- United States

- /

- Banks

- /

- NasdaqCM:PKBK

Undiscovered Gems Parke Bancorp and Two Promising Small Caps to Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a significant rise of 38% over the past 12 months, with earnings forecasted to grow by 15% annually. In such dynamic conditions, identifying good stocks often involves looking beyond well-known names to uncover smaller companies like Parke Bancorp that have strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Parke Bancorp (NasdaqCM:PKBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Parke Bancorp, Inc. is the bank holding company for Parke Bank, offering personal and business financial services to individuals and small to mid-sized businesses, with a market cap of $254.52 million.

Operations: Parke Bancorp generates revenue primarily from its community banking segment, amounting to $63.15 million. The company's net profit margin reflects its profitability dynamics in the financial services sector.

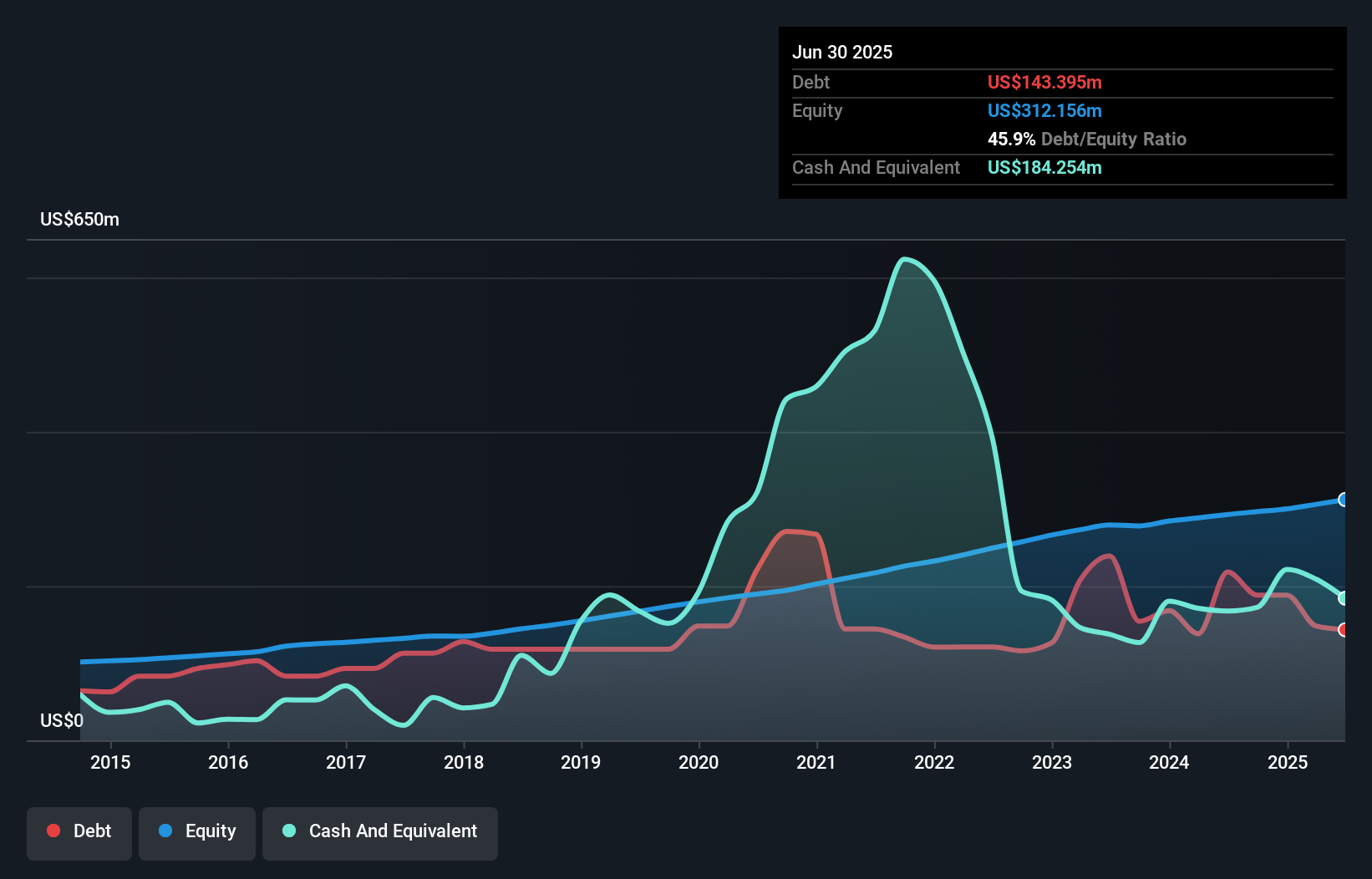

Parke Bancorp, a smaller player in the banking sector, showcases strong financial health with total assets of US$2.1 billion and equity of US$296.5 million. Primarily funded by low-risk customer deposits, it has a net interest margin of 3.3%. The company maintains an appropriate bad loan ratio at 0.7% and a robust allowance for bad loans at 265%. Despite recent negative earnings growth (-8%), its valuation seems attractive as it trades significantly below estimated fair value. Recent announcements include a share repurchase program and consistent dividend payouts, highlighting its commitment to shareholder returns.

- Get an in-depth perspective on Parke Bancorp's performance by reading our health report here.

Examine Parke Bancorp's past performance report to understand how it has performed in the past.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that provides nuclear fuel components and services to the nuclear power industry globally, with a market capitalization of approximately $1.61 billion.

Operations: Centrus Energy generates revenue primarily from its Low-Enriched Uranium (LEU) segment, contributing $320.80 million, and Technical Solutions, which adds $71.80 million. The company's net profit margin or gross profit margin is not provided in the available data.

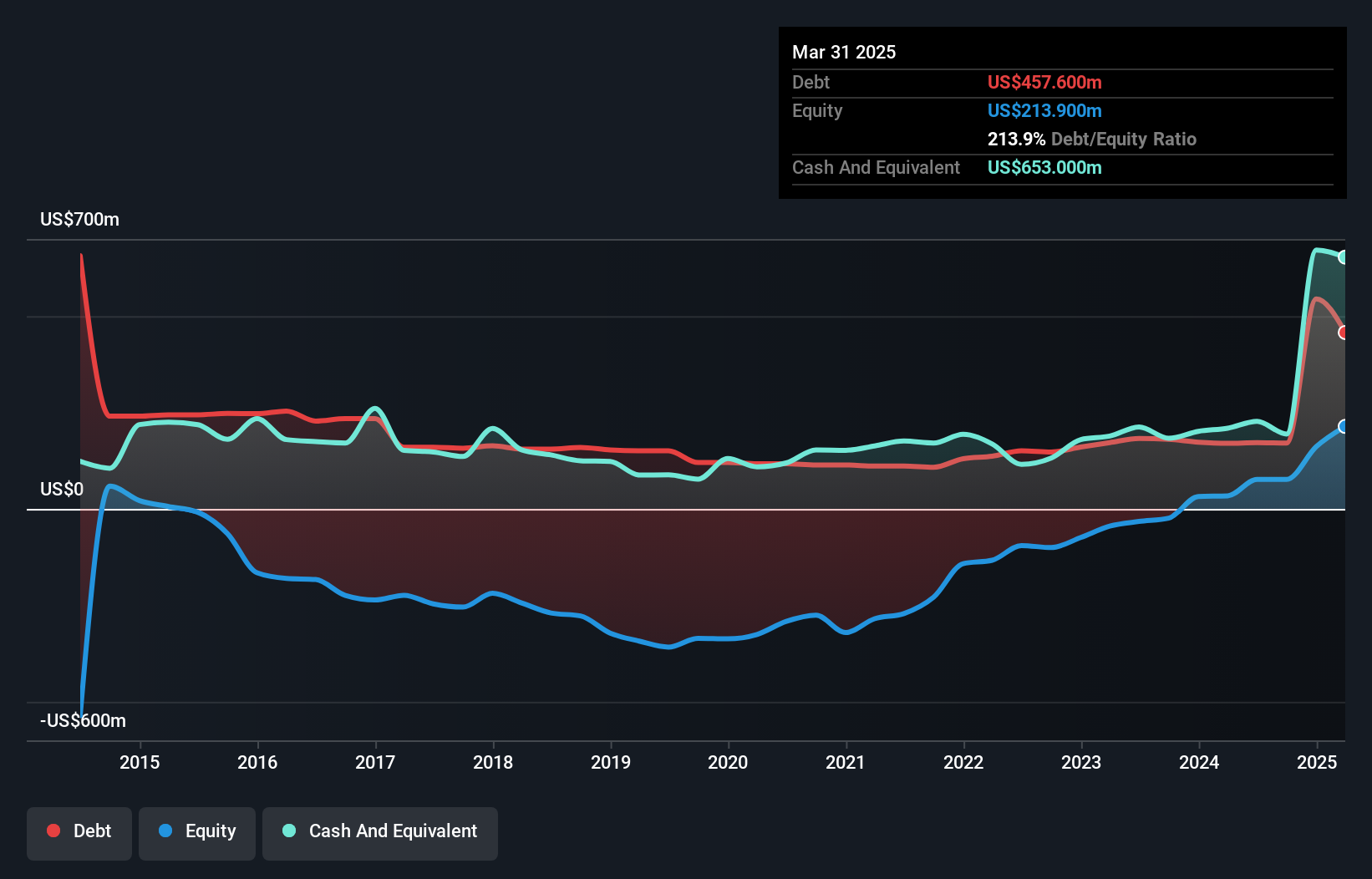

Centrus Energy, a player in the nuclear fuel sector, has shown impressive earnings growth of 164.9% over the past year, outpacing its industry by a wide margin. The company reported net income of US$30.6 million for Q2 2024, significantly up from US$12.7 million last year, with basic earnings per share rising to US$1.89 from US$0.84. Despite its high-quality earnings and trading at 42% below estimated fair value, Centrus faces challenges like shareholder dilution and significant insider selling recently observed over the past three months while maintaining more cash than total debt indicates financial stability amidst volatility concerns.

- Dive into the specifics of Centrus Energy here with our thorough health report.

Gain insights into Centrus Energy's past trends and performance with our Past report.

ASA Gold and Precious Metals (NYSE:ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market capitalization of $431.52 million.

Operations: ASA Gold and Precious Metals Limited generates revenue primarily through investment management activities. The company operates with a market capitalization of $431.52 million, focusing on the gold and precious metals sector.

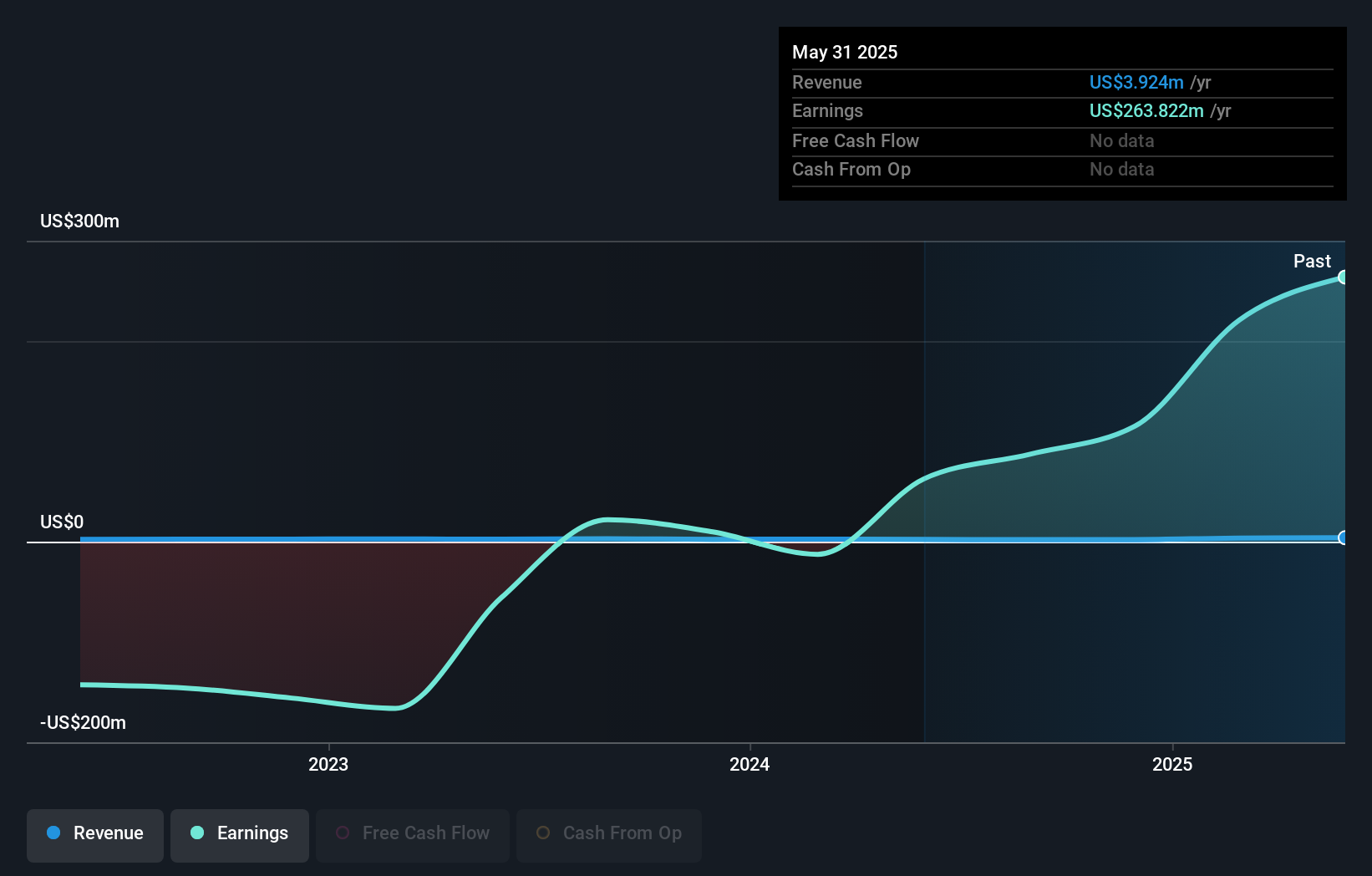

ASA Gold and Precious Metals, a smaller player in the precious metals sector, recently reported a net income of US$91.18 million for nine months ending August 2024, significantly influenced by a one-off gain of US$91.3 million. The company has seen an impressive earnings growth rate of 299% over the past year, far outpacing the industry average of 17.9%, but faces challenges with declining earnings at an annual rate of 35.9% over five years. With no debt on its books for five years and a low price-to-earnings ratio of 4.9x compared to the market's 18.7x, ASA appears undervalued yet lacks substantial revenue streams beyond US$2 million annually.

Make It Happen

- Dive into all 226 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Parke Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PKBK

Parke Bancorp

Operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives