- United States

- /

- Capital Markets

- /

- NYSE:BEN

Franklin Resources (BEN): Assessing Valuation After Sector Rally Triggered by Powell’s Jackson Hole Comments

Reviewed by Simply Wall St

The latest surge in Franklin Resources (BEN) has likely grabbed the attention of investors watching for shifts in the financial sector. The catalyst behind this move was Fed Chair Jerome Powell’s unexpectedly dovish speech at the Jackson Hole symposium, where he acknowledged the possibility of upcoming interest rate cuts. While Franklin Resources itself did not announce any transformative company news, Powell’s remarks kickstarted a broad relief rally in financial stocks, including BEN.

This positive momentum arrives after an already strong year for the stock. Over the past year, Franklin Resources has delivered a 30% total return, with much of the acceleration coming in the last three months. The sector-wide optimism follows recent product launches, such as the expansion of Franklin's Canadian ETF lineup. However, it has been the changing interest rate outlook rather than company-specific news that has driven the biggest price moves lately.

After such a run, some investors are questioning whether there is real value left for new buyers in Franklin Resources, or if the rally has already priced in the best-case scenario for future growth.

Most Popular Narrative: Fairly Valued

According to community narrative, Franklin Resources is currently fairly valued based on analyst forecasts that balance recent earnings growth against forward-looking risks and opportunities.

The company is actively expanding its presence in non-U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia. This positions Franklin Resources to benefit from rising global wealth and the increasing allocation of institutional capital worldwide. These factors are likely to support future AUM growth and top-line revenue expansion.

What powers this fair value call? There is a bold growth strategy highlighted in the numbers, built on international expansion, product innovation, and significant profit margin forecasts. Curious about the forecasted changes in earnings and how they influence the price target? Explore further to see which unique projections distinguish this valuation.

Result: Fair Value of $25 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent client outflows and ongoing fee compression could challenge the outlook and potentially limit Franklin Resources’s ability to meet growth expectations.

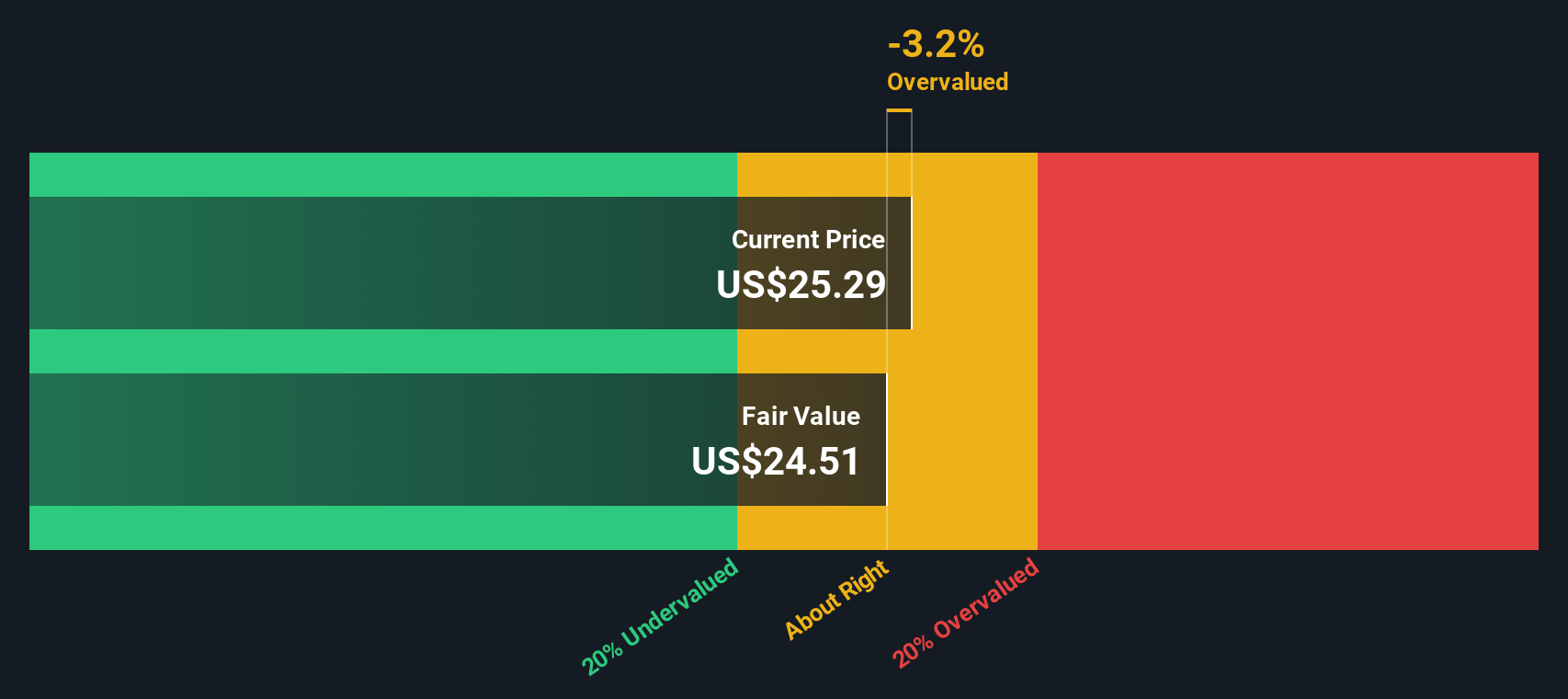

Find out about the key risks to this Franklin Resources narrative.Another View: SWS DCF Model Suggests Overvaluation

Looking at Franklin Resources through the lens of our DCF model, we get a different perspective. This method currently suggests the stock could be overvalued. Does this signal caution, or is the market seeing something analysts have missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Franklin Resources Narrative

If you want to dig deeper or see things from another angle, you can quickly build your own perspective and uncover insights in just minutes. You can also do it your way.

A great starting point for your Franklin Resources research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not let opportunity pass you by. The market is filled with possibilities beyond Franklin Resources. Use the Simply Wall Street Screener to target companies with strong trends, undiscovered potential, or unique growth drivers. Start broadening your watchlist with a few of these powerful ideas today:

- Boost your income potential as you hunt for established businesses offering attractive yields with dividend stocks with yields > 3%.

- Position yourself at the forefront of innovation by backing exciting firms transforming healthcare with artificial intelligence using healthcare AI stocks.

- Unleash growth by tracking companies at the intersection of finance and the next wave in digital technology through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEN

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives