- United States

- /

- Consumer Finance

- /

- NYSE:COF

Capital One (COF): Margin Drop to 4% Counters Bullish Growth Narrative

Reviewed by Simply Wall St

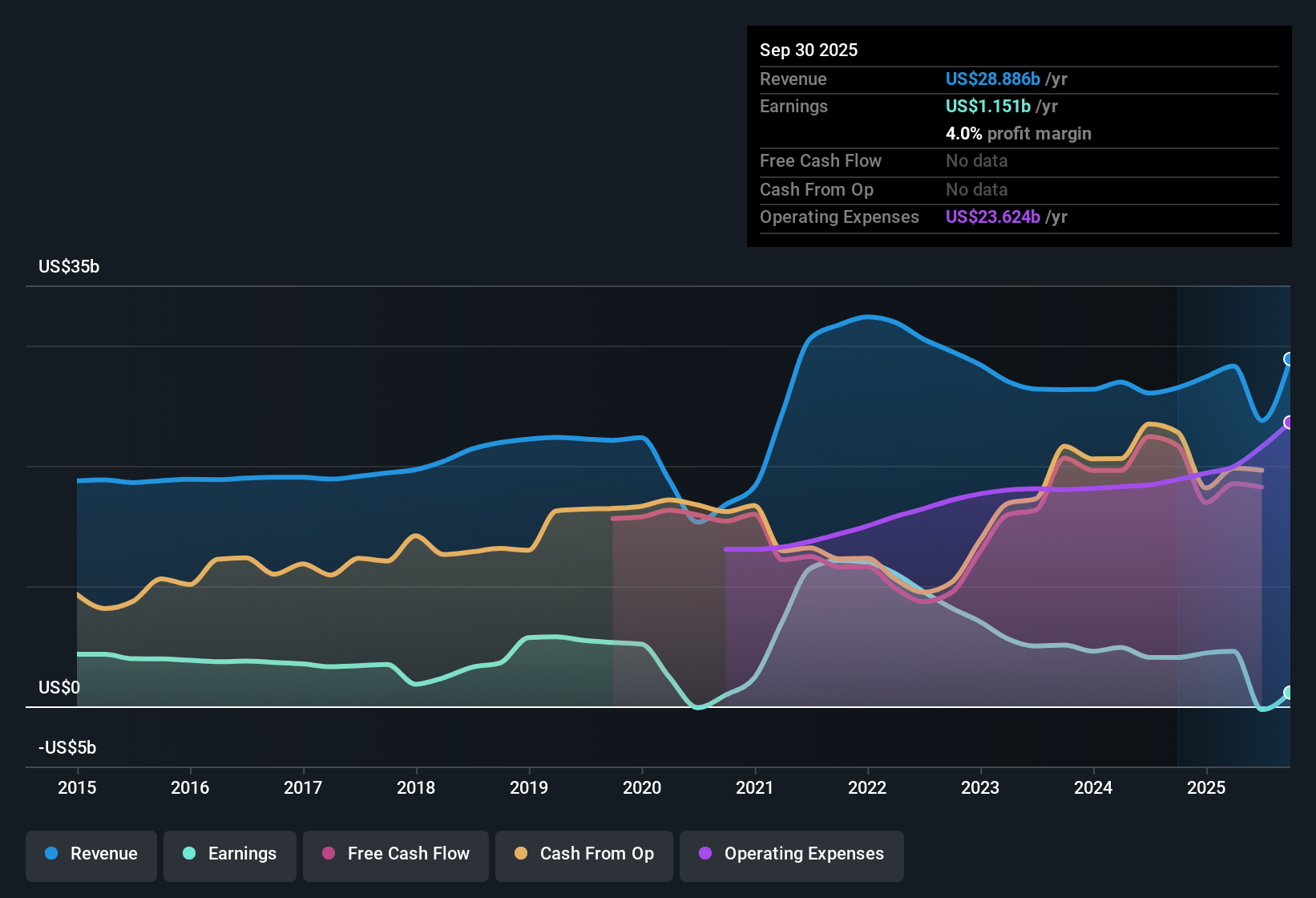

Capital One Financial (COF) is forecasting a robust 20.5% annual revenue growth and an even more impressive 51.42% yearly increase in earnings, well ahead of the US market averages. However, net profit margins have sharply dropped from 15.3% last year to 4%. Over the last five years, earnings have retreated by 19.7% per year. With margins under pressure, investors are looking to the promise of strong future growth to shift the outlook for the stock.

See our full analysis for Capital One Financial.Next up, we’ll see how these headline numbers measure up to the most widely followed narratives. Where does the data validate the market story, and where does it offer a surprise?

See what the community is saying about Capital One Financial

Share Dilution and Margin Stress

- Capital One’s outstanding share count is expected to grow by 0.34% annually for the next three years, while net profit margins have dropped from 15.3% a year ago to 4% now.

- Analysts' consensus view raises two important themes:

- The Discover acquisition and technology investments could expand the business and improve fee income, but execution on both comes with integration and cost risks.

- If Capital One invests heavily but fails to generate expected revenue synergy, higher expenses and a slow margin recovery could undermine the positive outlook, especially with diluted shares spreading future earnings more thinly.

- To see how the latest moves shape consensus thinking, check the full market narrative for insights on risk and potential rewards. 📊 Read the full Capital One Financial Consensus Narrative.

PE Ratio Sits Well Above Peers

- Capital One trades at a price-to-earnings ratio of 122.4x, much higher than both its peer group (30.8x) and the broader US Consumer Finance industry average of 10.1x.

- Analysts' consensus narrative calls out a valuation disconnect:

- To justify the projected price target of $258.57, market expectations imply Capital One must deliver on a steep profit expansion, with a PE ratio falling to 6.9x by 2028, which is significantly below today’s level and even undercuts peer averages.

- The high current PE suggests the market is paying up for anticipated growth but remains exposed if performance or integration disappoint.

Earnings Forecasts Hinge on Integration Success

- Consensus forecasts call for revenue to climb 32.7% annually and for profit margins to rise from 16.1% now to 25.6% in three years, contingent on Discover network scale and technology upgrades being realized.

- According to the consensus narrative:

- Successful execution on Discover integration and technology strategy could push Capital One’s earnings to $16.9 billion and EPS to $21.24 by July 2028, with fee and interchange income as major contributors.

- However, any integration delays, rising expenses, or failure to grow the Discover payments network to critical size could undermine the bullish earnings trajectory and potentially cap margin and revenue gains below consensus estimates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Capital One Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? In just a few minutes, you can build and share a narrative that reflects your unique perspective. Do it your way

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite promising growth projections, Capital One’s steep profit margin drop, high valuation, and need for flawless integration leave its outlook heavily dependent on perfect execution.

If you want investments with more reasonable price tags and downside protection, check out these 874 undervalued stocks based on cash flows to focus on companies trading well below fair value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives