- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (NYSE:AXP) Announces US$9 Preferred Dividend for Series D Shareholders

Reviewed by Simply Wall St

American Express (NYSE:AXP) recently declared a quarterly dividend on its preferred shares, a decision that aligns with its steady financial strategies. Last week, the company's shares remained flat, coinciding with a broader market rally spurred by optimistic employment data and potential trade talks between the U.S. and China. While the dividend announcement could enhance shareholder value, the market's overall positive sentiment was primarily driven by larger macroeconomic events. Additionally, American Express's recent debt financing activities indicate a proactive approach in managing capital structure, potentially supporting future growth opportunities.

We've identified 1 possible red flag for American Express that you should be aware of.

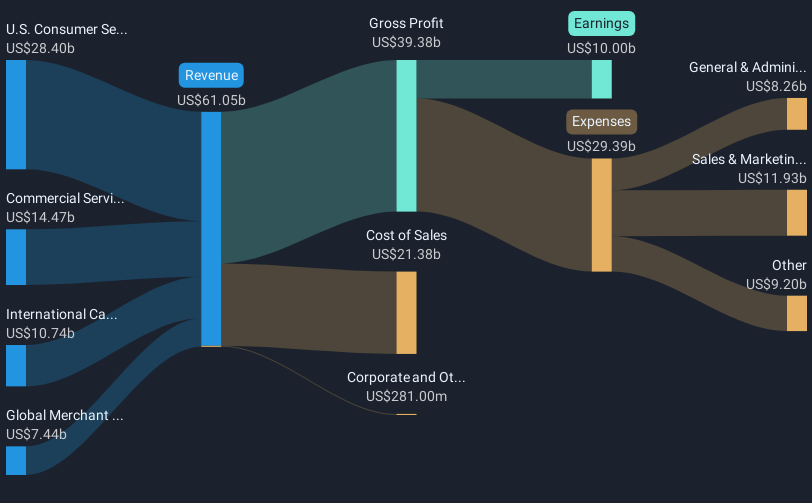

American Express's recent quarterly dividend announcement for its preferred shares aligns with its strategy to maintain stable financial management. This move, despite its limited effect on AXP's share price during the broader market rally, could further solidify investor confidence. Over the last five years, the company's total shareholder return was an astounding 230.56%, demonstrating its capacity to generate value over the long term. Comparing the company's performance to the market, while AXP's shares exceeded the US market's 9.5% return over one year, they underperformed the US Consumer Finance industry's 18.6% one-year return.

The challenge going forward relates to American Express's revenue and earnings forecasts, especially considering pressures on airline and entertainment spending that could affect growth expectations. These challenges, outlined in the analysis, highlight the need for the company to balance rising reward expenses with slow revenue growth in certain areas. The precision in managing costs and leveraging a diversified revenue base will be critical. With a current share price near US$260.14, the market's valuation aligns closely with bearish analyst sentiment, which places a price target of US$248.77. This reflects a relatively small difference and implies a belief among some analysts that potential risks might already be priced in.

Evaluate American Express' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American Express, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives