- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Assessing Corpay After 10% Slide and Cross-Border Payments Expansion in 2025

Reviewed by Simply Wall St

Thinking about what to do with Corpay stock? You are not alone; it has been a hot topic ever since recent price swings caught the attention of both cautious investors and growth optimists. Over just the past week, Corpay saw its shares dip by 2.7%, and that slide stretches to a 10.0% drop for the last 30 days. Year-to-date, the stock is down 12.3%. These moves might have some people concerned, but to put things in perspective, Corpay has still returned a solid 70.9% over three years, along with a 23.8% gain over five years. In other words, this stock’s story is far from finished, and the recent pullback could be more of an opportunity than a warning sign, especially as broader market conditions continue shifting and financial technology names like Corpay navigate evolving buyer sentiment.

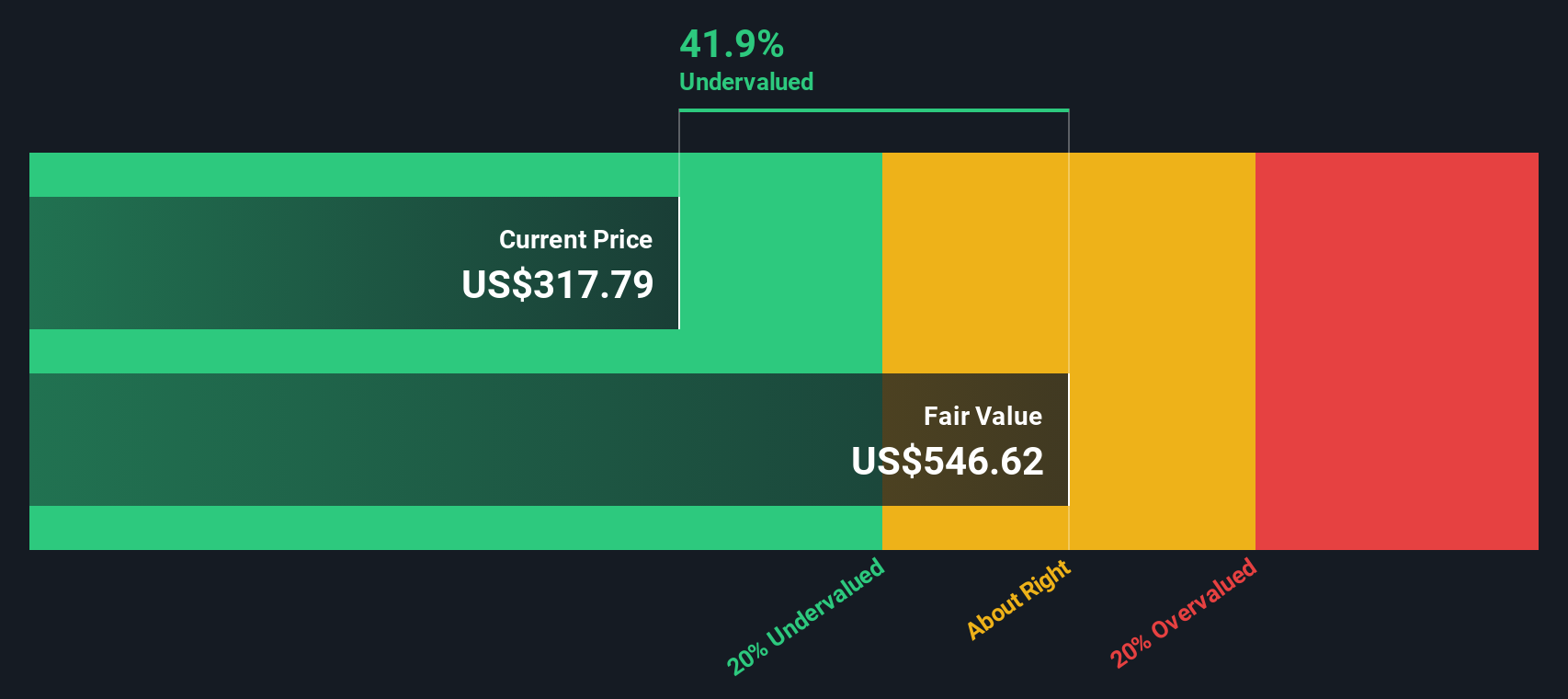

The real question is, at this price, does Corpay have more room to run, or are risks catching up? When we look at how undervalued or overvalued Corpay currently is, a quick glance at its valuation score tells us a lot: the company is undervalued in 4 out of 6 standard checks. That is a promising start, but surface-level numbers only get you so far. Next, we will break down the main approaches analysts use to value a company like Corpay, and, later in the article, we will cover an even smarter way to cut through the noise and see what really drives true value.

Why Corpay is lagging behind its peersApproach 1: Corpay Excess Returns Analysis

The Excess Returns valuation model focuses on the company’s ability to generate returns on invested capital that exceed its cost of equity. In Corpay’s case, the data tells a compelling story. With a Book Value of $55.64 per share and Stable Earnings Per Share (EPS) of $30.98, Corpay’s return on equity is notably high, averaging 37.38%. This performance is based on future return estimates from a panel of four analysts, adding credibility to the projections. The company’s cost of equity stands at $6.87 per share, making its Excess Return a healthy $24.11 per share.

Furthermore, the outlook remains strong as Corpay’s Stable Book Value is expected to grow to $82.87 per share, supported by ongoing analyst projections. The built-in cushion between generated returns and the cost of equity indicates robust profitability and suggests capacity for long-term value creation. Based on the Excess Returns model, the estimated intrinsic value signals that Corpay stock is trading at a substantial 45.4% discount to its fair value.

Given these figures, Corpay looks considerably undervalued compared to its intrinsic worth, making it attractive for investors seeking growth at a reasonable price.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Corpay.

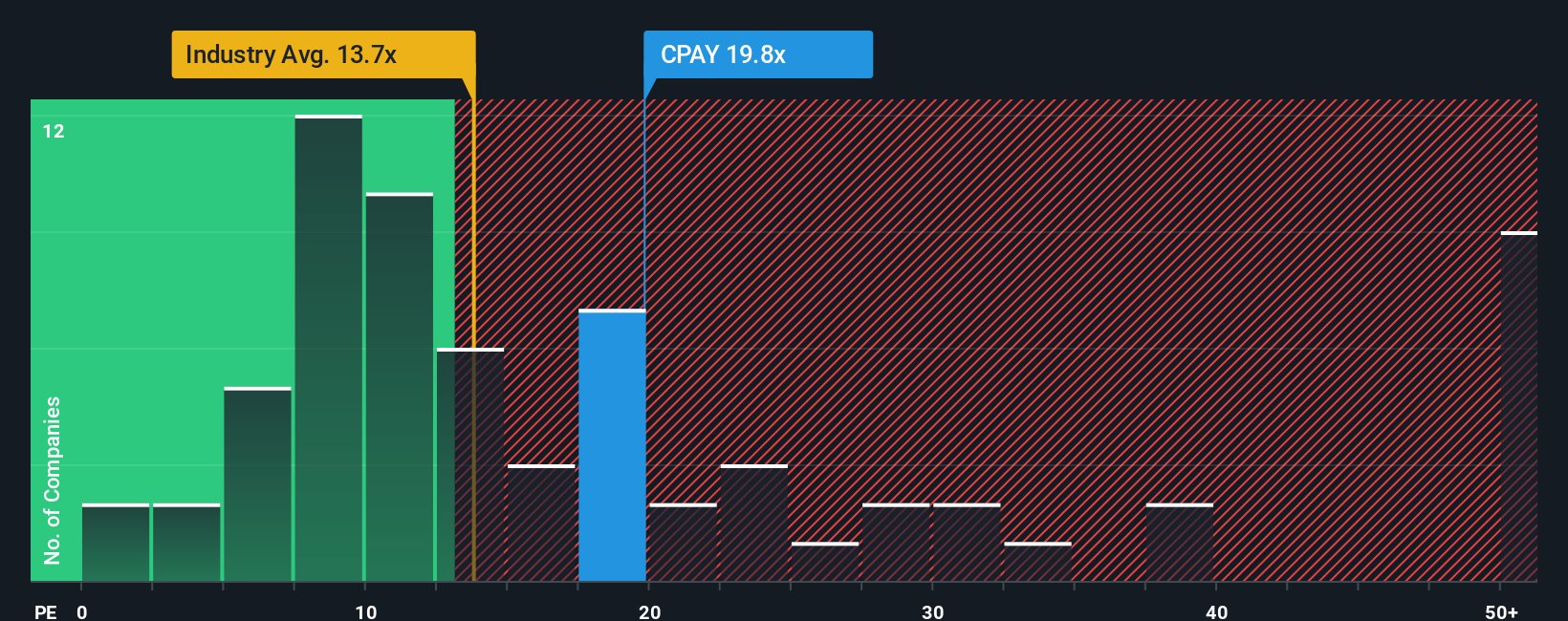

Approach 2: Corpay Price vs Earnings

For established, profitable companies like Corpay, the Price-to-Earnings (PE) ratio is widely considered a reliable metric for stock valuation. The PE ratio measures how much investors are willing to pay for each dollar of earnings the company generates. This makes it a useful way to benchmark whether a stock’s price reflects its current profitability.

Generally, a “normal” or “fair” PE ratio is influenced by growth expectations and company-specific risks. Companies with faster earnings growth or lower risk profiles typically command higher PE ratios, while those with slower growth or more risks trade at lower multiples.

Currently, Corpay trades at a PE ratio of 20.05x. This sits slightly above the Diversified Financial industry average of 16.69x, yet significantly below its peer average of 38.20x. However, rather than just comparing these raw numbers, it is helpful to consider Simply Wall St’s “Fair Ratio,” a proprietary benchmark that goes beyond traditional comparisons. The Fair Ratio for Corpay is 19.26x, which factors in its earnings growth, profit margins, industry context, market capitalization, and unique risk profile. This holistic approach provides a more tailored sense of value than relying solely on industry or peer benchmarks.

With Corpay’s actual PE of 20.05x almost right in line with its Fair Ratio of 19.26x, the stock currently looks fairly valued on a PE basis.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Corpay Narrative

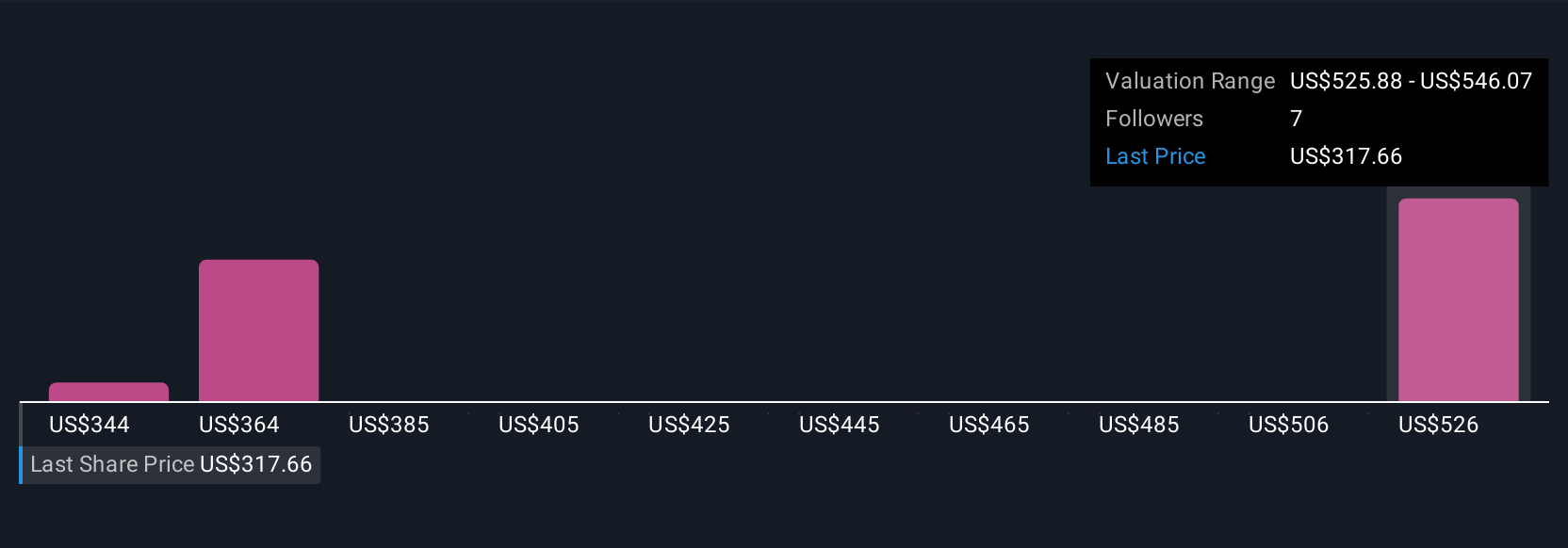

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, connecting what you believe about its future to specific numbers, such as fair value, upcoming revenue, or profit margins. Narratives turn every investment decision into a dynamic, personalized process: you link what is happening in the real world with a forecast, and that forecast shows you a fair value for the company. With Simply Wall St’s Community page, millions of investors easily build and compare their own Narratives for Corpay, making this a powerful, accessible tool for anyone.

Using Narratives, you can quickly check if the current price is above or below your fair value and decide if it is time to buy, hold, or sell. Your Narrative automatically updates as new news or earnings come in, so you always have an up-to-date view grounded in your assumptions. For example, one investor might see Corpay’s expansion in cross-border payments as a game changer, leading them to set a fair value up to $445 per share. Another, focused on rising compliance risks or segment underperformance, might see the downside and set their fair value much lower, at $320. Narratives ensure your decision is guided by what matters to you, not just generic analyst averages.

Do you think there's more to the story for Corpay? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion