- United States

- /

- Capital Markets

- /

- NYSE:BEN

Franklin Resources (BEN): Assessing Valuation After Analyst Upgrade, Apera Deal, and New Product Launches

Reviewed by Kshitija Bhandaru

Franklin Resources (NYSE:BEN) attracted attention after BMO Capital started coverage with an Outperform rating. At the same time, the firm completed its acquisition of Apera Asset Management and introduced tax aware long-short strategies on its Canvas platform.

See our latest analysis for Franklin Resources.

Franklin Resources has kept investors on their toes in 2025, as new product launches and strategic acquisitions have stoked optimism even amid net outflows from parts of the business. While this acceleration in assets under management and ongoing innovation have supported the share price, momentum has cooled lately, and the stock’s longer-term growth story is reflected in its 1-year total shareholder return of 0.26% and a 5-year total return of 28.2%.

If shifts in financial services have sparked your curiosity, it is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

So with analyst views still split but Franklin Resources trading nearly 20 percent below some price targets, the question is whether the lingering discount signals an opportunity for value seekers, or if future growth is already factored into the price.

Most Popular Narrative: 8.9% Undervalued

With the latest fair value estimate set at $25.45 against a closing price of $23.18, current sentiment points to meaningful upside from here. This widely followed narrative highlights Franklin Resources' global reach and strategic innovation as key drivers of valuation.

The company is actively expanding its presence in non-U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia. This positions Franklin Resources to benefit from the rising global wealth and the increasing allocation of institutional capital worldwide. This is expected to support future AUM growth and top-line revenue expansion.

Curious? There’s one assumption hiding behind this bullish view that could make all the difference. Is it about relentless revenue growth, soaring profit margins, or something surprising? The backbone of this fair value is a projection you won’t want to miss. Ready to see what really sets Franklin’s valuation apart?

Result: Fair Value of $25.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing net outflows and persistent fee pressure could undermine confidence in the upside case if these trends do not improve soon.

Find out about the key risks to this Franklin Resources narrative.

Another View: Are the Numbers Really That Compelling?

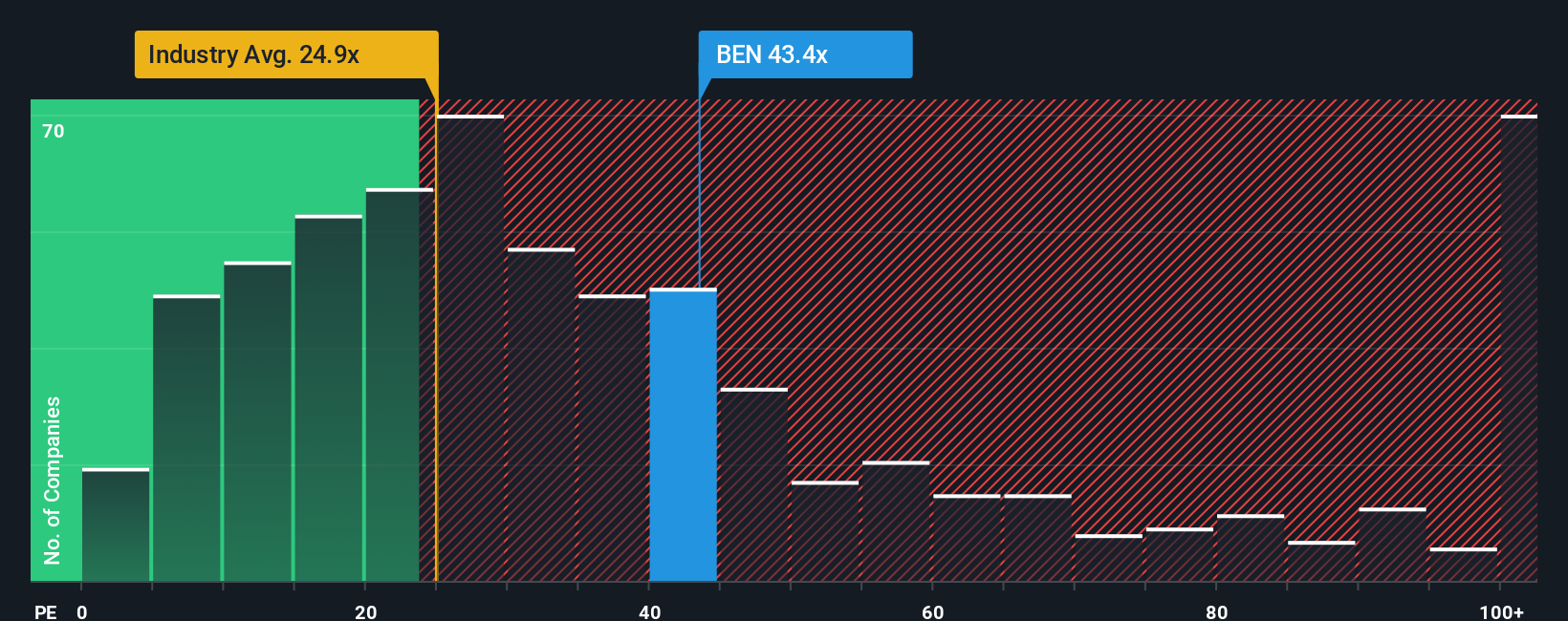

Looking at share price through a different lens, Franklin Resources currently trades at a price-to-earnings ratio of 44.4x, which is significantly higher than both the US industry average of 27.1x and the average among close peers at 17.5x. However, regression analysis suggests a fair ratio of just 18.9x. This points to a valuation that could face pressure if market sentiment turns. Does this mean the stock is riding too high on hope, or could improving fundamentals justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Resources Narrative

Prefer a hands-on approach or want to chart your own path through the numbers? You can craft a personal Franklin Resources narrative in just minutes, and Do it your way.

A great starting point for your Franklin Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more potential by putting the Simply Wall Street Screener to work for you. You’ll want to be ahead of the curve with these:

- Tap into tomorrow’s breakthroughs by checking out these 25 AI penny stocks that are set to shape the rapidly evolving world of artificial intelligence.

- Boost your portfolio’s income with these 19 dividend stocks with yields > 3% which offers strong yields and a history of reliable payouts.

- Stay at the forefront of finance by examining these 78 cryptocurrency and blockchain stocks as it transforms the future of payments and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEN

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives