- United States

- /

- Software

- /

- NasdaqGS:NBIS

3 Promising Growth Companies With Insider Ownership Up To 37%

Reviewed by Simply Wall St

As U.S. markets experience a mixed performance with the Nasdaq and S&P 500 slipping while the Dow Jones edges higher, investors are keenly observing how Federal Reserve policies and major corporate partnerships impact broader market dynamics. In this environment, growth companies with significant insider ownership can be particularly appealing, as insider stakes often signal confidence in the company's long-term potential amidst fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.3% | 62.8% |

| Hippo Holdings (HIPO) | 14.0% | 41.2% |

| Hesai Group (HSAI) | 15.5% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.3% | 33% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

Let's review some notable picks from our screened stocks.

Niu Technologies (NIU)

Simply Wall St Growth Rating: ★★★★★★

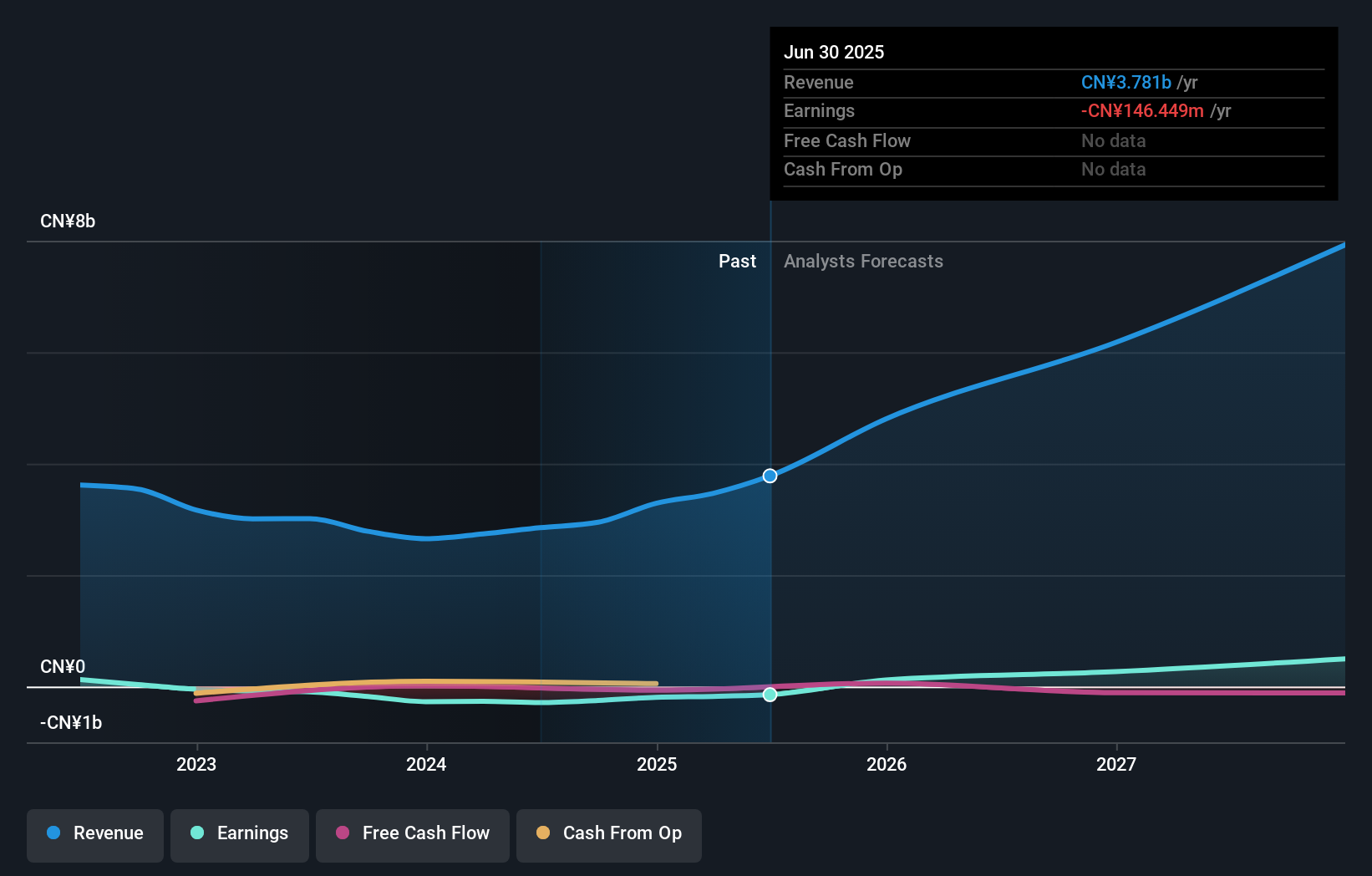

Overview: Niu Technologies designs, manufactures, and sells electric scooters in China, Europe, and internationally with a market cap of $336.02 million.

Operations: The company's revenue primarily comes from its electric scooter segment, which generated CN¥3780.77 million.

Insider Ownership: 37.2%

Niu Technologies is experiencing robust growth, with revenue forecasted to increase 28.4% annually, outpacing the US market. The company has seen substantial insider buying recently, indicating confidence in its future prospects. Niu's earnings are expected to grow 92.78% per year, with profitability anticipated within three years, surpassing average market growth rates. Recent earnings reports show improved financial performance and increased sales volumes year-over-year, supporting positive revenue guidance for the upcoming quarter.

- Take a closer look at Niu Technologies' potential here in our earnings growth report.

- The analysis detailed in our Niu Technologies valuation report hints at an deflated share price compared to its estimated value.

Nebius Group (NBIS)

Simply Wall St Growth Rating: ★★★★★☆

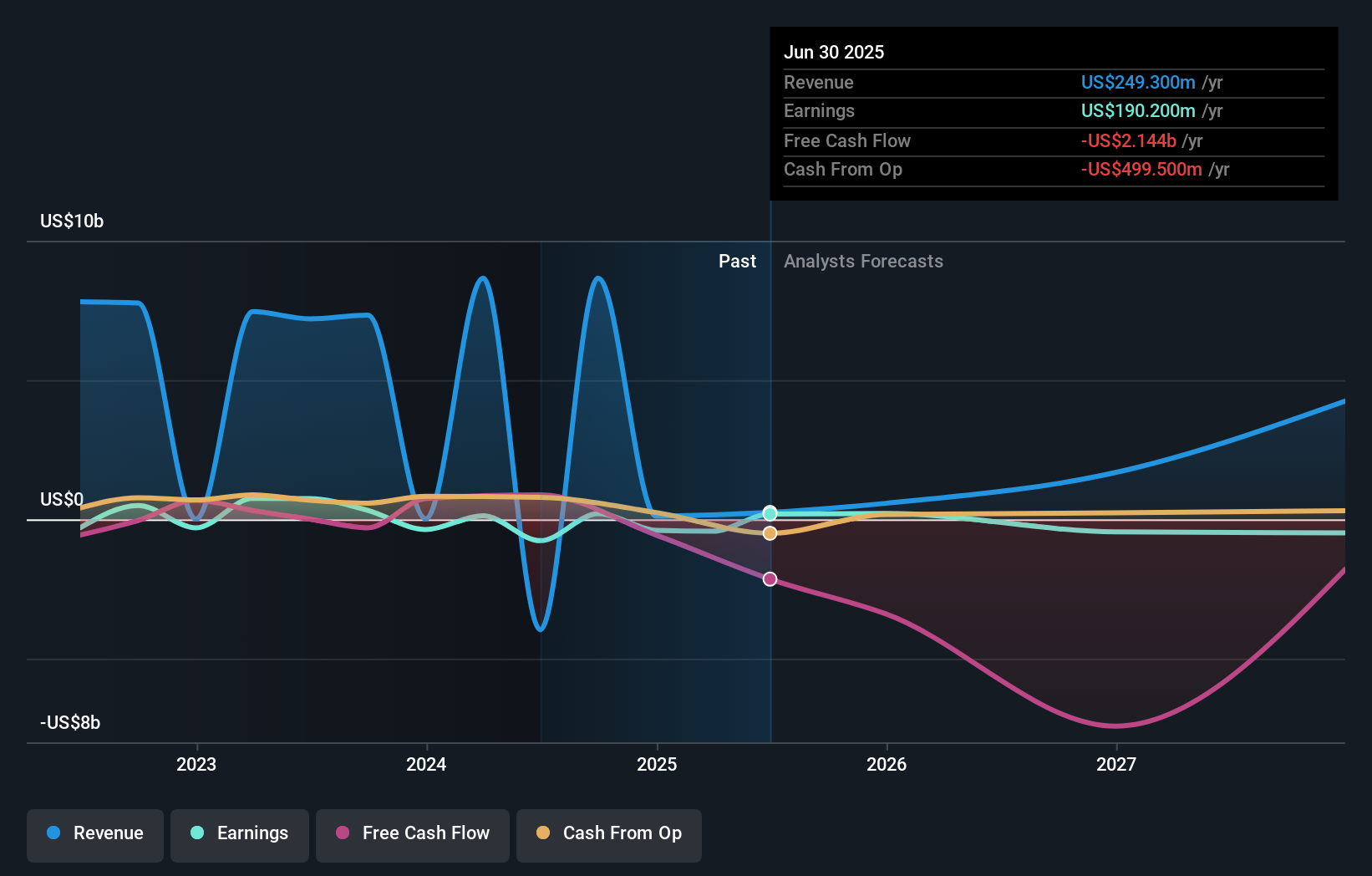

Overview: Nebius Group N.V. is a technology company focused on developing full-stack infrastructure for the global AI industry across the Netherlands, Europe, North America, and Israel, with a market cap of $24.78 billion.

Operations: The company's revenue segments include $0.60 million from Avride, $186 million from Nebius, and $41.40 million from Tripleten.

Insider Ownership: 16.5%

Nebius Group is experiencing significant growth, with revenue expected to rise 48.4% annually, surpassing the US market average. The company recently reported a dramatic increase in net income and sales year-over-year, becoming profitable this year. Despite its volatile share price and past shareholder dilution, Nebius's earnings are projected to grow 30.3% per year. Recent financing activities include $2.375 billion in fixed-income offerings and a $1 billion equity offering to support expansion initiatives like their AI infrastructure agreement with Microsoft.

- Click here and access our complete growth analysis report to understand the dynamics of Nebius Group.

- Insights from our recent valuation report point to the potential overvaluation of Nebius Group shares in the market.

Apollo Global Management (APO)

Simply Wall St Growth Rating: ★★★★☆☆

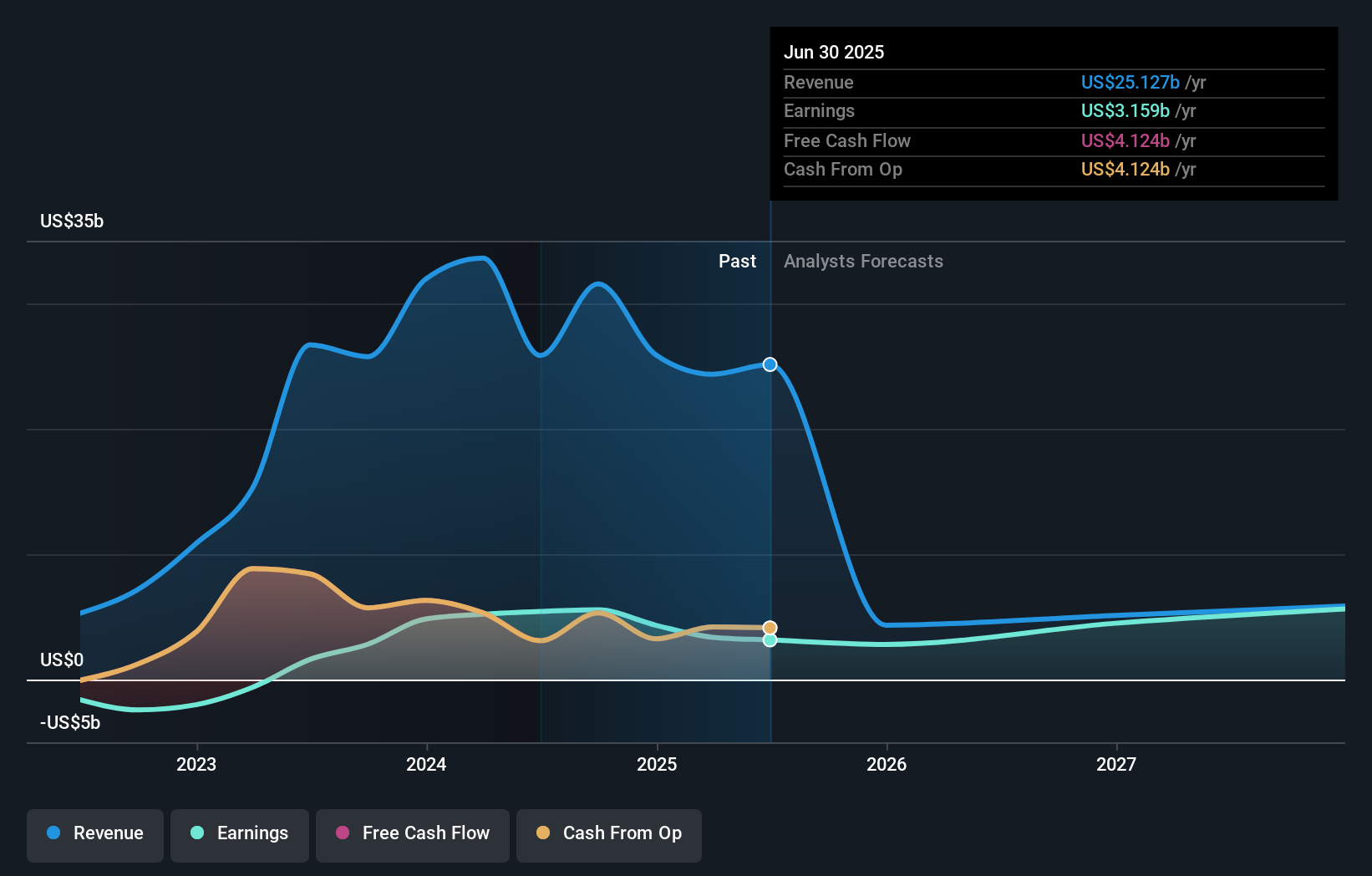

Overview: Apollo Global Management, Inc. is a private equity firm that specializes in investments across credit, private equity, infrastructure, secondaries and real estate markets with a market cap of $82.80 billion.

Operations: Apollo Global Management's revenue is derived from three main segments: Asset Management at $5.24 billion, Principal Investing at $1.15 billion, and Retirement Services at $21.40 billion.

Insider Ownership: 20%

Apollo Global Management is positioned for growth, with earnings projected to rise 27.8% annually, outpacing the US market. Despite recent insider selling, Apollo's strategic acquisitions and partnerships highlight its robust capital deployment capabilities. The firm's interest in acquiring Bank of Queensland's $3.8 billion loan portfolio underscores its focus on expanding credit strategies globally. However, revenue is expected to decline significantly over the next three years, posing a challenge to sustaining growth momentum amidst these strategic endeavors.

- Unlock comprehensive insights into our analysis of Apollo Global Management stock in this growth report.

- The valuation report we've compiled suggests that Apollo Global Management's current price could be quite moderate.

Key Takeaways

- Access the full spectrum of 204 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives