- United States

- /

- Capital Markets

- /

- NYSE:BEN

Assessing Franklin Resources’s Valuation After BMO Capital’s Positive Analyst Initiation and Alternative Investments Expansion

Reviewed by Kshitija Bhandaru

Franklin Resources (NYSE:BEN) has caught investor attention after BMO Capital Markets began coverage with a positive outlook. The firm highlighted the company’s strong core business and growing expansion into alternative investments.

See our latest analysis for Franklin Resources.

Franklin Resources has drawn new interest as it pushes deeper into alternatives and completes more strategic transactions, signaling confidence in future growth. While the share price has pulled back from recent highs and dipped 6% over the past month, its year-to-date price return of 13% is still outperforming many peers. Meanwhile, the 1-year total shareholder return stands at an impressive 17.8%, highlighting steady long-term momentum even as short-term sentiment remains mixed.

If this uptick in value and renewed investor focus has you curious, now is a great time to discover fast growing stocks with high insider ownership.

With solid value metrics, steady dividend growth, and expanding alternative investments, does Franklin Resources still offer investors a bargain at current levels? Or has the market already accounted for its next leg of growth?

Most Popular Narrative: 10% Undervalued

The most closely followed narrative places Franklin Resources’ fair value at $25.45, just above the last close of $22.79, sparking renewed debate on whether the current price fully reflects future catalysts and growth drivers.

The company is actively expanding its presence in non-U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia. This positions Franklin Resources to benefit from the rising global wealth and the increasing allocation of institutional capital worldwide. This is likely to support future AUM growth and top-line revenue expansion.

Curious about what really powers this optimistic view? It all hinges on a blend of transformative market moves, bold profit projections, and a dramatic shift in earnings quality. Want to uncover the key numbers and expectations that shape this projected valuation? You will not believe what is driving the forecast. Dive into the full narrative to see exactly how the future could unfold.

Result: Fair Value of $25.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net outflows or the ongoing squeeze on fees could quickly derail current growth expectations for Franklin Resources in the quarters ahead.

Find out about the key risks to this Franklin Resources narrative.

Another View: Market Multiples Raise a Warning

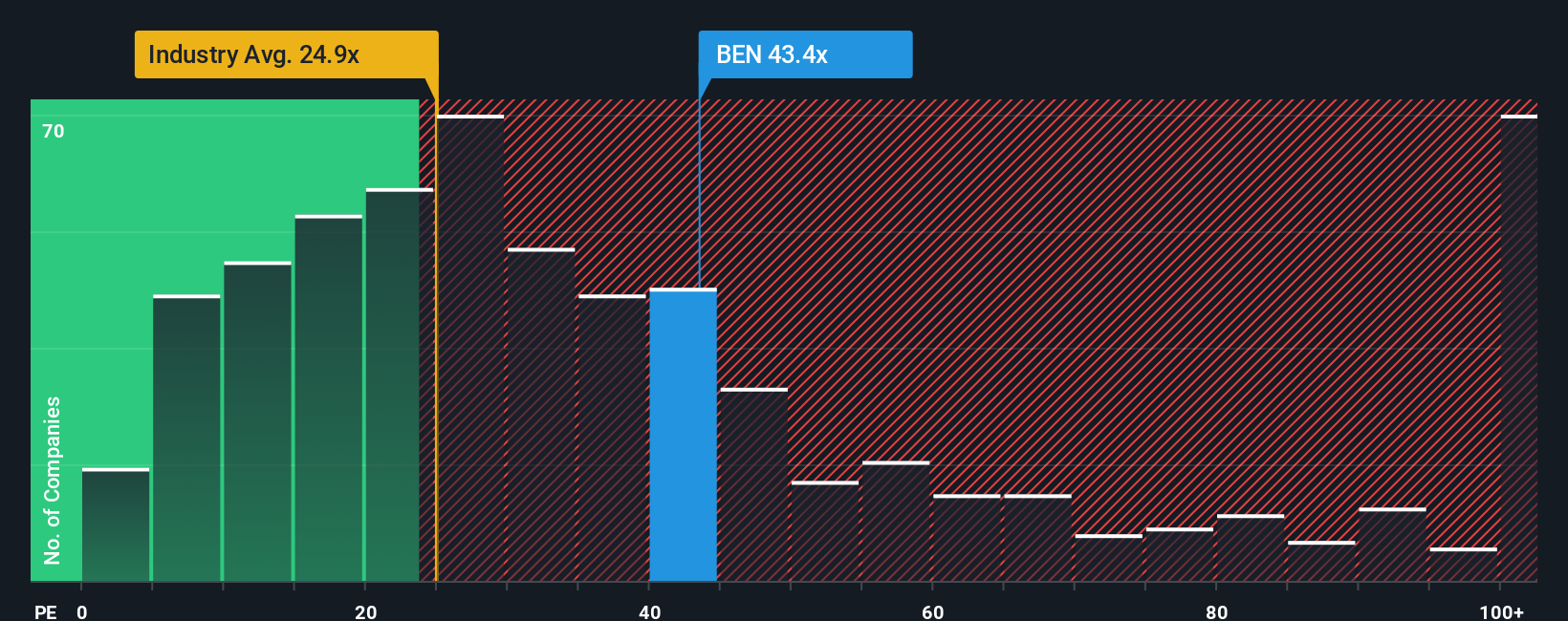

While some see Franklin Resources as undervalued, a quick look at its price-to-earnings ratio shows a different story. The company’s P/E stands at 43.7x, which is much higher than the industry average of 25.8x, its peer average at 17.1x, and the fair ratio of 18.9x. That premium signals real valuation risk if expectations are not met. Will the market continue to reward such a rich multiple or is a correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Resources Narrative

If you are eager to dig into the data and shape your own opinion instead of following the consensus, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Franklin Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to find hidden gems or untapped opportunities? Put the power of the Simply Wall Street Screener to work and don’t let the market’s next big story pass you by.

- Capture income potential by targeting companies with outstanding yields using these 18 dividend stocks with yields > 3% for reliable cash flows and steady performance.

- Spot tomorrow’s tech leaders and unlock growth by searching these 24 AI penny stocks that focus on artificial intelligence innovation and disruption.

- Pinpoint true value and gain an edge by filtering for these 874 undervalued stocks based on cash flows that are trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEN

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives