- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (NYSE:AXP) Faces Shareholder Proposal To Reassess Executive Pay Guidelines

Reviewed by Simply Wall St

American Express (NYSE:AXP) experienced a 2% increase in its share price last week, a period during which investor activism emerged as a focal point following the National Legal and Policy Center's call for changes in executive compensation. This move aligns with broader market dynamics, where uncertainty over trade tariffs exerted downward pressure on indices like the Dow Jones, hindering potential broader gains. Despite a flat market performance overall, American Express's proactive stance on shareholder proposals might have momentarily buoyed investor sentiment, contributing to a positive price movement for the company amidst complex market conditions.

American Express has 2 risks we think you should know about.

Over the past five years, American Express experienced a remarkable total return of 279.39%, reflecting significant growth. During this period, the company focused on enhancing customer engagement through acquisitions of Tock and Rooam, and a partnership with Formula 1. This effort to appeal to Millennials and Gen Z was complemented by strategic expansions in international markets. Notably, the collaboration with Alipay, launched in February 2025, aimed at facilitating payment solutions for international travelers in China, further highlighted its commitment to expanding its global footprint.

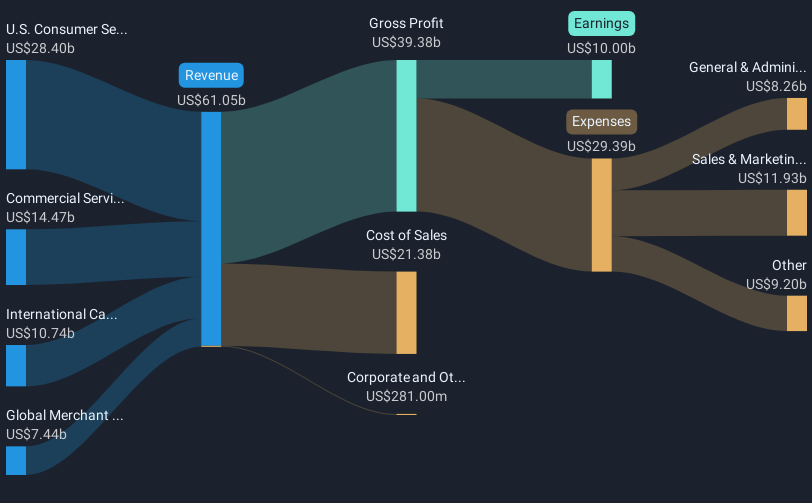

In terms of financial maneuvering, American Express reported robust earnings growth, with its net income showing a notable increase year-over-year as of January 2025. This was supported by strategic adjustments in capital structure through the issuance of $1.45 billion in fixed-to-floating rate notes and an increased quarterly dividend, underscoring its dedication to shareholder value. Over the past year, American Express matched the Consumer Finance industry's return, affirming its strong competitive positioning.

Evaluate American Express' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American Express, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives