corpay's new agreements and innovations like Multi-Currency Accounts aim to bolster its market position, yet market sentiment appears cautious, reflected in the share price downturn. In contrast, its Q4 results showed healthy year-over-year sales growth, though net income slightly softened, hinting at external challenges and market volatility impacting investor confidence.

See the full analysis report here for a deeper understanding of Corpay.

The last five years have seen Corpay’s shares return 60.09% when factoring in both share price growth and dividends. This period witnessed several key developments for the company, including the introduction of its Multi-Currency Accounts in February 2025, aimed at improving global transaction efficiency for businesses. Another pivotal moment was the successful launch of the Corpay World Elite Business Mastercard in June 2024, enhancing expense management options for corporate clients.

Corpay’s strategic partnership approach was bolstered by high-profile collaborations, such as with Manchester City and UFC, enhancing its brand visibility in the foreign exchange space. Despite these achievements, executive changes like the announced departure of CFO Tom Panther in March 2025 may influence investor sentiment. Corpay’s earnings growth, though trailing industry peers annually, has contributed to its five-year performance, supported by a steady increase in sales from US$3.76 billion to US$3.97 billion, highlighting the company's ongoing resilience despite recent market volatility.

- See how Corpay measures up with our analysis of its intrinsic value versus market price.

- Analyze the downside risks for Corpay and understand their potential impact—click to learn more.

- Got skin in the game with Corpay? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Corpay, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Reasonable growth potential and fair value.