- United States

- /

- Chemicals

- /

- NasdaqGM:ARQ

3 US Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, with major indexes like the Dow Jones and S&P 500 on track for significant weekly gains, investors are closely watching growth companies that exhibit strong insider ownership. High insider ownership can be an indicator of confidence in a company's potential, making these stocks particularly noteworthy amid current market optimism.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| MoneyLion (NYSE:ML) | 20.2% | 92.4% |

| Myomo (NYSEAM:MYO) | 13.7% | 56.7% |

| Hesai Group (NasdaqGS:HSAI) | 24.4% | 74.4% |

Here we highlight a subset of our preferred stocks from the screener.

Arq (NasdaqGM:ARQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arq, Inc. is a North American company that produces activated carbon products and has a market cap of $265.22 million.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to $110.02 million.

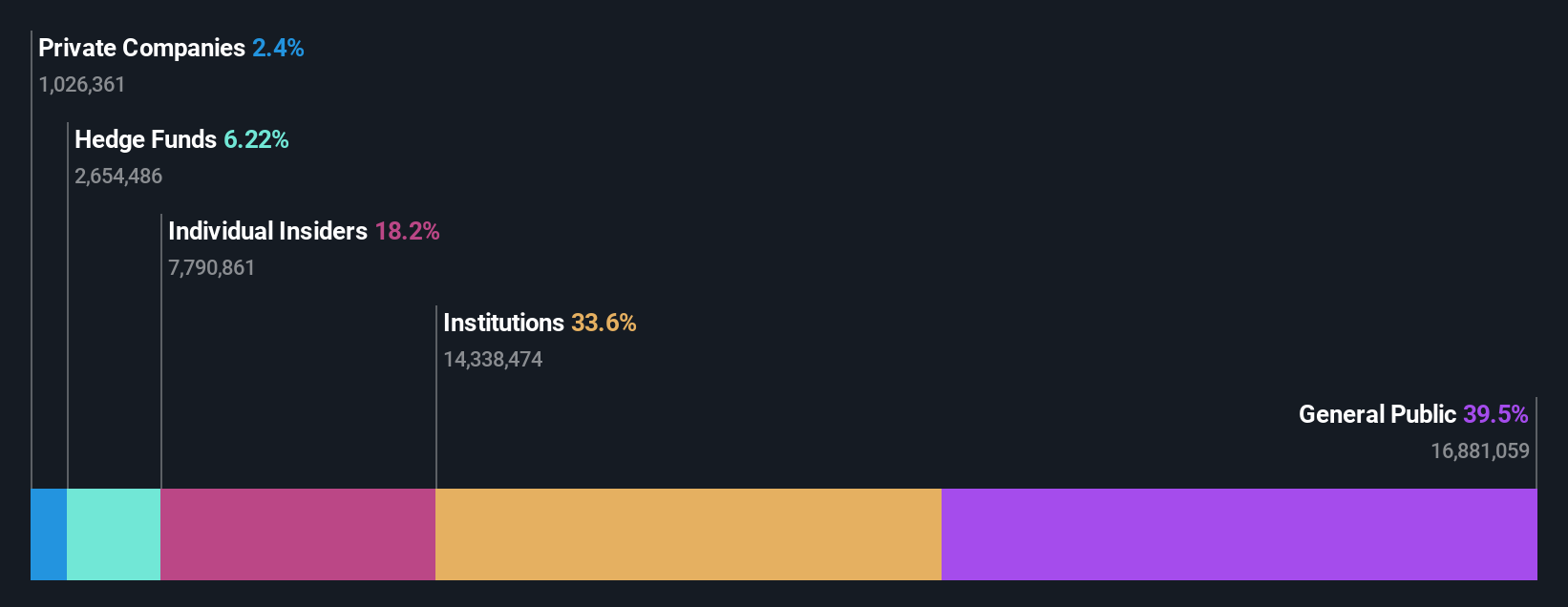

Insider Ownership: 18.4%

Earnings Growth Forecast: 50.8% p.a.

Arq is positioned for growth with forecasted annual revenue increases of 17.2%, outpacing the broader US market. Despite past shareholder dilution, earnings have grown significantly, and profitability is expected within three years. Recent debt financing via a $30 million revolving credit facility enhances liquidity but highlights financial constraints with less than one year of cash runway. The company's recent shift from net loss to net income indicates improving financial health, though insider trading data remains unavailable.

- Unlock comprehensive insights into our analysis of Arq stock in this growth report.

- Our expertly prepared valuation report Arq implies its share price may be too high.

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers real estate, energy, infrastructure, and environmental management solutions across the United States with a market cap of $442.80 million.

Operations: The company generates $406.31 million in revenue from delivering engineering and related professional services to its clients.

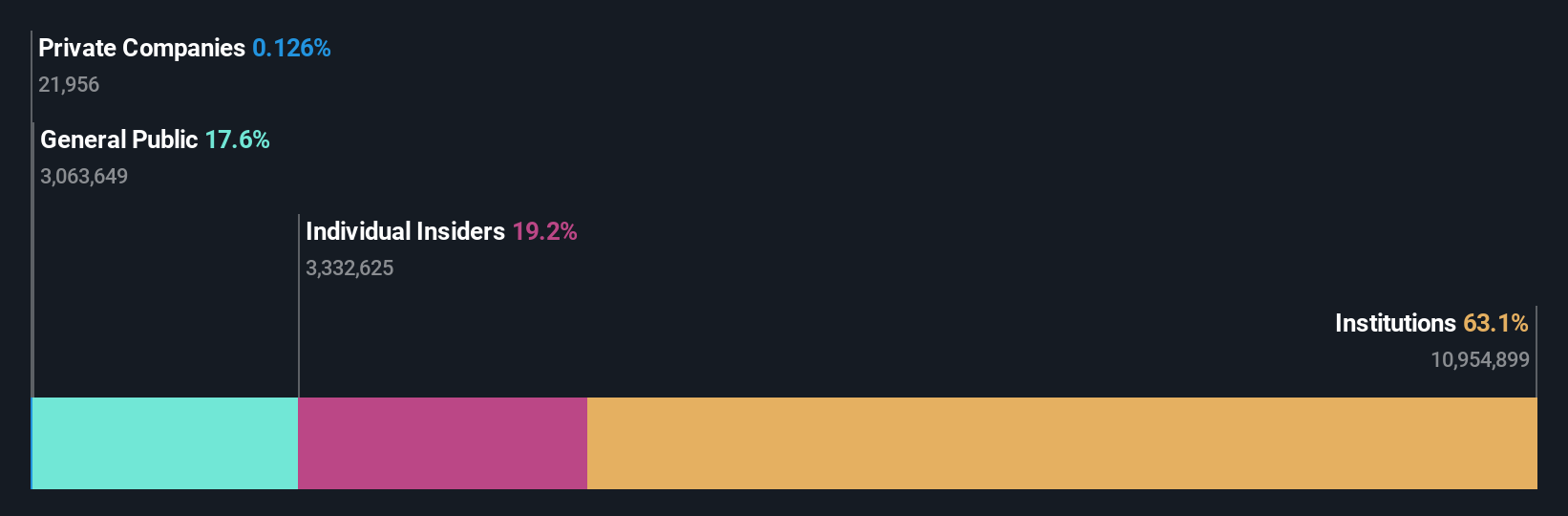

Insider Ownership: 19%

Earnings Growth Forecast: 131.5% p.a.

Bowman Consulting Group is forecasted to achieve annual revenue growth of 11.6%, surpassing the US market average, with expectations of profitability within three years. Despite past shareholder dilution, the company trades below its estimated fair value and has recently secured multiple contracts, including a $1.5 million project with Nebraska's Department of Transportation and a $5 million contract with Illinois Tollway. Analysts anticipate a 42.9% stock price increase, reflecting positive sentiment despite limited insider trading data.

- Delve into the full analysis future growth report here for a deeper understanding of Bowman Consulting Group.

- Our comprehensive valuation report raises the possibility that Bowman Consulting Group is priced lower than what may be justified by its financials.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bridge Investment Group Holdings Inc. operates in the real estate investment management sector in the United States with a market capitalization of approximately $908.13 million.

Operations: The company generates revenue of $404.93 million as a fully integrated real estate investment manager in the United States.

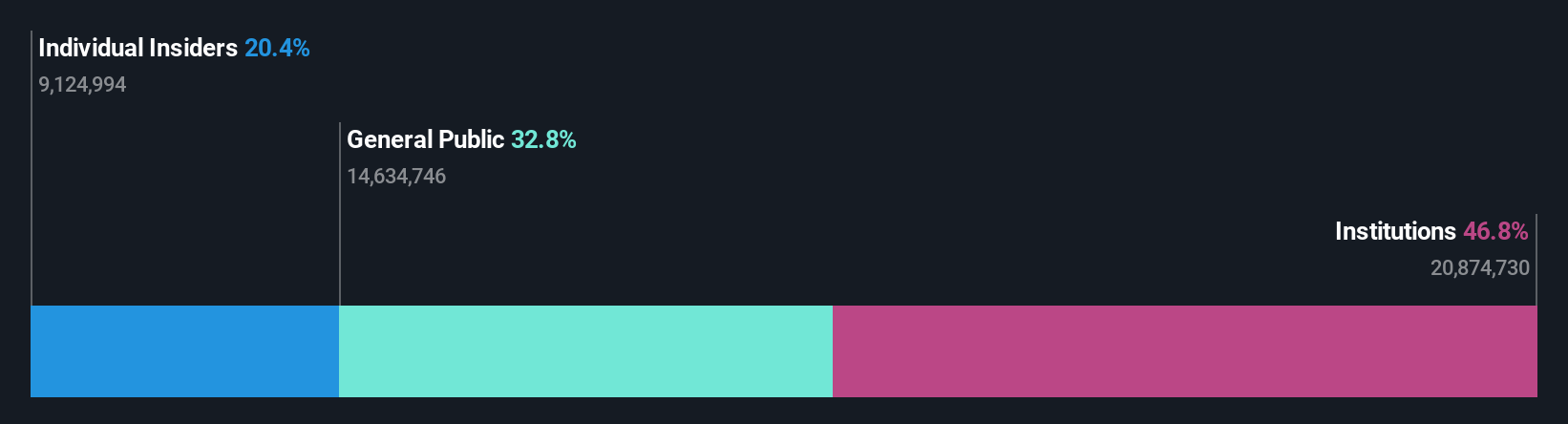

Insider Ownership: 13.8%

Earnings Growth Forecast: 51.4% p.a.

Bridge Investment Group Holdings is experiencing significant earnings growth, forecasted at 51.4% annually, outpacing the US market. Despite a high debt level and an unsustainable dividend yield of 8.56%, insider ownership remains strong with more shares bought than sold recently. The company trades at a 23.3% discount to its fair value, with analysts predicting a 23.2% price rise. Recent earnings showed improved profitability with net income reaching US$29.62 million for the nine months ending September 2024.

- Dive into the specifics of Bridge Investment Group Holdings here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Bridge Investment Group Holdings' share price might be too pessimistic.

Turning Ideas Into Actions

- Investigate our full lineup of 202 Fast Growing US Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARQ

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives