- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Evaluating American Express (AXP) After Analyst Earnings Downgrades and a Pre-Results Share Price Pullback

Reviewed by Simply Wall St

American Express (AXP) slipped more than the broader market after analysts trimmed earnings estimates ahead of its next results, even as Wall Street still expects roughly 18% EPS growth and about 10% revenue expansion.

See our latest analysis for American Express.

Even with the latest dip, American Express is still trading near $371.15, and that kind of resilience lines up with its roughly mid teens 90 day share price return and powerful multi year total shareholder returns. This suggests that momentum remains firmly intact.

If this sort of established growth story has you thinking about what else might be out there, it could be worth exploring fast growing stocks with high insider ownership next.

With the stock already trading above the average analyst target and pricing in strong double digit growth, the key question now is whether American Express still offers upside for new buyers or if the market has already baked in its future gains.

Most Popular Narrative: 5.5% Overvalued

With American Express last closing at $371.15 against a narrative fair value of about $351.87, the story leans toward a premium pricing outlook.

Capital discipline and strong returns on equity, alongside significant shareholder returns via dividends and buybacks, provide financial flexibility to continue investing in network, product enhancements, and partnerships, enhancing long-term growth prospects for both revenue and EPS.

Want to see why steady margins, accelerating revenue, and shrinking share count could justify a rich future multiple? The narrative stitches these assumptions into one bold valuation roadmap. Curious which financial levers matter most, and how long they need to hold up to support that price tag? Dive in to see the full playbook.

Result: Fair Value of $351.87 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in premium cards and shifting payment habits toward mobile wallets and BNPL could squeeze margins and challenge American Express's growth assumptions.

Find out about the key risks to this American Express narrative.

Another Angle on Valuation

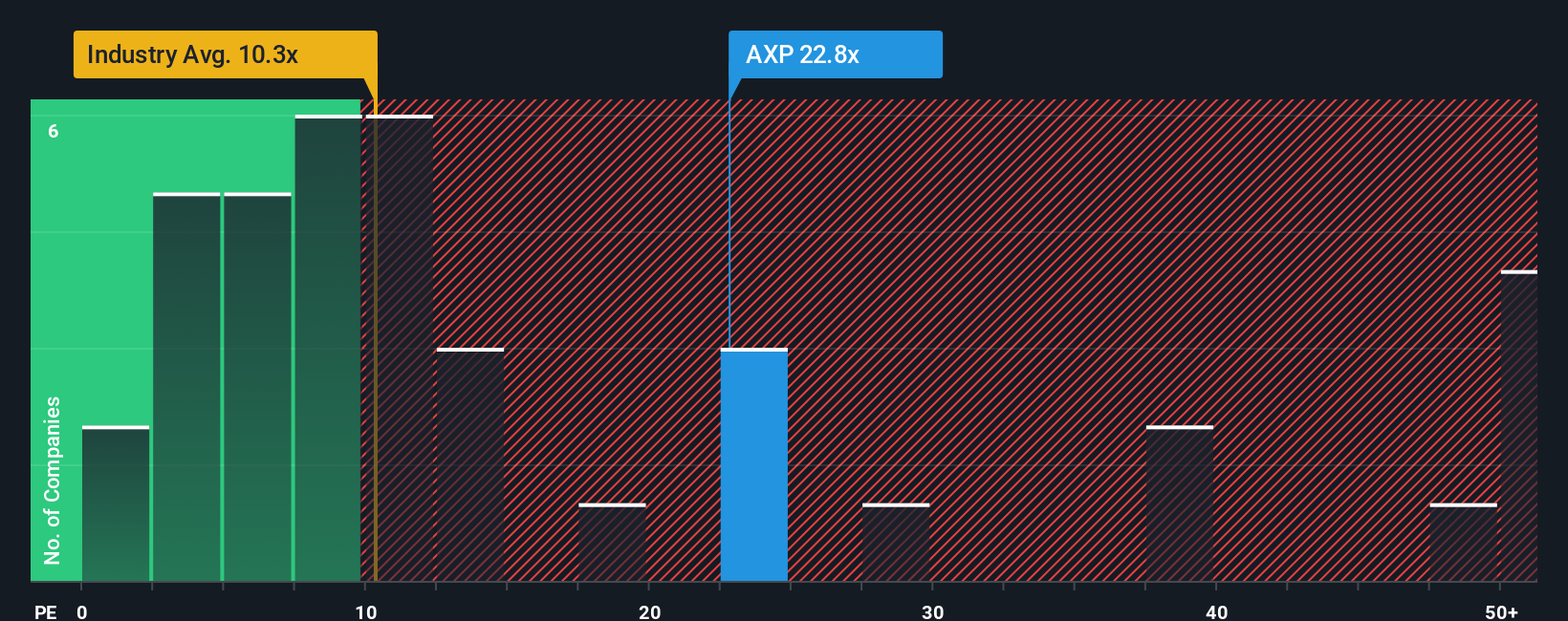

Analysts see American Express as good value against peers at a 24.6x P E ratio versus 25.3x, but that looks rich beside the Consumer Finance industry at 10.1x and a fair ratio of 19.8x. Is the premium a moat worth paying for or a risk building quietly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Express Narrative

If you see the outlook differently or simply want to dig into the numbers yourself, you can build a personalized view in just a few minutes using Do it your way.

A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street to work and secure a few fresh, data driven ideas that could reshape your portfolio’s next decade.

- Turbocharge your hunt for value by targeting companies trading below their intrinsic worth using these 909 undervalued stocks based on cash flows backed by detailed cash flow analysis.

- Strengthen your income stream by focusing on reliable payers with attractive yields using these 15 dividend stocks with yields > 3% built around dividend staying power.

- Capitalize on the digital finance shift by tracking innovators shaping blockchain infrastructure and payment rails via these 81 cryptocurrency and blockchain stocks before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026