- United States

- /

- Mortgage REITs

- /

- NYSE:CIM

Chimera Investment (CIM): Evaluating Valuation After HomeXpress Acquisition Raises Growth and Credit Risk Questions

Reviewed by Kshitija Bhandaru

Chimera Investment (CIM) stock is drawing attention after its acquisition of HomeXpress, a non-QM mortgage originator. While the deal could fuel future earnings, investors are weighing potential credit risks and funding uncertainties.

See our latest analysis for Chimera Investment.

Chimera Investment’s share price has slipped 8% over the past month, reflecting investors’ caution around the company’s shift into non-QM mortgages. Its recent HomeXpress acquisition signals growth ambitions, but near-term momentum has clearly faded despite three-year total shareholder returns remaining comfortably in positive territory.

If strategic moves in specialty finance have you wondering what else is out there, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares down and a sizable discount to analyst targets, is the market underestimating Chimera Investment’s potential upside? Alternatively, are recent risks fully factored in and future growth already priced into today’s valuation?

Most Popular Narrative: 16% Undervalued

With Chimera Investment last closing at $13.02 and the widely followed fair value narrative coming in at $15.50, investors are weighing if market skepticism is missing structural tailwinds driving future worth. This sharp difference raises the question: are current earnings and assets more powerful than they appear?

The acquisition of HomeXpress, a leading non-QM originator, is expected to be materially accretive to earnings in 2026 and 2027, aligning with the ongoing expansion of the non-agency and non-QM mortgage markets. This should directly drive revenue growth and enhance return on equity.

Curious why this valuation stands out? The narrative hinges on a set of bold growth projections and surprisingly optimistic margin assumptions. Want to see which levers analysts believe will supercharge earnings and reset the company’s profit trajectory? Dig deeper to find the critical financial forecasts that shape this bullish outlook.

Result: Fair Value of $15.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit risk and funding vulnerabilities mean that setbacks in non-QM performance or volatile interest rates could quickly challenge Chimera’s positive outlook.

Find out about the key risks to this Chimera Investment narrative.

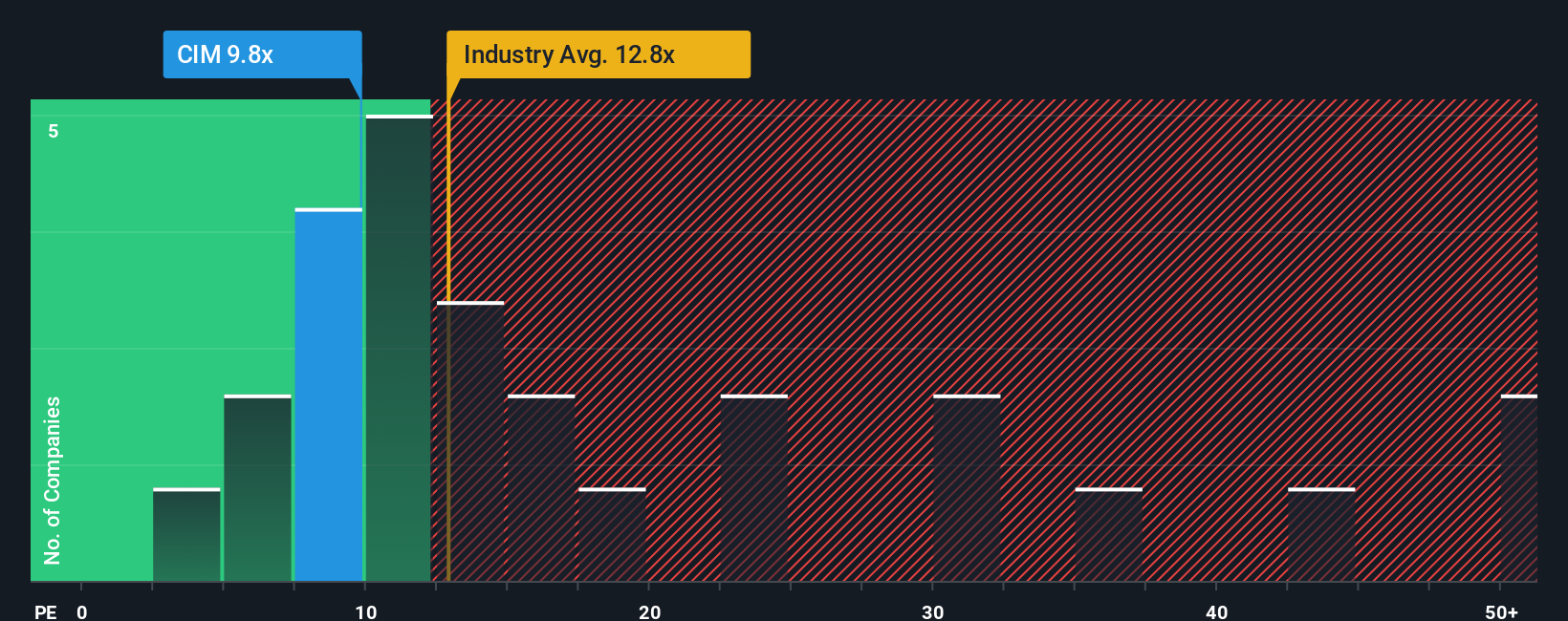

Another View: Market Ratios Tell a Different Story

Looking through the lens of price-to-earnings ratios, Chimera Investment appears attractively valued. Trading at 10x earnings, it is cheaper than both its peer average of 13x and the industry’s 12.9x, and still below the fair ratio of 12.2x. This gap suggests possible upside, but do these discounts flag deeper risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chimera Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chimera Investment Narrative

If you have a different perspective or want to dive into the numbers yourself, it only takes a few minutes to craft your own view. Do it your way.

A great starting point for your Chimera Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your strategy by tapping into fresh trends and untapped opportunities. These handpicked lists make it easy to outsmart the market and catch the next big story before everyone else.

- Spot income potential by reviewing these 18 dividend stocks with yields > 3% topping 3% yields. These options are designed for those building stable cash flow in their portfolios.

- Get ahead of tomorrow’s tech by sizing up these 25 AI penny stocks that are rewriting the rules with real-world artificial intelligence breakthroughs.

- Boost your value hunt and unearth underappreciated gems through these 881 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIM

Chimera Investment

Operates as a real estate investment trust (REIT) in the United States.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives