- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Stability, not Growth may be Keeping the Price Up for the American Express Company (NYSE:AXP)

American Express Company (NYSE:AXP) has been keeping up steady stock performance and in the last 5 years the stock is up 125% just on price increase, but closer to 150% if we include dividends. In this article, we will go over the earnings performance, implied valuation and see what analysts are expecting from the company in the next few years.

View our latest analysis for American Express

Earnings & Outlook

The company released earnings last week, here are the highlights:

- Q1 revenues were US$12b, up 21% from Q1 2021

- Net income came at US$2.07b, down 6.2% from Q1 2021

- EPS of US$2.73 were also better than expected, beating analyst predictions by 11%

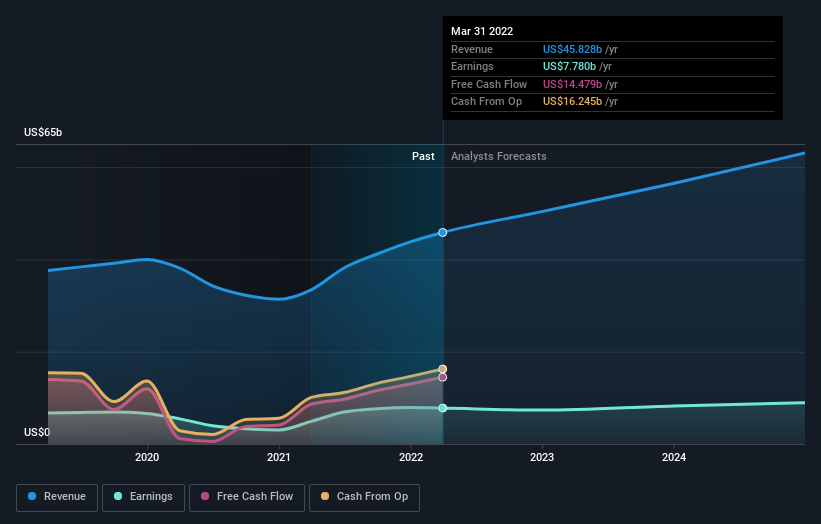

By looking at future analyst estimates, we can see if the company has further growth potential. It seems that revenues are expected to rise, however investor's earnings are expected to maintain roughly current levels.

Taking into account the latest results, the current consensus from American Express' 20 analysts is for revenues of US$50.3b in 2022, which would reflect a decent 9.8% increase in its sales over the past 12 months. Management also reaffirmed their outlook and posts revenue growth guidance between 18% and 20% for 2022 - equating to US$52b, slightly above analysts' estimates for 2022.

Earnings per share are expected to dip 5.6% to US$9.75 in the same period. On a net income basis, analysts are expecting US$7.359b in 2023, US$8.25b in 2024 and US$8.924b.

Valuation

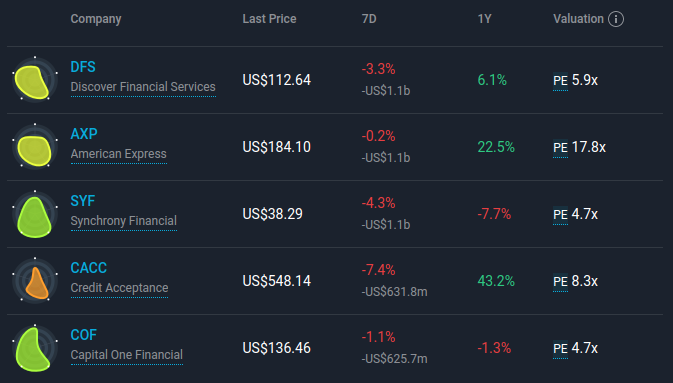

Given that the expected future earnings are stable, a Price to Earnings (PE) ratio may be an appropriate way with which we can compare how much the market is paying for every dollar in earnings.

For American Express, the trailing (historical) PE is 17.8x. Considering that earnings are relatively stable, we can use estimates and compute a forward PE of 18.27x. This implies that the stock may get more expensive as investors are not projecting to see enough earnings growth.

One can always value a stock on an intrinsic basis as well, and our general DCF valuation model can give investors a great baseline when thinking about the future of American Express.

A shortcut to this, which only applies if a company has stable future earnings, is to take the future earnings estimate (US$7.351b), and divide it by the current enterprise risk premium for the market (5%), giving us a stable growth intrinsic value of:

US$7.351b / 0.05 = US$147.2b

The stock has a market cap of US$134.5b, implying that it is slightly undervalued by 9%. You can compare this with our more detailed DCF.

The current relative valuation might be somewhat high if investors consider that the market PE is 16.8x, however the Consumer Finance industry PE is 6x, implying either that the company is overvalued or that very low growth is expected in this industry in the future. Notably, the industry PE has dropped below the 3Y average 8.1x PE, indicating a negative shift in momentum for this industry.

Investors can also use our industry analysis to compare top gainers and losers on key metrics:

Conclusion

American Express is continuing solid performance with expected business expansion and revenue growth. The bottom line is forecasted to slump in 2023, but the company should maintain a stable level of earnings.

This sets it apart from industry peers on a PE basis, as risk reduction seems to play a role in keeping the price up, rather than high forecasted earnings.

The company has driven stable returns over the years and is a high performing stock, however it seems that earnings might not be keeping up with the overall growth in the stock price.

With that in mind, we wouldn't be too quick to come to a conclusion on American Express. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple American Express analysts - going out to 2024, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with American Express .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives