- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Will American Express' (AXP) Focus on Premium Experiences Sustain Its Competitive Edge?

Reviewed by Sasha Jovanovic

- American Express recently announced the upcoming retirement of Vice Chairman Doug Buckminster in March 2026 and reaffirmed its regular quarterly dividend of US$0.82 per common share, payable this November.

- At the same time, the company has received top rankings in customer satisfaction and introduced new product and digital initiatives, highlighting its ongoing focus on premium experiences and innovation in the competitive payments space.

- We'll explore how American Express's strengthened customer satisfaction rankings and product enhancements may shape its broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American Express Investment Narrative Recap

To be a shareholder in American Express, you need confidence in its continued appeal to premium cardmembers, effective product enhancements, and strong brand reputation, which drive long-term growth through customer retention and net card fee expansion. The recent announcement of Vice Chairman Doug Buckminster’s upcoming retirement is not expected to materially influence near-term catalysts or change the biggest current risk: intensifying competition in the premium card segment, which pressures margins and customer acquisition costs.

Perhaps most relevant to these developments is the company’s reaffirmed quarterly dividend of US$0.82 per share, signaling financial resilience and commitment to shareholder returns. This action aligns with American Express’s capital discipline but does not directly affect short-term catalysts like the upcoming U.S. Platinum Card relaunch or ease risks from competitors refreshing their premium offerings.

Yet, beneath these headlines, investors should also be mindful of how alternative digital payments could shift spending habits...

Read the full narrative on American Express (it's free!)

American Express' outlook anticipates $85.7 billion in revenue and $13.5 billion in earnings by 2028. This reflects a 10.6% yearly revenue growth and a $3.5 billion earnings increase from $10.0 billion currently.

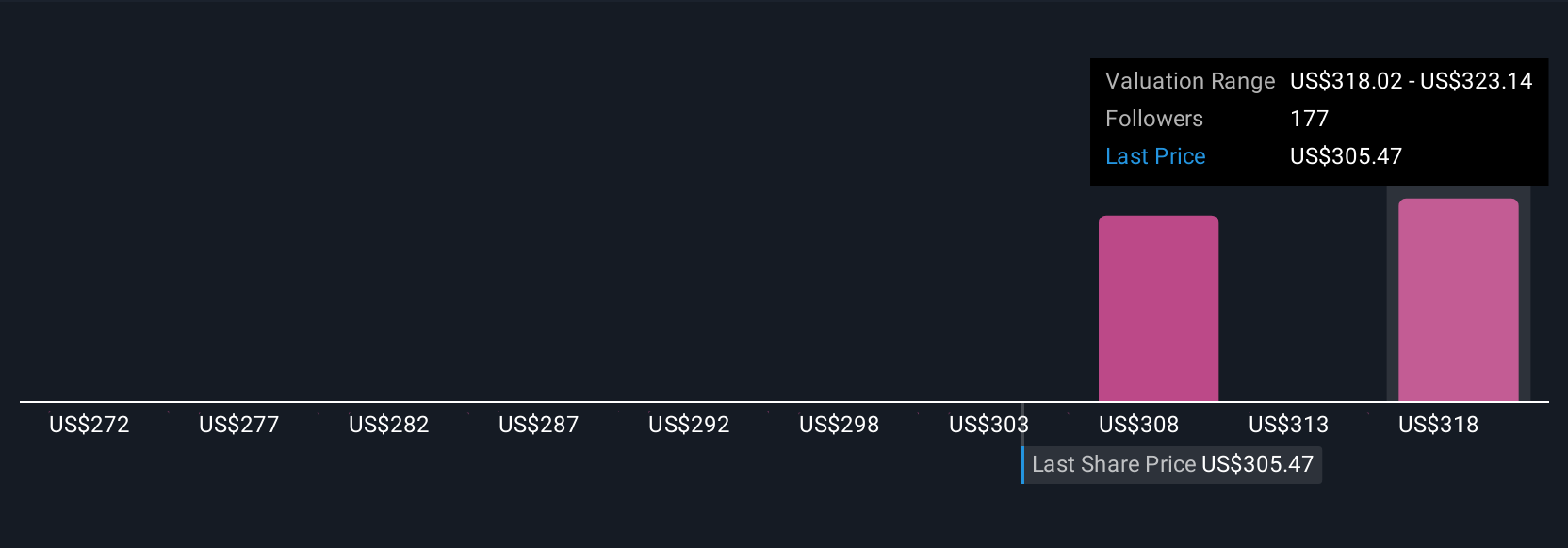

Uncover how American Express' forecasts yield a $329.62 fair value, in line with its current price.

Exploring Other Perspectives

The most optimistic analysts were forecasting American Express to reach US$85 billion in revenue and US$14.7 billion in earnings by 2028, but opinions diverge sharply, some see big gains from tech investments and global expansion, while others caution that digital disruption may be underestimated. Consider the full picture, as new developments could prompt a reassessment of these expectations.

Explore 11 other fair value estimates on American Express - why the stock might be worth as much as 10% more than the current price!

Build Your Own American Express Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Express research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Express' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives