- United States

- /

- Consumer Finance

- /

- NYSE:COF

Assessing Capital One Stock After Its Strong 42.4% Gain Over the Past Year

Reviewed by Bailey Pemberton

So, you are thinking about what to do with Capital One Financial stock. Maybe you already own a few shares, or perhaps you are considering jumping in after seeing its impressive run. The stock closed recently at $213.85, and while it has pulled back by 4.4% over the past week and 3.5% in the last month, zooming out paints a much bigger picture. For starters, Capital One is sporting a 19.7% gain year-to-date, a huge 42.4% gain over the last year, and a whopping 190.2% increase over the past five years. Clearly, this is a stock that has rewarded patience and a long-term perspective.

Of course, these big moves have happened alongside some notable shifts in the broader markets. Inflation trends and changes in interest rate expectations have nudged investors either toward or away from financial stocks in recent quarters, and Capital One has benefitted at times when the outlook for consumers has improved. While the recent dip might cause jitters, long-term performance suggests investors have consistently reassessed the company's risk and growth profile upward.

But is the stock actually undervalued at these prices, or has it run too far ahead? That is where things get really interesting. On a numerical value score that checks six key undervaluation criteria, Capital One scores a 4, meaning it is undervalued in four out of six possible ways. That is a solid mark for anyone concerned about overpaying. Up next, I will break down exactly which valuation methods flag Capital One as a buy, and why there is an even deeper approach to valuation you will not want to miss at the end.

Approach 1: Capital One Financial Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic value based on the returns it generates above its cost of equity. In other words, it measures how efficiently Capital One Financial converts shareholders' equity into profits that exceed the baseline required by investors.

For Capital One, the latest data shows a Book Value of $165.04 per share. Analysts expect a stable Book Value of $182.53 per share in the future. The company's steady earnings power, or Stable EPS, stands at $21.30 per share, according to a weighted consensus from eight analysts. With a Cost of Equity at $15.98 per share, Capital One produces an Excess Return of $5.31 per share, demonstrating that its earnings consistently exceed the expected cost of capital. Over the long run, the company's average Return on Equity is estimated at 11.67%, highlighting robust profitability.

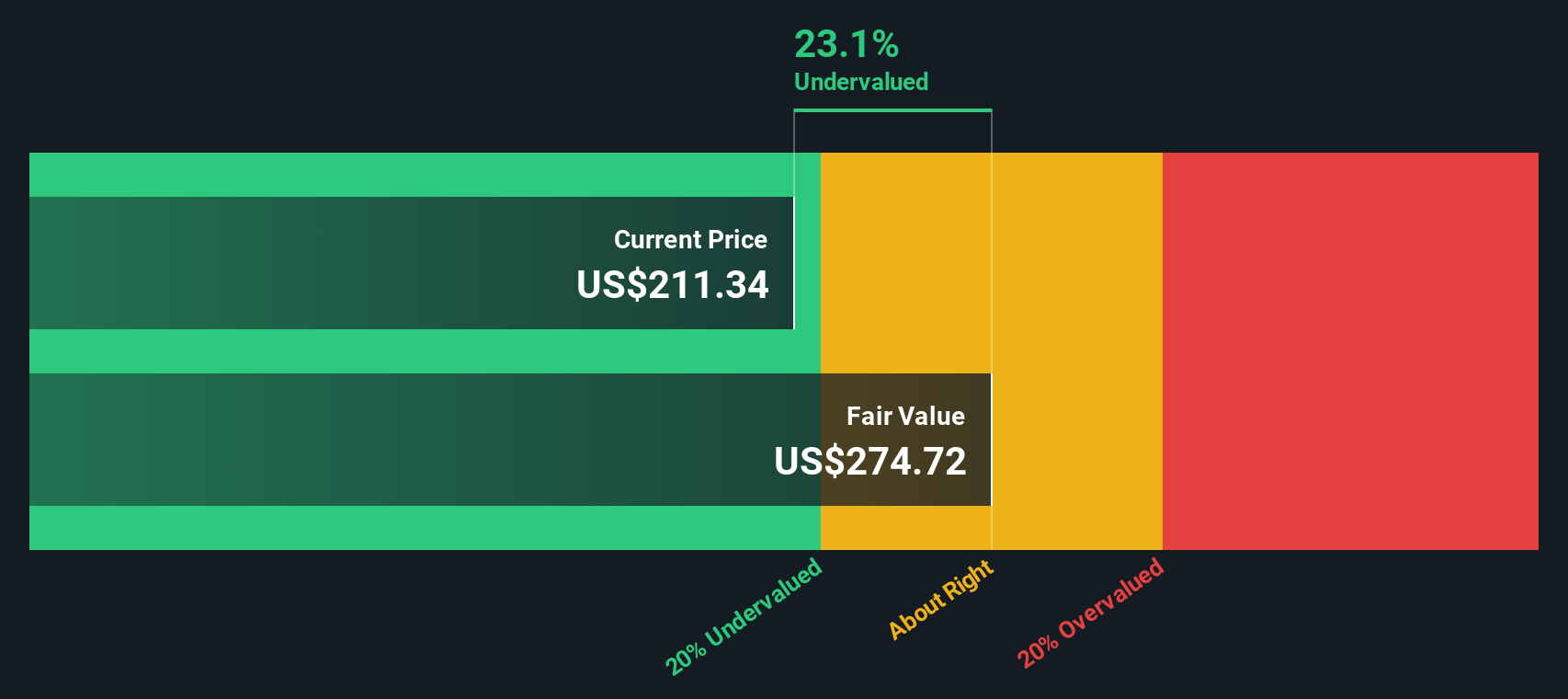

Putting it all together, the model estimates Capital One's intrinsic value at $276.12 per share. With the current share price at $213.85, this implies the stock is trading at a 22.6% discount. This suggests it is undervalued relative to what its fundamentals justify.

Result: UNDERVALUED

Our Excess Returns analysis suggests Capital One Financial is undervalued by 22.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Capital One Financial Price vs Book

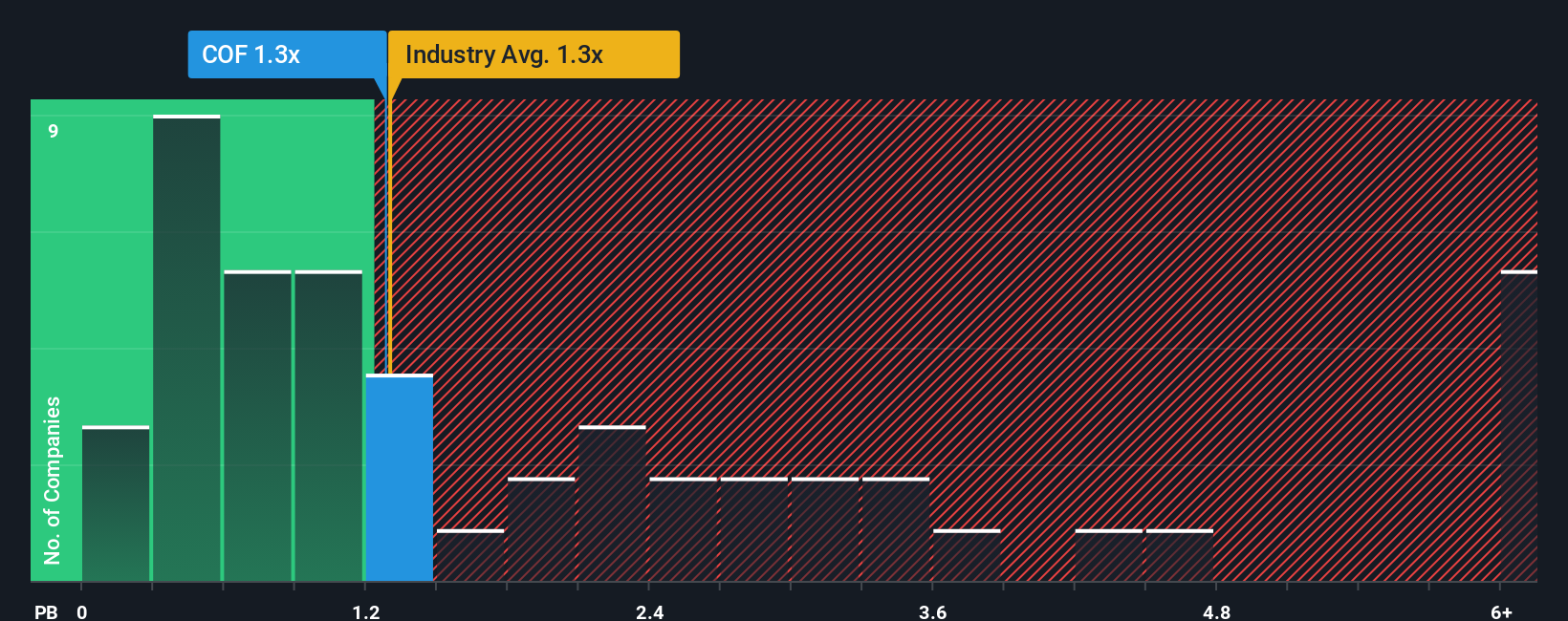

For financial companies, the Price-to-Book (P/B) ratio is often the most suitable valuation tool. This is because banks and lenders like Capital One Financial derive much of their value from tangible assets and equity, making book value a strong proxy for what the business is worth. The P/B ratio allows investors to see how much they are paying for each dollar of the company's net assets, which is particularly meaningful when profits are stable and assets are reliably valued.

Growth expectations and perceived risk both play a key role in shaping what a fair or "normal" P/B ratio should be. Companies expected to grow efficiently, with high returns on equity and lower risk, usually deserve a higher P/B multiple. Those with poorer prospects or riskier profiles may appear cheap for a reason.

Capital One's current P/B ratio stands at 1.30x. This puts the stock roughly in line with the Consumer Finance industry average of 1.30x, but well below its peer group average of 3.61x. Such a discount could suggest the market is pricing in lower growth or higher risk, or it may indicate an opportunity if those fears are overdone. While comparing against peers and the industry gives helpful context, Simply Wall St's proprietary Fair Ratio goes a step further. The Fair Ratio blends a number of factors unique to Capital One, including its earnings growth rate, profit margins, risk profile, industry characteristics, and size, to estimate what a justified P/B multiple should be. This approach is a more tailored measure of value than basic industry or peer comparison.

For Capital One, the Fair Ratio is very close to its actual P/B multiple, with less than a 0.10 difference. This signals that the stock is trading at about the level its unique performance and risk profile would warrant right now.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

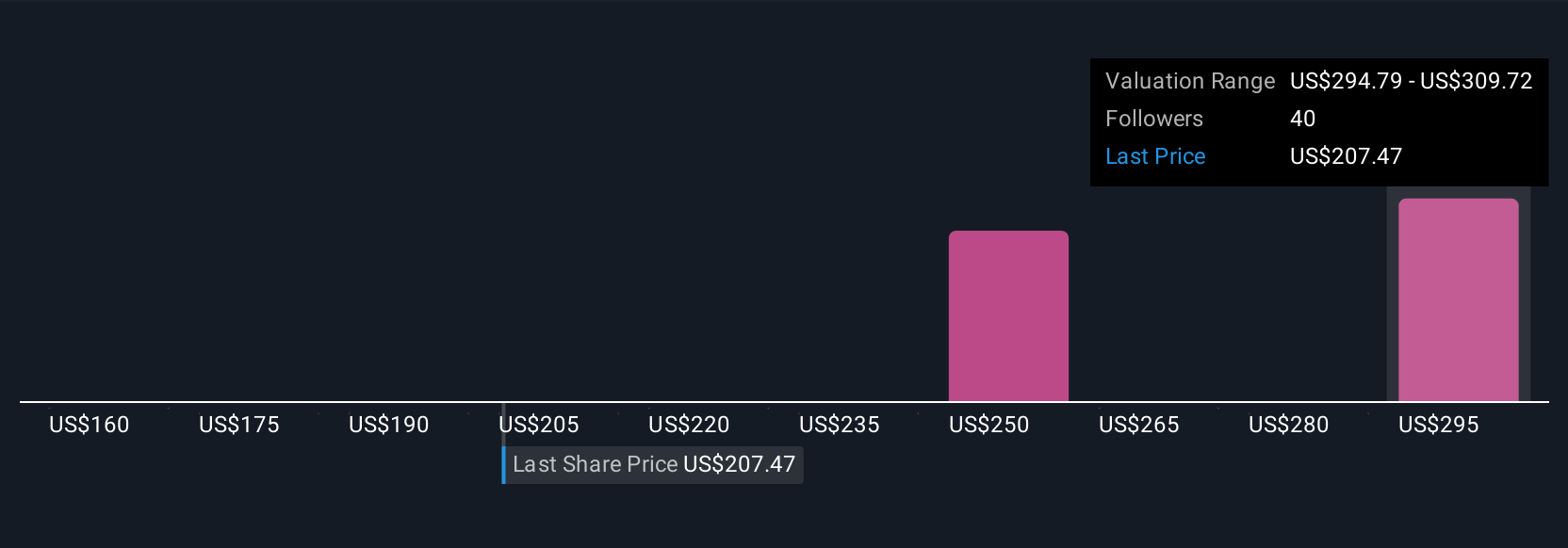

Upgrade Your Decision Making: Choose your Capital One Financial Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personalized "story" for a company, connecting your view of Capital One Financial’s future, such as where revenue, earnings, and margins are headed, to your estimate of fair value. All of this is backed by numbers and your perspective. Narratives make it easy to see how your view links to an actual forecast and a price, helping you decide if now is the right time to buy or sell. Available to millions of investors through Simply Wall St’s Community page, Narratives are intuitive to create and automatically update as key news or earnings arrive. This ensures your decision is always based on the latest information. For example, the most optimistic Capital One Narrative, reflecting belief in successful technology investments and strong payments growth, recently estimated a fair value of $265 per share; meanwhile, the most cautious, weighing risks like integration costs and competition, set theirs at just $160. Narratives help you compare your fair value to the current price, making smarter, evidence-based investment decisions both simple and dynamic.

Do you think there's more to the story for Capital One Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives