- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Berkshire’s Leadership Split and Buffett’s Conservative Pivot Might Change the Case for Investing in BRK.A

Reviewed by Sasha Jovanovic

- On September 30, 2025, Berkshire Hathaway’s board amended its by-laws to separate the roles of Chairman and Chief Executive Officer, with Greg Abel set to become CEO in January 2026 while Warren Buffett remains Chairman.

- This formal leadership transition, paired with Buffett’s recent shift toward conservative investments, signals a significant change in both governance and capital allocation at the company.

- We’ll explore how this robust governance change, alongside Buffett's pivot to Treasuries, shapes Berkshire Hathaway’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Berkshire Hathaway's Investment Narrative?

Being a Berkshire Hathaway shareholder has always meant believing in the unique mix of disciplined asset management, insurance operations, and patient capital allocation that Warren Buffett built. The decision to separate the Chairman and CEO roles, with Greg Abel taking the reins from Buffett but Buffett remaining as Chairman, marks a real governance shift, but based on recent share price moves and robust board independence, it’s not likely to disrupt immediate catalysts. Short-term, all eyes are on the possible Occidental Petroleum deal, quarterly earnings momentum, and Buffett’s pivot towards safer Treasuries, which reflects a conservative stance given tepid earnings growth and some margin pressure. If anything, this separation could make risk oversight stronger, but questions linger about how Abel might steer capital as CEO or whether Buffett’s cautious approach could cap future returns if the market rebounds. However, current cash deployment decisions could still limit upside if conditions shift unexpectedly.

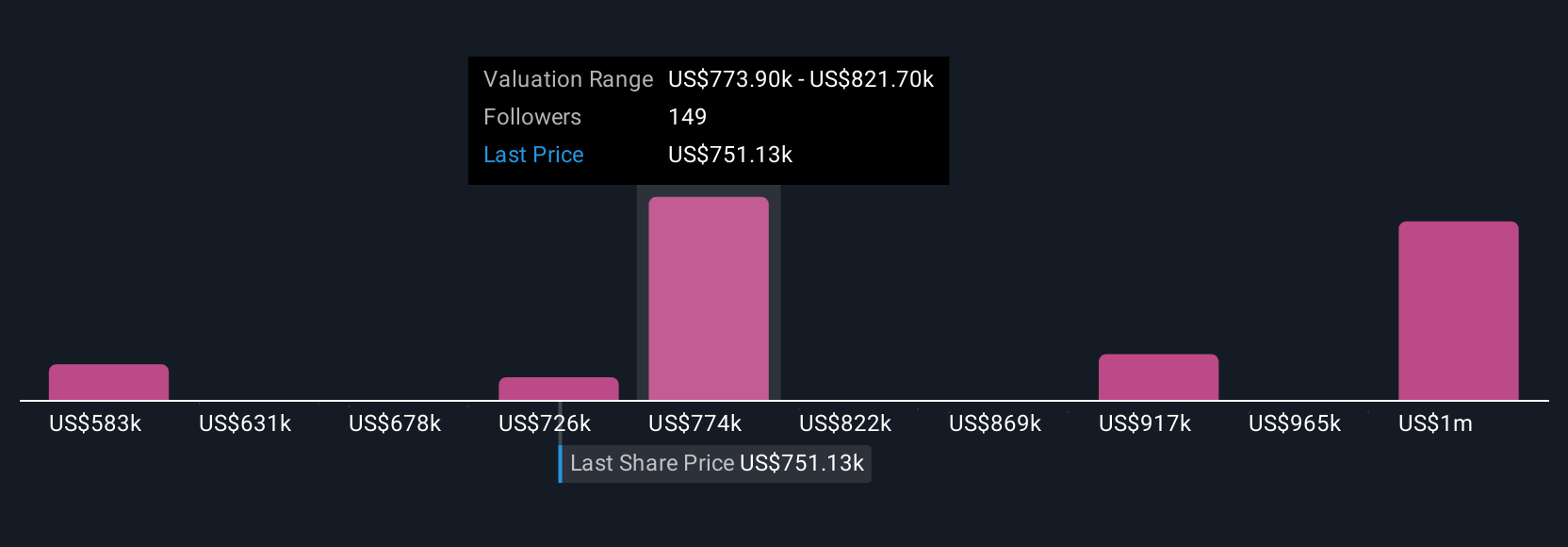

Despite retreating, Berkshire Hathaway's shares might still be trading 31% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 29 other fair value estimates on Berkshire Hathaway - why the stock might be worth 22% less than the current price!

Build Your Own Berkshire Hathaway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Berkshire Hathaway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Berkshire Hathaway's overall financial health at a glance.

No Opportunity In Berkshire Hathaway?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives