- United States

- /

- Consumer Finance

- /

- NYSE:COF

Is Now the Right Moment to Revisit Capital One After Recent Share Price Decline?

Reviewed by Bailey Pemberton

If you have Capital One Financial in your portfolio or you are wondering whether now is the right time to jump in or cash out, you are definitely not alone. The stock has pulled back a bit lately, dipping by 3.6% over the past week and sliding 9.5% in the last 30 days. For some investors, that kind of movement sparks anxiety. But if you zoom out, things look more interesting. Capital One is still up 13.7% for the year, with a two-year gain of 28.7%. Looking even further back, the numbers become eye-catching. The stock has gained 125.8% over three years and an impressive 188.8% in five years. Not too shabby for a financial services stalwart.

What is driving these moves? Much of it connects to shifting expectations around inflation, interest rates, and the resilience of consumer spending. While some market jitters have weighed on the sector as a whole, investors are clearly rewarding companies they believe can weather both macro bumps and longer-term changes in financial habits. As for Capital One, its ability to adapt and grow has helped the company pass most undervaluation screens available. In fact, Capital One gets a valuation score of 5 out of 6 checks, underscoring its potential value in a crowded market.

But do traditional valuation models really tell the whole story? Let’s walk through how Capital One stacks up against key valuation approaches, and why there may be an even sharper way to size up the stock by the end of this article.

Approach 1: Capital One Financial Excess Returns Analysis

The Excess Returns valuation model focuses on how much value a company generates over and above the basic cost of capital invested by shareholders. Instead of only looking at current profits or future cash flows, this method evaluates whether management is producing meaningful, repeatable value over time by comparing returns on equity to the company’s cost of equity.

For Capital One Financial, the numbers stand out. The Book Value per share sits at $165.04, while the Stable EPS estimate is $21.42, based on weighted analyst forecasts of future return on equity. The Cost of Equity is $16.13 per share, which means the company is generating an Excess Return of $5.29 per share. With an average return on equity of 11.68% and a stable Book Value forecast rising to $183.45 per share, Capital One demonstrates a durable ability to outpace its capital costs. This suggests real potential for long-term value compounding.

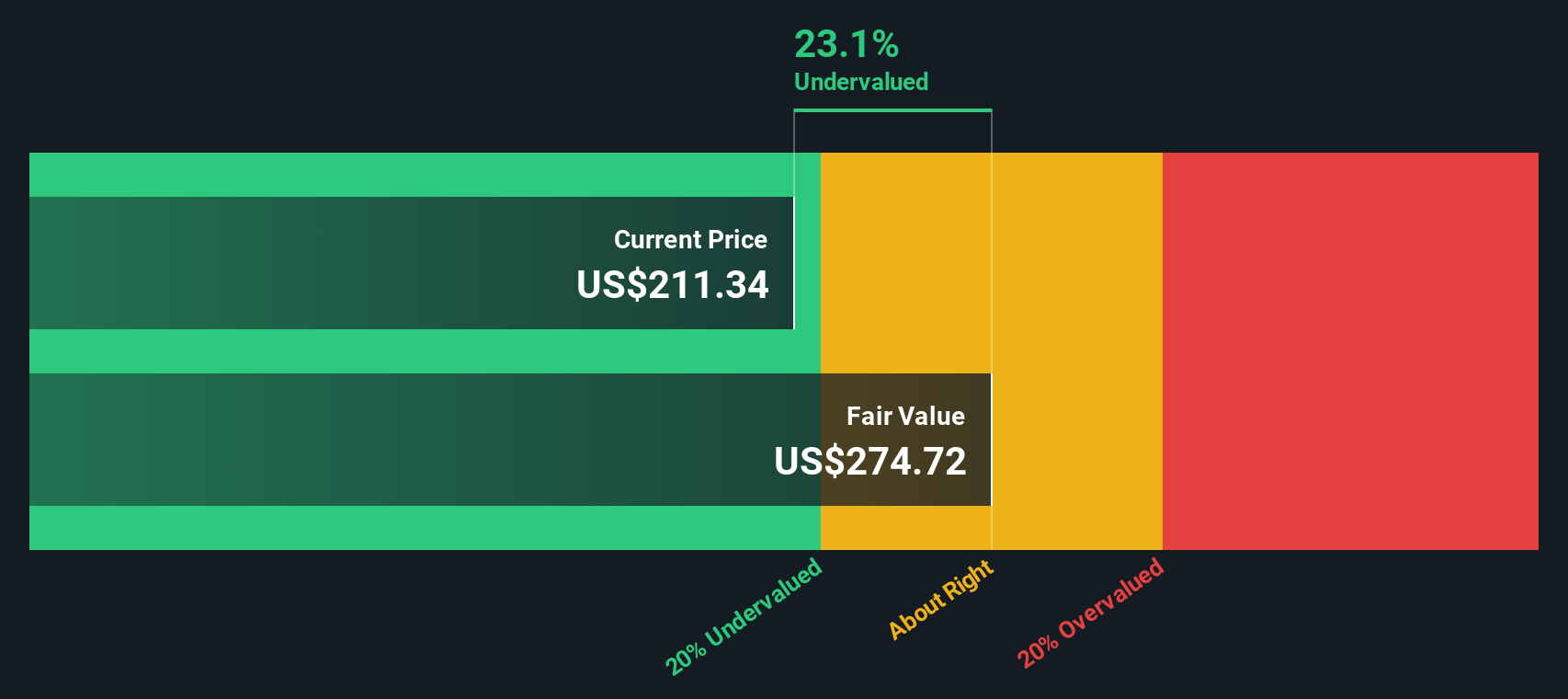

The Excess Returns model calculates an intrinsic value that is 26.4% above the current market price. This result indicates the stock is undervalued at present levels and could offer a margin of safety for investors seeking opportunity in the financials space.

Result: UNDERVALUED

Our Excess Returns analysis suggests Capital One Financial is undervalued by 26.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Capital One Financial Price vs Book

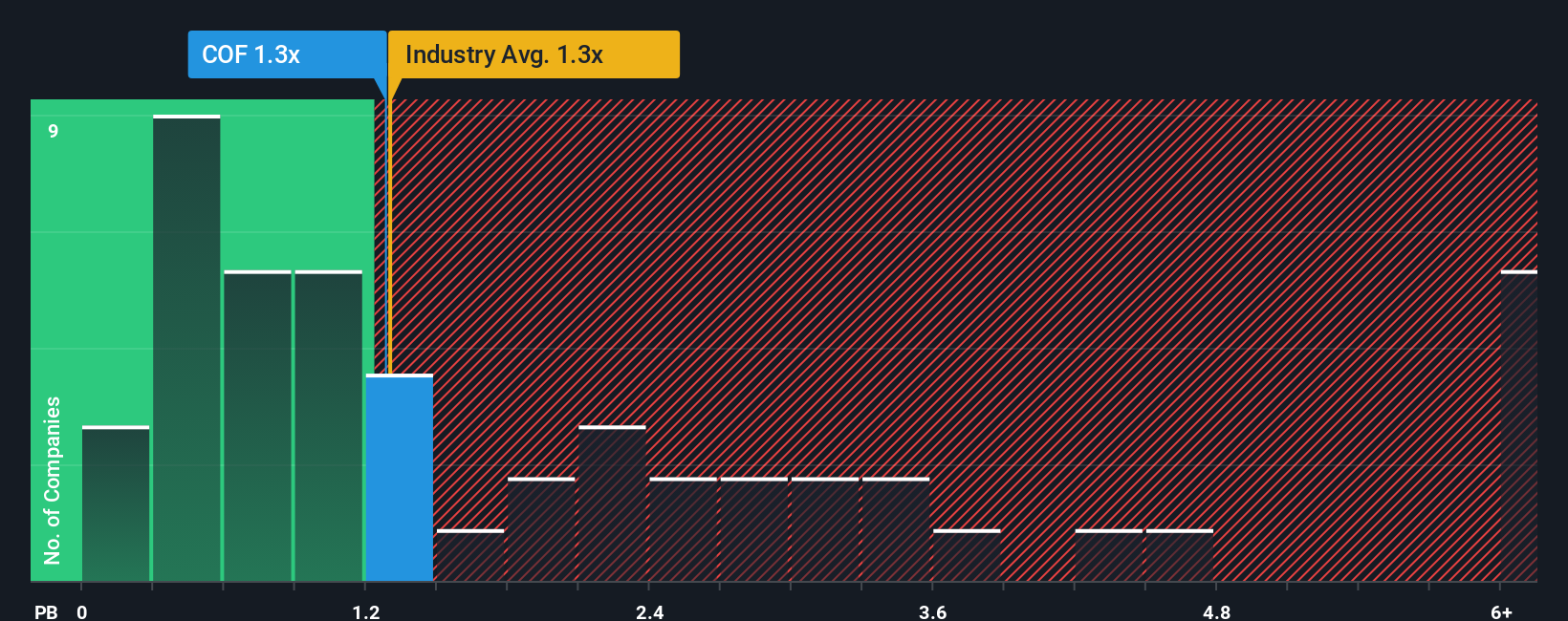

The price-to-book (P/B) ratio is often the preferred valuation metric for financial companies like Capital One, as it reflects how much investors are paying relative to the company’s net assets. For profitable banks and consumer finance businesses, book value provides a meaningful foundation, since it represents the tangible assets left after liabilities are accounted for.

Growth expectations and risk drive what qualifies as a “normal” P/B multiple. Companies growing rapidly or carrying less risk often command higher ratios, while lower growth or elevated risk pulls the ratio down. Capital One currently trades at a P/B of 1.23x, slightly below the Consumer Finance industry average of 1.28x and far below the peer group average of 3.54x. This suggests that the stock is being valued more conservatively by the market compared to others in the sector.

Rather than simply benchmarking against the industry or closest peers, Simply Wall St’s proprietary "Fair Ratio" offers a more tailored assessment. This metric considers not only peer multiples but also factors such as Capital One’s earnings growth, risk profile, profit margins, and size. As a result, it provides a more granular view of fair valuation for this specific business. In comparing Capital One’s actual P/B with its Fair Ratio, the difference is minor, indicating that the current market price is well aligned with its underlying fundamentals.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Capital One Financial Narrative

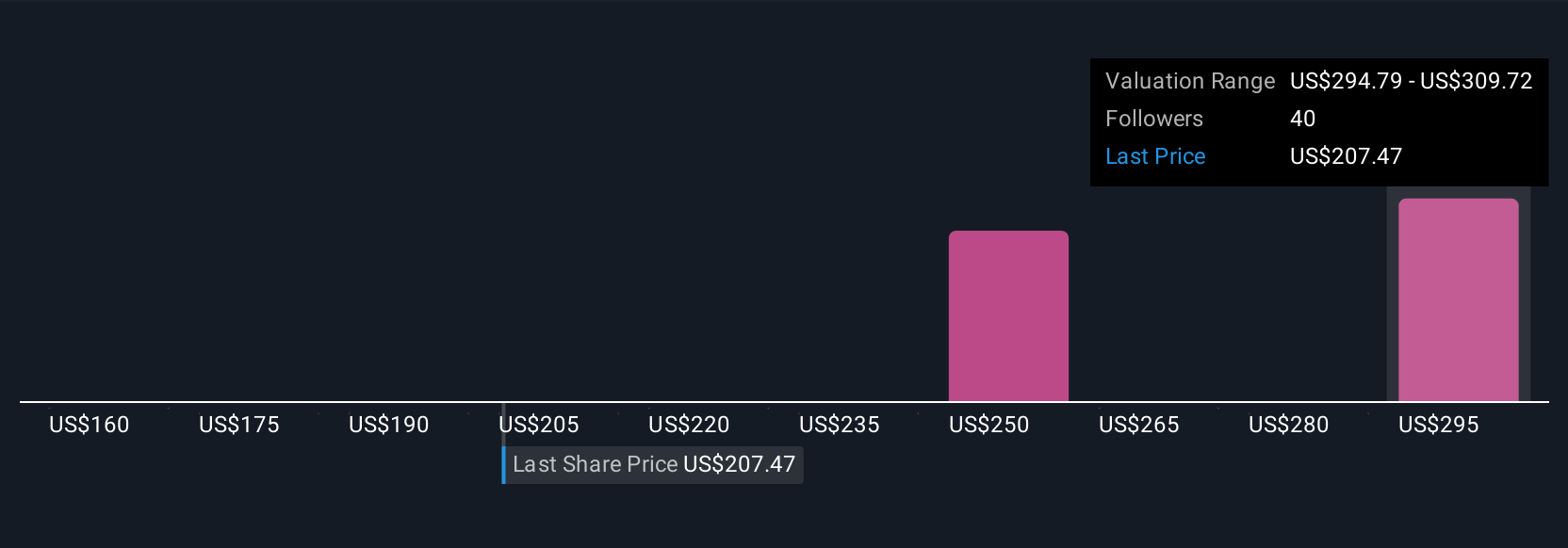

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple but powerful tool that allows you to create and test your own “story” for a company by combining your personal view of its future (like expected revenue, earnings, or margins) with an explicit financial forecast and a calculated fair value.

Each Narrative connects your perspective on a company’s business drivers to projected numbers, showing you right away how your assumptions compare to the market price. The best part is that this interactive approach is accessible directly on Simply Wall St’s Community page, where millions of investors craft, share, and update their Narratives in response to new information, such as company news or earnings releases.

By comparing the Fair Value estimate from your Narrative with the current Price, you can see in real time whether your story says it’s a buy, hold, or sell. This can help you make more confident, informed decisions as the market evolves. For example, some Capital One investors are extremely bullish and set their Fair Value as high as $265, forecasting strong Discover acquisition synergies and technology-driven growth, while more cautious users believe future integration costs and competition justify a Fair Value as low as $160. Narratives put your investing intuition in the driver’s seat. Try building your own for Capital One and see how your view stacks up.

Do you think there's more to the story for Capital One Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives