- United States

- /

- Consumer Finance

- /

- NYSE:BFH

Should Anticipation of Another Earnings Beat Prompt Action From Bread Financial Holdings (BFH) Investors?

Reviewed by Sasha Jovanovic

- Bread Financial Holdings announced it will discuss its third quarter 2025 results during a conference call and webcast that occurred on October 23, 2025, after continued strong earnings surprises in the previous two quarters.

- Recent analyst sentiment remains upbeat, with indicators such as a positive Earnings ESP and insiders purchasing shares, reflecting heightened anticipation around the company’s consistent trend of outperforming earnings estimates.

- We'll explore how anticipation of another earnings beat could influence the company's investment narrative and future growth expectations.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bread Financial Holdings Investment Narrative Recap

To see value in Bread Financial Holdings, you need confidence in the company’s ongoing digital investments and new card partnerships to deliver improved earnings, even with modest loan growth and revenue guidance for 2025. The upcoming Q3 2025 earnings report is the most important short-term catalyst, as a further earnings beat could reinforce positive sentiment, a risk remains that slowing consumer lending or worsening credit quality could quickly reverse recent momentum. The latest news does not materially change these fundamentals, but eyes are on credit trends, as even minor deterioration could weigh heavily on profitability.

Among recent announcements, Bread Financial’s new $200 million share repurchase program stands out given the upcoming earnings report, signaling a commitment to returning capital to shareholders. This move comes as the company faces stubbornly high bad loan ratios, making continued buybacks compelling for shareholders but also introducing debate over capital allocation priorities in light of current credit risks.

In contrast, investors should be closely watching for signs that rising credit losses might start to affect not only near-term results, but...

Read the full narrative on Bread Financial Holdings (it's free!)

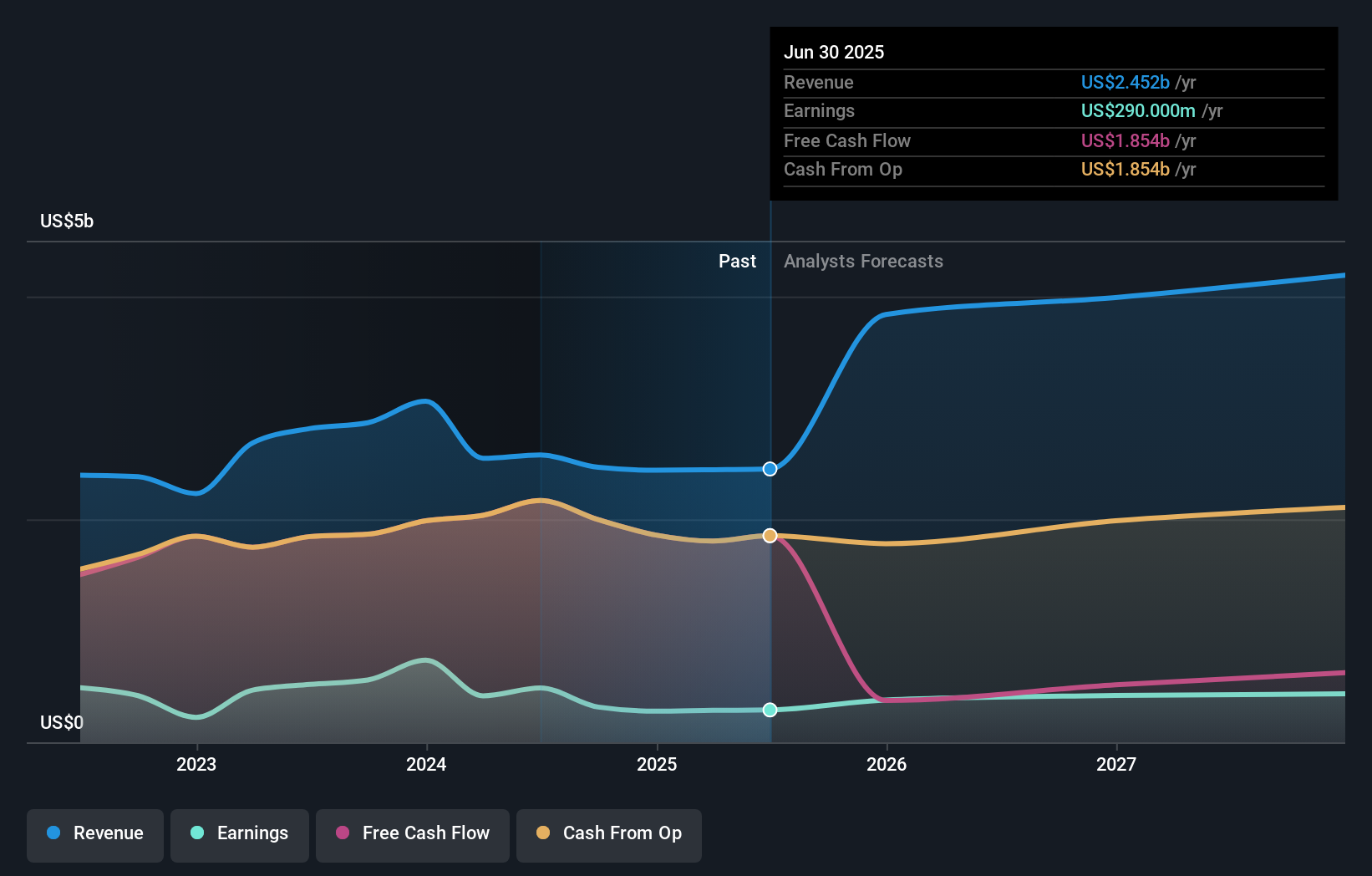

Bread Financial Holdings' narrative projects $4.3 billion in revenue and $379.5 million in earnings by 2028. This requires 20.3% yearly revenue growth and a $89.5 million earnings increase from the current $290.0 million.

Uncover how Bread Financial Holdings' forecasts yield a $69.40 fair value, a 28% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for Bread Financial Holdings range from US$59.00 to US$69.40 across two perspectives. As you weigh these opinions, remember that flat to declining loan growth could affect the company's ability to close the gap between intrinsic value and market price.

Explore 2 other fair value estimates on Bread Financial Holdings - why the stock might be worth just $59.00!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives