- United States

- /

- Capital Markets

- /

- NYSE:CNS

How Growing Spotlight on High Yield Funds at Cohen & Steers (CNS) Is Shaping Income Strategies

Reviewed by Sasha Jovanovic

- Recent media coverage has spotlighted Cohen & Steers’ high yield income funds, which offer monthly income yields over 8% across sectors such as real estate, preferred securities, infrastructure, and utilities.

- This attention underscores growing investor interest in diversified alternative income sources and Cohen & Steers’ reputation for active management and consistent distributions.

- We'll explore how increased focus on Cohen & Steers’ income products could reshape its investment narrative and client demand outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cohen & Steers Investment Narrative Recap

To be a shareholder in Cohen & Steers, investors typically need to believe in the firm's ability to deliver consistent income from alternative assets and adapt to evolving client demand, especially as preferences shift toward higher-yield and diversified products. The recent spotlight on their high yield income funds highlights growing interest, but does not materially change the near-term risk of net outflows from institutional clients, which remains the most significant risk to earnings stability for now.

Out of the recent announcements, the launch of Cohen & Steers’ new real estate strategy in partnership with IDR Investment Management offers the most direct link to current catalysts, as it builds product breadth and aims to attract clients seeking both listed and private real estate exposure. This expansion supports the catalyst of broader product diversification and could help mitigate cyclical outflows tied to single-sector concentration.

In contrast, what many investors may miss is the impact of persistent structural industry shifts away from active management and toward lower-fee passive products, which...

Read the full narrative on Cohen & Steers (it's free!)

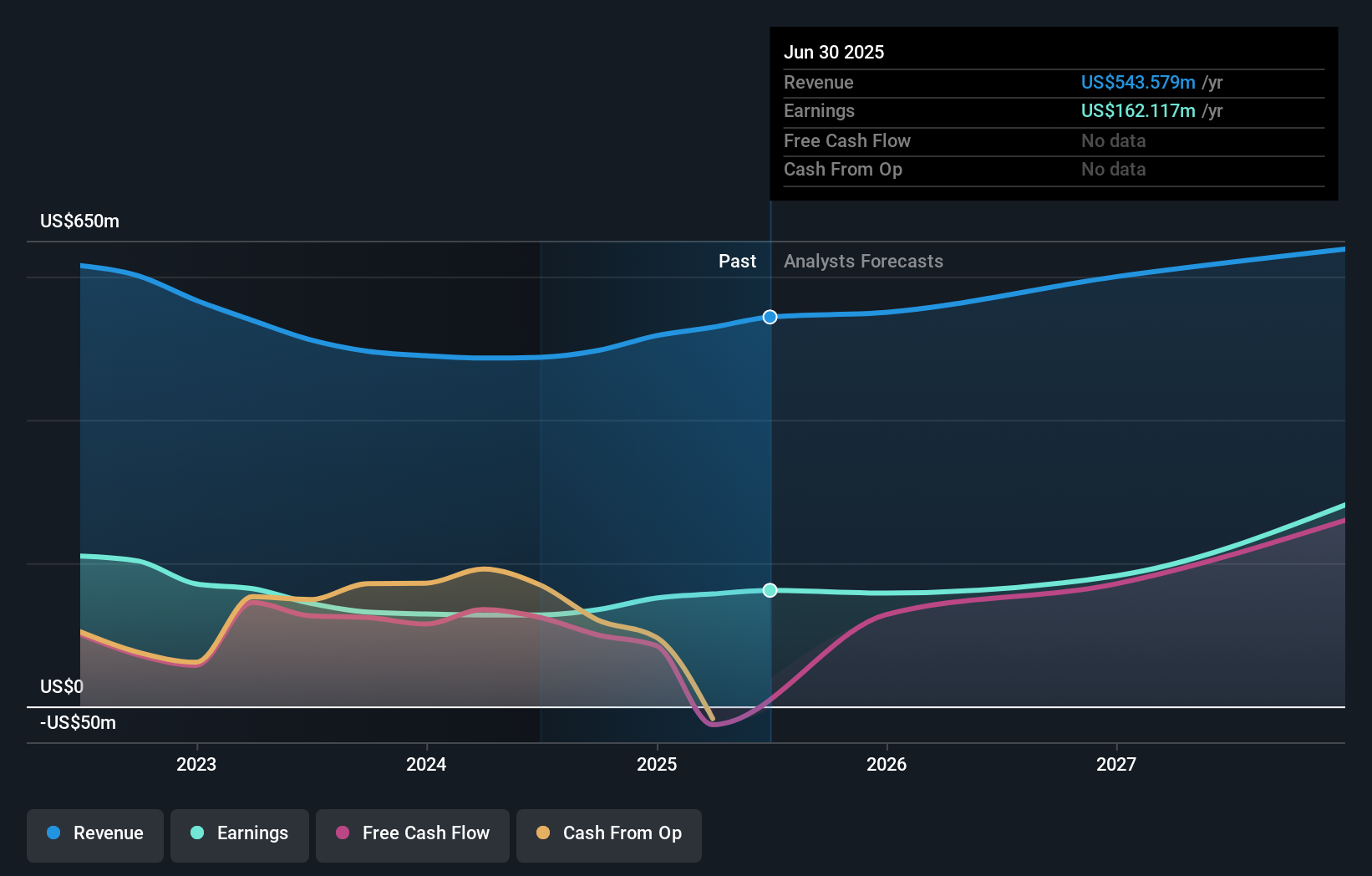

Cohen & Steers' outlook anticipates $704.3 million in revenue and $318.2 million in earnings by 2028. This scenario assumes a 9.0% annual revenue growth rate and a $156.1 million increase in earnings from current earnings of $162.1 million.

Uncover how Cohen & Steers' forecasts yield a $74.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Every fair value estimate from the Simply Wall St Community stands at US$74.33 from one contributor. While some investors see growth opportunity in expanding real estate strategies, evolving industry preferences toward passive investing could present significant challenges for future profitability.

Explore another fair value estimate on Cohen & Steers - why the stock might be worth just $74.33!

Build Your Own Cohen & Steers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cohen & Steers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cohen & Steers' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives